REAL ESTATE INVESTMENT BLOG

Canyon View Capital Investment Insights

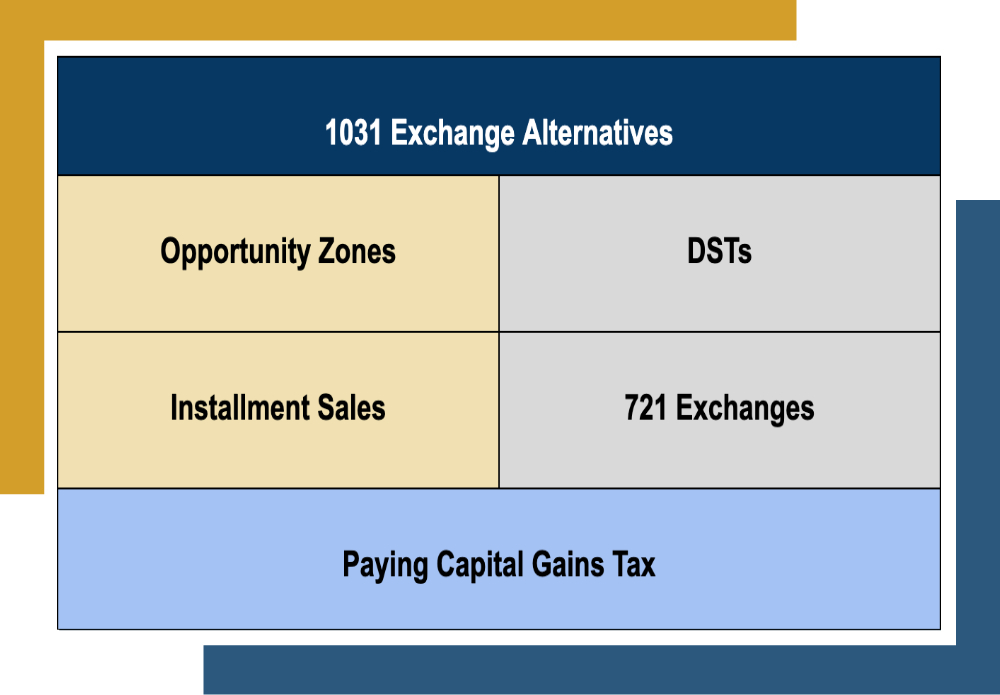

As a real estate investor, you know that selling a property is a big decision. You may be ready to move on

