Welcome to

Canyon View Capital

Tax Advantaged Funds of Institutional Quality

Canyon View Capital at a glance

Real Estate Under Management

Units

Properties

Years of Real Estate Investment

Why Choose Canyon

View Capital

Stability

Tax Savings

Stock Market Alternative

A Message From Our

CEO & Founder

Bob Davidson, CPA

CEO & Founder

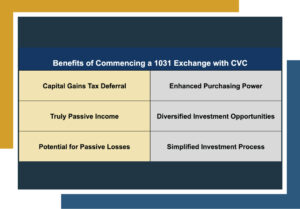

Investment with Canyon View Capital—a privately held Santa Cruz, CA corporation—offers a solution for accredited investors to assist in off-setting taxable passive income and solid returns with its tax-deferred Balanced Fund option.

Canyon View Capital also offers investment options for returns from your IRA through investment in multifamily real estate.

A balanced portfolio includes real estate. Canyon View Capital makes this possible for accredited investors without the hassle of being a property manager.

Discover Canyon View

Investment Approach

Investment Approach

Vertical Integration

Vertical Integration

About Us

About Us

Portfolio

Portfolio

Investor Relations

Investor Relations

Investment Insights

Investment Insights

They Have Helped Us Become

Who We Are Today

Our Latest News

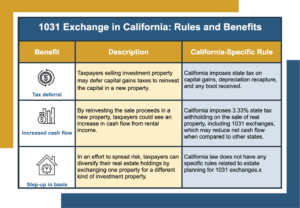

1031 Exchange California Rules Investors Should Know

As a real estate investor, you know that selling a property is a big decision. You may be ready to move on from a long-held property or look for a new opportunity in a different area. Whatever the case, a downside to selling an investment property is the capital gains

1031 Exchange Guidelines for 2025

Welcome to the world of 1031 exchanges! If you’re a real estate investor, you may already know the sting of capital gains taxes when selling an investment property. But with a 1031 exchange, you can defer those taxes and keep more capital working for you. In 2025, the guidelines for

1031 Exchange Eligibility

Many investors know the frustration of selling an investment property at a profit, only to hand over 20% or more of those gains to the IRS in capital gains taxes. The good news? It doesn’t have to be this way. Savvy investors are turning to the 1031 exchange, a powerful