As a real estate investor, you know that selling a property is a big decision. You may be ready to move on from a long-held property or look for a new opportunity in a different area. Whatever the case, a downside to selling an investment property is the capital gains taxes that come with it. But what if I told you that you don’t have to pay them?

That’s right – using a tax strategy called a 1031 exchange allows you to defer those taxes and reinvest in new properties. However, as a California investor, you may be wondering about any rules and regulations specific to California you need to follow.

In this article, we’ll break down 1031 exchange rules in California and explain why having an expert is crucial for a smooth process. If you’re a real estate investor aiming to defer capital gains taxes and reinvest, keep reading to learn how these rules can benefit you. Use the links below to navigate the post.

| Discussion Topics |

|---|

1031 Exchange California Rules Investors Should Know

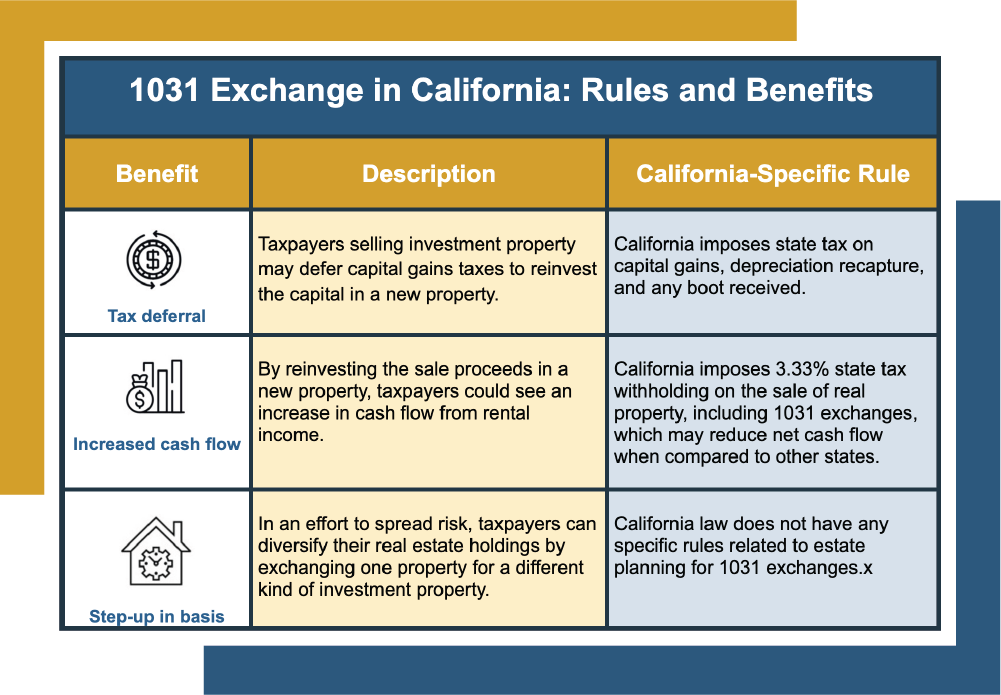

You may be wondering about any specific 1031 exchange California rules, as tax laws often vary by state. While California does recognize Section 1031 of the IRC and does not have any laws directly related to 1031 exchanges, there are a few state rules that apply to selling and buying property in the state or exchanging property in California for one in another state.

California-Specific Rule

| How a 1031 Exchange Works | ||

|---|---|---|

| Benefit | Description | California-Specific Rule |

Tax deferral

| Taxpayers selling investment property may defer capital gains taxes to reinvest the capital in a new property. | California imposes state tax on capital gains, depreciation recapture, and any boot received. |

Increased

| By reinvesting the sale proceeds in a new property, taxpayers could see increased cash flow from rental income. | California imposes 3.33% state tax withholding on the sale of real property, including 1031 exchanges, which may reduce net cash flow compared to other states. |

Diversification

| Taxpayers can diversify their real estate holdings by exchanging one property for a different investment property to spread risk. | California has a “clawback” provision: if you exchange a California property for one in another state when you sell the new property, you may be subject to California state tax and the state of the final sale. |