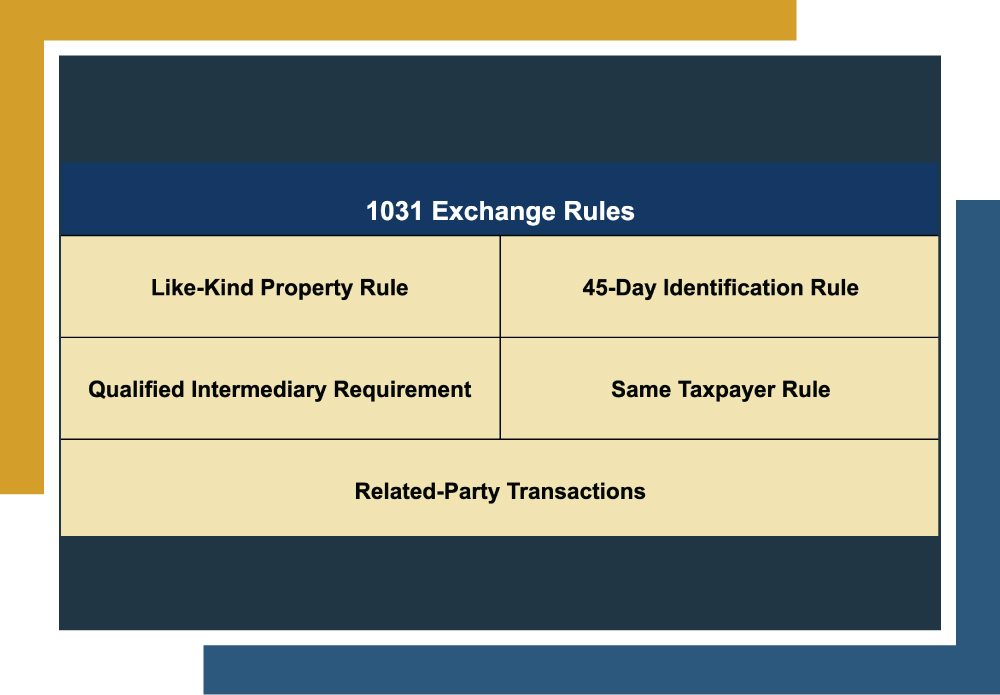

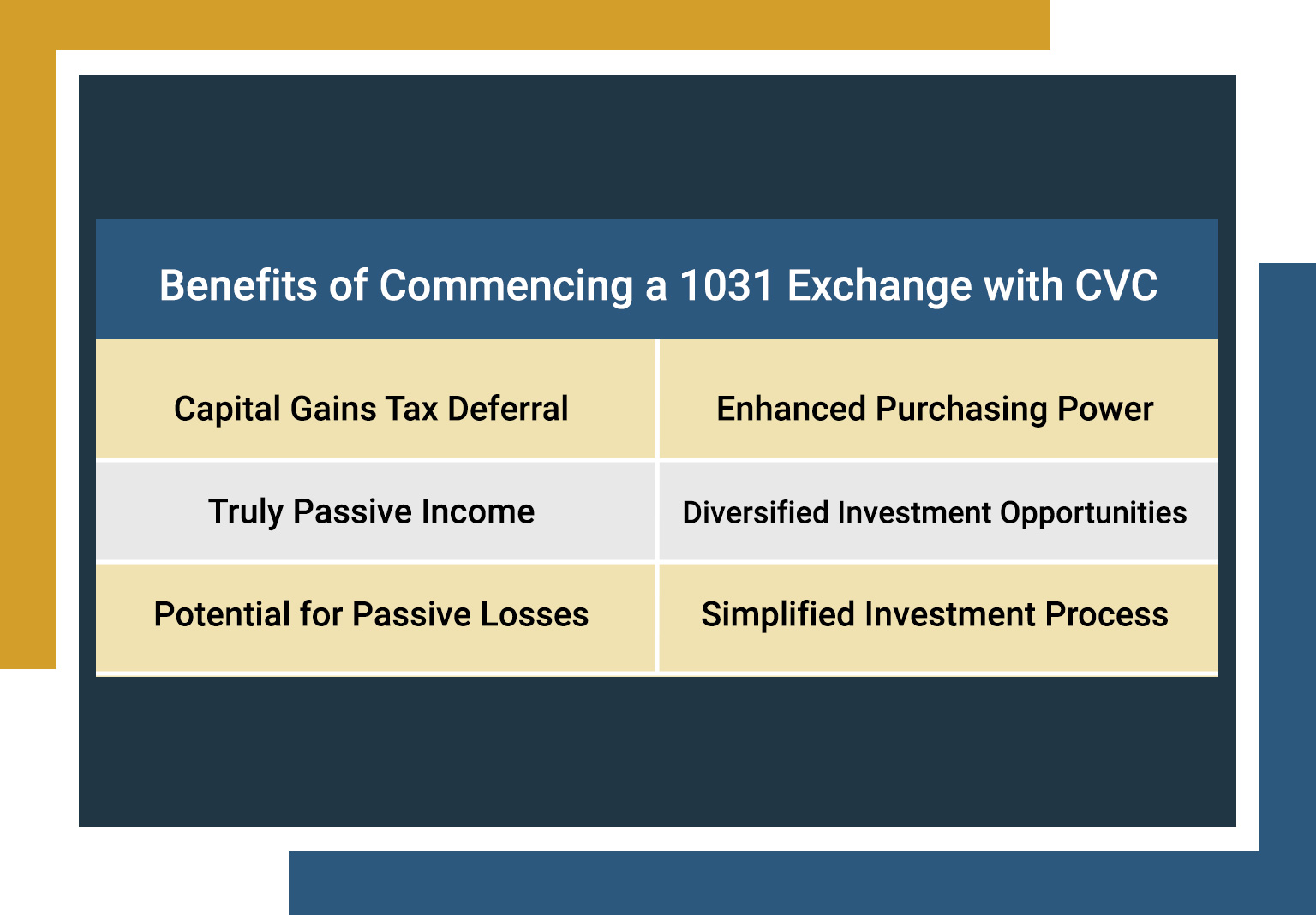

Welcome to the world of 1031 exchanges! If you’re a real estate investor, you may already know the sting of capital gains

