Investment Approach

CVC Balanced Fund

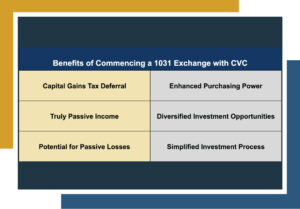

Our CVC Balanced Fund is a growth fund for investors seeking equity like exposures with tax advantages and moderate investment income.

Overview of CVC Balanced Fund

Our CVC Balanced Fund is a growth fund for investors seeking equity like exposures with tax advantages and moderate investment income. This diversified fund is invested in all properties owned by Canyon View Capital and provides relative liquidity. For those seeking passive losses to off-set any passive income (i.e., income received from rental/investment properties or royalties), the CVC Balanced Fund is an ideal investment choice

Canyon View Capital, a privately held Santa Cruz, CA corporation, owns, manages, and operates $1 Billion of multifamily real estate in America’s heartland. Over the past 40 years, the CVC management team has shared its wisdom and expertise in value investing, leverage, compounded interest, and tax-advantaged funds with its investors. They’ve helped countless families plan for their future, increase their purchasing power, enjoy their retirement, and realize steady, stable returns.

Please Contact Canyon View Capital for fund performance comparisons and advice on how to best leverage your individual investment strategy for your long-term benefit. Verification of accreditation status is required prior to receiving any fund performance information.

Our Latest News

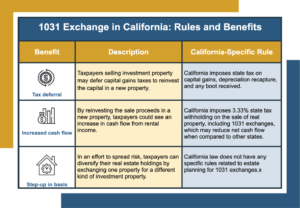

1031 Exchange California Rules Investors Should Know

As a real estate investor, you know that selling a property is a big decision. You may be ready to move on from a long-held property or look for a new opportunity in a different area. Whatever the case, a downside to selling an investment property is the capital gains

1031 Exchange Guidelines for 2025

Welcome to the world of 1031 exchanges! If you’re a real estate investor, you may already know the sting of capital gains taxes when selling an investment property. But with a 1031 exchange, you can defer those taxes and keep more capital working for you. In 2025, the guidelines for

1031 Exchange Eligibility

Many investors know the frustration of selling an investment property at a profit, only to hand over 20% or more of those gains to the IRS in capital gains taxes. The good news? It doesn’t have to be this way. Savvy investors are turning to the 1031 exchange, a powerful

CVC Balance Funds FAQs

An accredited investor is a person or entity that can deal with securities not registered with financial authorities by satisfying one of the requirements regarding income, net worth, asset size, governance status or professional experience. The term is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings. Accredited investors include natural individuals, banks, insurance companies, brokers and trusts.

SEC regulations prohibit us from publishing earnings on a public site. We welcome your questions and encourage you to call us at 831.480.6335.

An investor must meet the minimum requirements and be a good fit for the investment. One minimum requirement is investors must be accredited for the funds that are currently open for investment. An accredited investor is a person or entity that can deal with securities not registered with financial authorities by satisfying one of the requirements regarding income, net worth, asset size, governance status or professional experience. The term is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings. Accredited investors include natural individuals, banks, insurance companies, brokers and trusts.

Click HERE to determine if you are accredited or not.

trusts.

Canyon View Capital partners with IRA Services Trust Services Company as Trustee/Custodian to transfer your IRA(s) into our CVC Income Fund. For more information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335

An investor must meet the minimum requirements and be a good fit for the investment. One minimum requirement is investors must be accredited for the funds that are currently open for investment. An accredited investor is a person or entity that can deal with securities not registered with financial authorities by satisfying one of the requirements regarding income, net worth, asset size, governance status or professional experience. The term is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings. Accredited investors include natural individuals, banks, insurance companies, brokers and trusts. Click HERE to determine if you are accredited or not.

The minimum investment for either fund is $250,000. This may be in the form of a cash investment or an IRA/SEP/ROTH rollover. For more information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Our CVC Balance Fund (B Shares) is a tax-deferred fund and offers passive losses to offset passive income and available for cash investments only. Click here to learn more. The CVC Income Fund (A Shares) is a fully taxable fund (as portfolio income) and is available for both IRA/SEP/ROTH rollovers and cash investment. Click here to learn more

CVC’s founder and CEO, Robert (Bob) Davidson, started investing in real estate with his partners in the early 1980s. In 2001, we were incorporated as MyRetirementAssets, then rebranded under the current name of Canyon View Capital in 2012. For more information and inquiries regarding Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

No, but they are generally available. We will make every effort to work with you and create a good two-way communication on this complex process. There are windows for naming and closing a 1031 exchange that must be adhered to qualify for the 1031 tax deferred advantages. To discuss your individual situation with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Counter to a “buy-and-flip” acquisition philosophy that is quite common in the West and East coasts, CVC’s investment strategy is, instead, rooted in a “buy-and-hold” philosophy proven to deliver steady, attractive returns over the long term for our investors. We invest in America’s heartland—the Midwest and Midsouth regions of the US—and apply our value-investing philosophy with each of our acquisitions. For more information regarding our overall strategy and earnings, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Yes. We are happy to email this and other specific information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.