Active investment avenues demand vigilant monitoring, and not everyone has the time or skills for this level of involvement. Investors are keen to diversify their portfolios with real estate, and it is easy to see why: passive income. Learn more about passive income, taxes on passive income, and deductions so that you can choose your investments with ease and keep your money in your.

What is Passive Income?

The Internal Revenue Service (IRS) categorizes passive income as income that demands minimal effort to acquire. Active income, on the other hand, originates from employment or active involvement in a business venture.

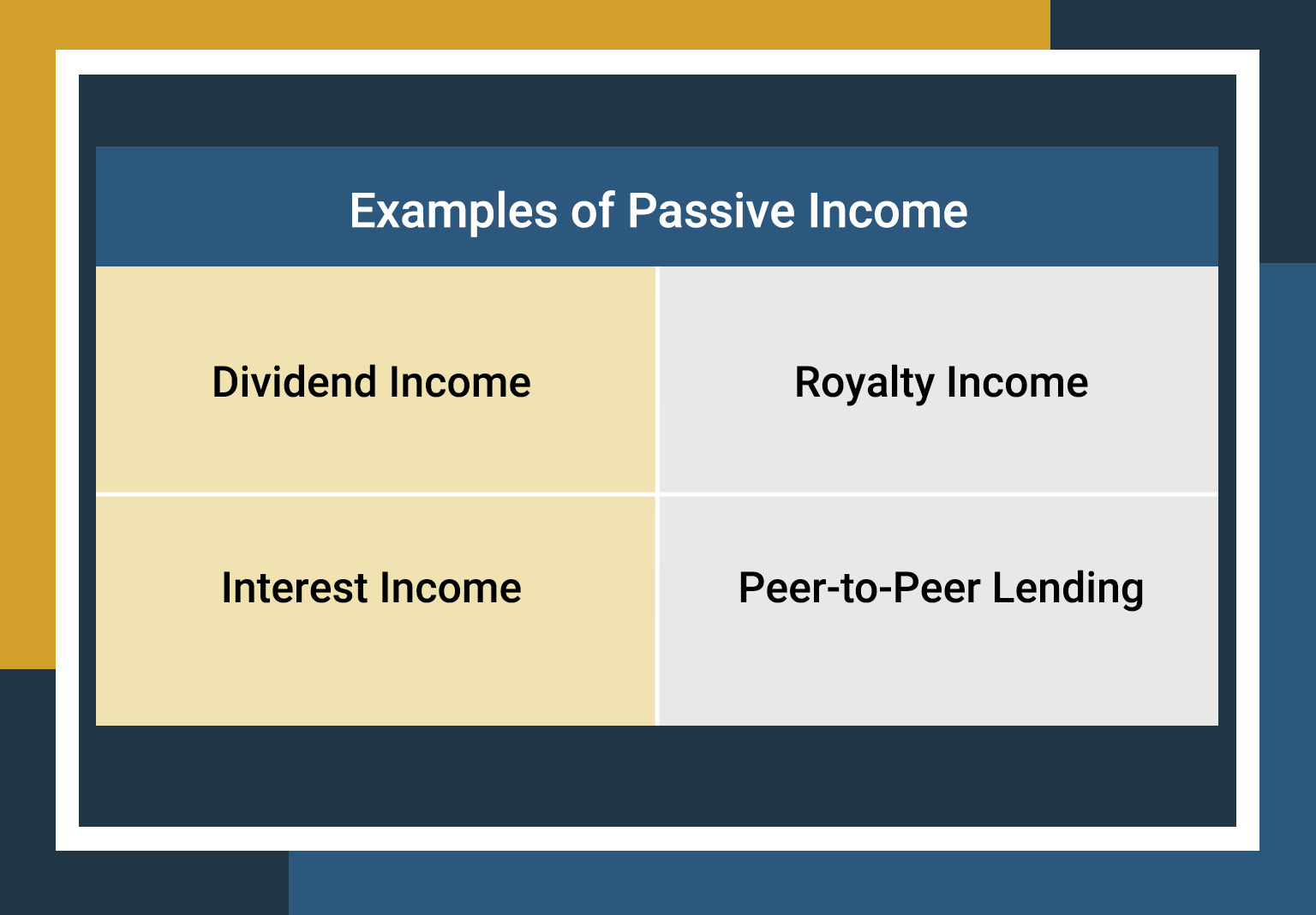

Forms of passive income include:

- Rental Income: Rental payments that you receive on properties that you own.

- Dividend Income: Dividend payments that you receive on stocks that you own.

- Interest Income: The interest earned from savings accounts, certificates of deposit, or bonds.

- Royalty Income: Royalties from work that you own. Musicians, actors, authors, etc., earn passive income through royalties from their work.

- Peer-to-Peer Lending: Platforms facilitating peer-to-peer lending allow investors to lend money to businesses or individual entities in exchange for passive interest payments.

Do You Have to Pay Taxes on Passive Income?

Yes, you must pay income taxes on passive income. The IRS taxes passive income because it is considered a part of an individual’s overall income, and the government uses these taxes to generate revenue and pay for public services.

Generally, it is taxed the same way that active income is. However, the exact tax treatment will depend on the precise source of your income.

Rental income is taxed like regular income, meaning that all rental payments, other income, pet fees, etc., that come from a rental property count as rental income and are taxed.

However, it’s worth noting that there are ways that you can deduct expenses related to rental income, such as mortgage interest, property taxes, operating expenses, and passive losses.

Deducting Passive Losses From Passive Income

Generating passive income offers an attractive opportunity to boost your cash flow with relatively lower levels of responsibility compared to other investment options. Nonetheless, there is one catch—the inevitable tax liability that accompanies it.

Fortunately, investors have a potent tool at their disposal to mitigate the tax burden associated with passive income, and that tool is leveraging passive losses.

Investors with passive income from one source and passive losses from another can generally use the passive losses to offset the passive income. Essentially, the loss from one activity reduces the taxable income of another.

Note that, like any investment, real estate comes with inherent risks. Moreover, using passive losses to reduce your tax burden means navigating complex tax laws. Always consult with a tax professional or financial advisor first.

Canyon View Capital Offers Real Estate Products Designed for Passive Income

Here at CVC, we’re passionate about real estate investing, which has led to a portfolio of multifamily real estate properties now valued at over $1 billion. We want to use our experience to help investors like you realize the benefits of multifamily investing in a genuinely passive option.

Instead of burdening yourself with the duties of managing real estate properties, you can invest in our properties and enjoy passive income and tax benefits such as passive losses.

Still need more information on the IRA Alternative Investments?

For over 40 years, Canyon View Capital has managed, owned, and operated real estate valued at over $1B1. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns. If you’re still wondering, “Do You Have to Pay Taxes on Passive Income?” reach out today!

1$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.