Many investors know the frustration of selling an investment property at a profit, only to hand over 20% or more of those

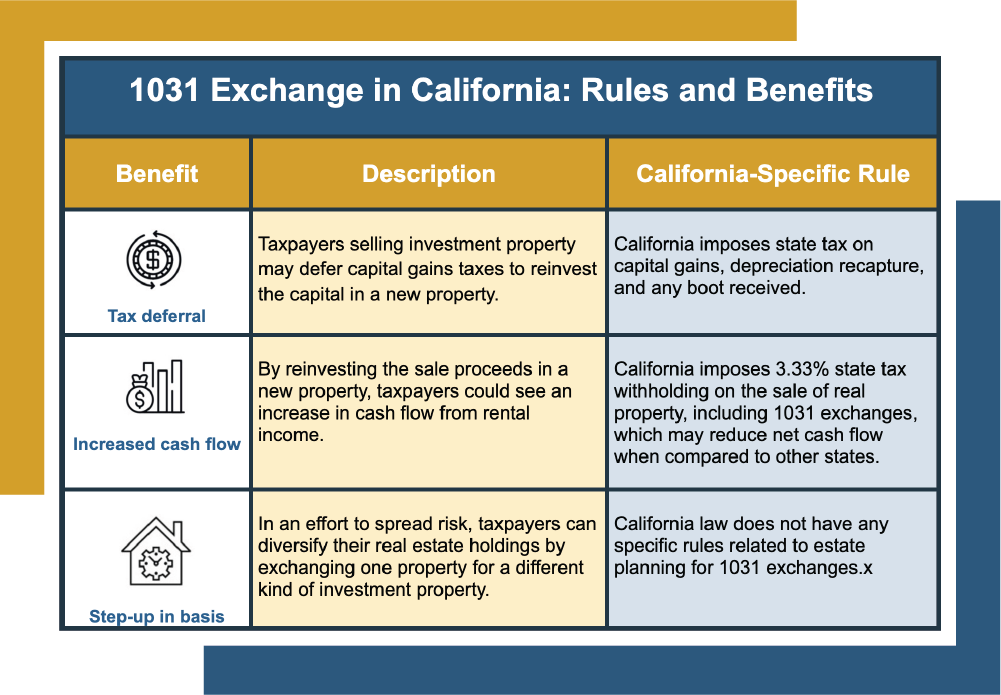

Taxes are one of life’s few certainties, and capital gains taxes, especially on real estate sales, can be among the most burdensome.

Welcome to the world of 1031 exchanges! If you’re a real estate investor, you may already know the sting of capital gains

Many property managers recognize the benefits of real estate investing, but shifting goals, property upgrades, or liability concerns may lead them to