Step-up in basis

| If a taxpayer holds a replacement property until death, the heirs receive a step-up in basis, which could potentially eliminate their capital gains tax liability. | California law has no specific rules related to estate planning for 1031 exchanges. |

Depreciation benefits

| Allows for continued depreciation benefits on the replacement property. | California does not conform to federal depreciation recapture rules. You must recapture any depreciation claimed on the property as income on your CA state tax return. |

Initiating 1031 exchanges in California is as simple as in any other state. However, you’ve probably noticed California aggressively tracks replacement properties purchased in different states. If you exchange your California property for one in Arkansas, for example, California will want to recoup the capital gains tax when you decide to sell your Arkansas property.

Why Do a 1031 Exchange in California?

For investors and property managers in California, a 1031 exchange can be a lucrative proposition because, as you probably already know, California has one of the highest capital gains taxes1 in the country, sometimes reaching 13.3%. That’s the kind of tax rate that can substantially reduce profits when selling investment property.

When using a 1031 exchange, California investors can defer paying state and federal capital gains taxes on the sale of their investment property, which can be a severe amount of money. Using this particular tax code allows you to reinvest your total sale proceeds into a new property, which could open the door to a higher-value property.

1031 Exchange California Strategies

Now that you’ve got the essential details of a 1031 exchange in California, let’s dive into how it works in practice. Here are two dynamic examples of 1031 exchange strategies in California:

The benefits of a 1031 exchange are clear: You defer capital gains taxes and boost income potential with a new investment. However, mistakes can be costly, so it’s essential to work with an experienced partner to navigate the process, including California-specific rules.

- Upgrading Investment Properties: An investor decides to sell a smaller rental property in San Diego and uses a 1031 exchange to reinvest the proceeds into a larger multi-family property with more favorable tax laws in Missouri. By deferring capital gains taxes on the sale, the investor can leverage more capital to acquire a higher-value asset that generates more significant rental income with fewer tax burdens.

- Diversifying Property Types: A commercial real estate investor sells an office in San Francisco and exchanges it for multiple smaller retail properties throughout California. This strategy diversifies the investor’s portfolio, reduces risk, and defers taxes. All allow the investor to reinvest all proceeds without capital gains tax, enhancing their income across different markets.

What Is a 1031 Exchange?

If you’re a real estate investor looking to defer taxes, a 1031 exchange may be the solution. This tax strategy allows you to reinvest proceeds from the sale of an investment property into another “like-kind“3 property, deferring capital gains taxes. The replacement property must be of equal or more excellent value and used for investment purposes.

Key points to know:

- Identify the replacement property within 45 days of selling the original.

- Complete the exchange within 180 days.

- An intermediary, not the seller, must hold proceeds.

Though not a way to avoid taxes forever, 1031 exchanges can help defer them indefinitely with careful planning.

Let CVC Help Guide Your 1031 Exchange

Now that you understand the 1031 exchange California rules, you’ll need a partner who knows the process inside and out. At Canyon View Capital, we’ve spent nearly four decades owning and managing over $1 billion4 in multifamily real estate. We’re here to share our expertise and help you maximize the benefits of a 1031 exchange.

With a portfolio of multifamily properties across the Midsouth and Midwest, we offer opportunities to exchange into properties as Tenants in Common, allowing you to enjoy the benefits of a 1031 exchange without the burden of property management.

We look forward to sharing our experience with you.

For over 40 years, the principals at Canyon View Capital have worked in real estate, with a portfolio currently valued at over $1B2. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

1World Population Review “Capital Gains Tax by State 2024,” worldpopulation review.com, Accessed Sep. 30, 2024.

2US Gov. “6 USC 1031: Exchange of real property held for productive use or investment,” uscode.house.gov. Accessed Oct. 1, 2024.

3IRS “Passive Activity Loss Rules: Definition and When You Can Use Them,” irs.gov. Accessed Oct. 1, 2024.

4$1B figure based on the aggregate value of all CVC-managed real estate investments as valued on March 31, 2023.

Gary Rauscher, President of Canyon View Capital

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.