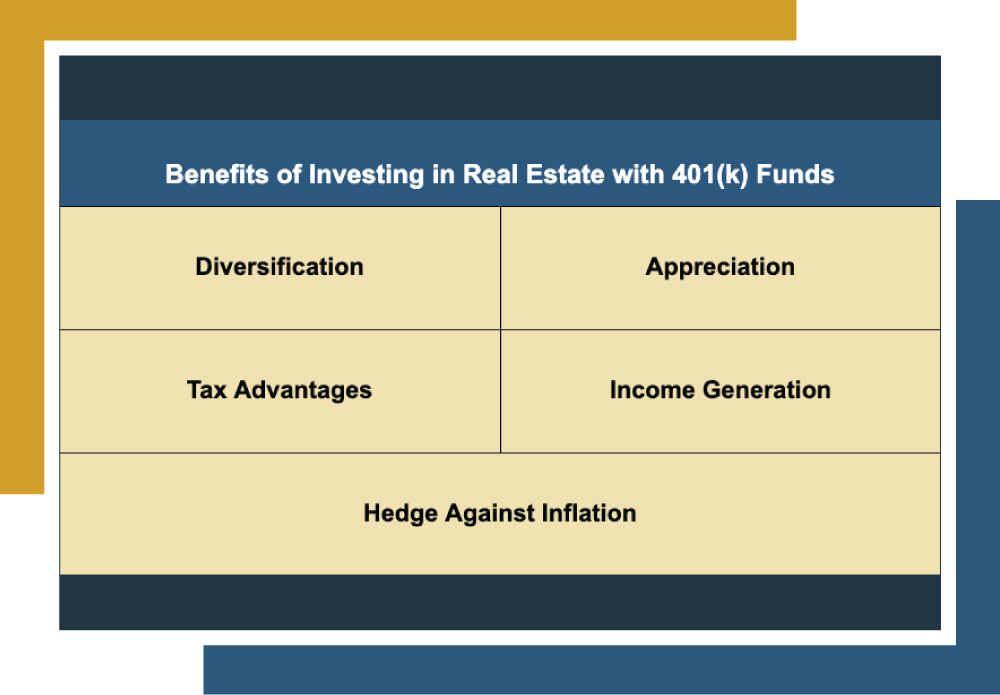

The trusty 401(k) has long been considered a de facto success route for retirement savings. However, recent economic trends and headwinds have

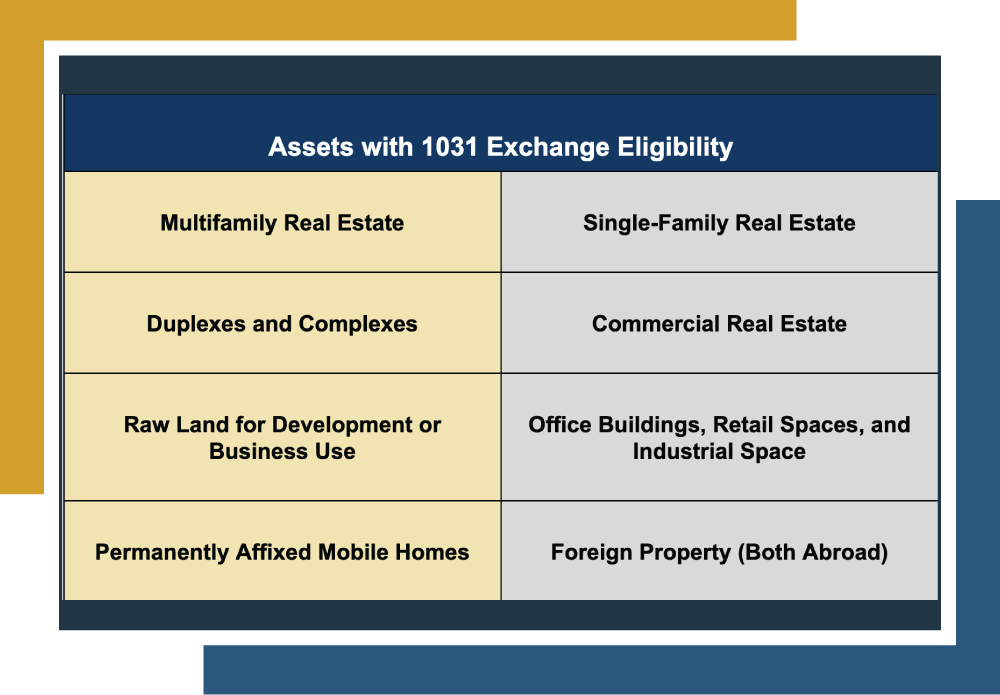

Savvy investors understand the importance of diversifying their portfolios, exploring new investment avenues to increase their income potentially, and spreading risk across

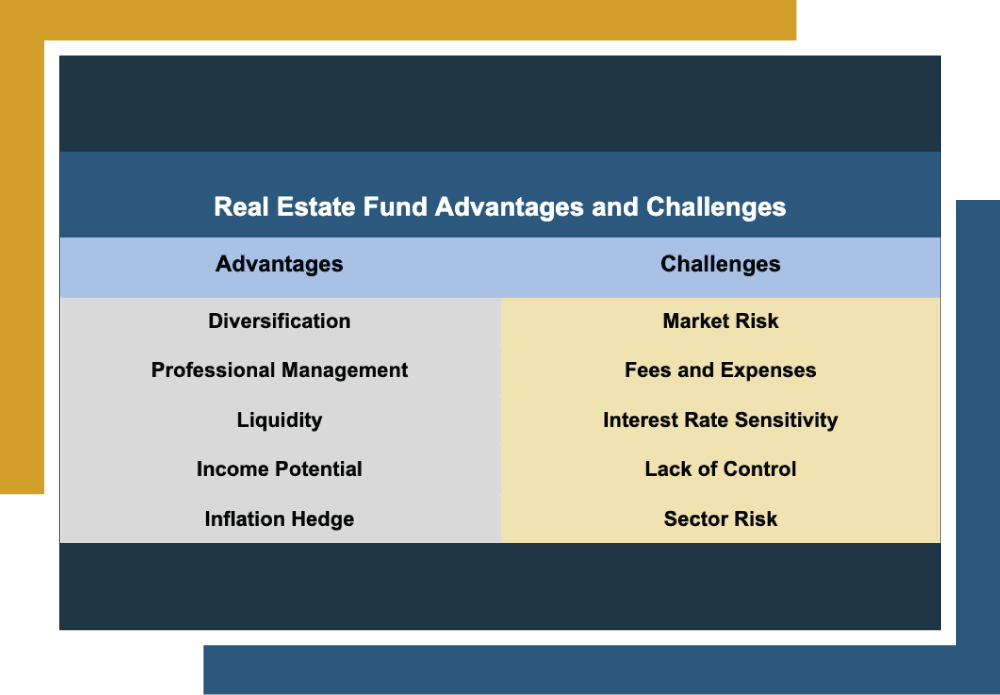

Much like other investment avenues, real estate investing offers diverse opportunities for investors seeking financial freedom. While many opt for the traditional

Like other investment options, real estate provides various opportunities for those seeking financial freedom. While many investors choose the traditional route of

Eager To Find Alternatives To Stock Market Fluctuations?

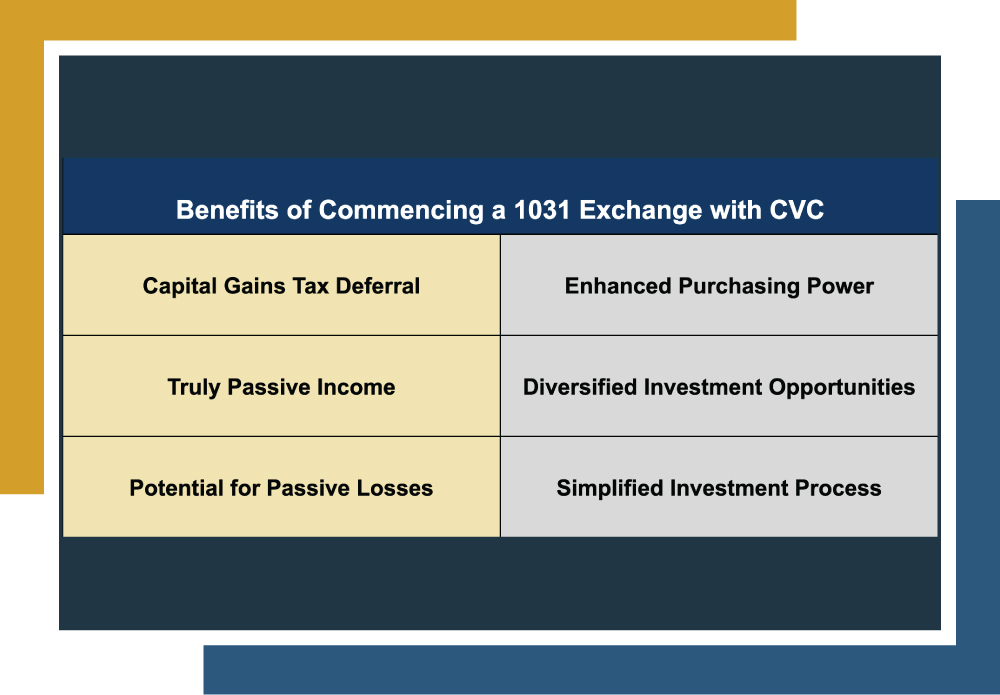

Canyon View Capital’s approach is tailored for tax-advantaged, passive income, offering you the chance to become a hands-free real estate investor. We prioritize client satisfaction and respect, ensuring that both seasoned and new investors feel heard and valued by our dedicated team

Ready to diversify your portfolio and feasibly spread your investment risk?

Reach out to one of our team members to see if you’re eligible to join Canyon View Capital’s family of investors today!