Investors have traditionally leaned on personal savings accounts such as 401(k)s and IRAs to save for the future. However, some concerns are associated with them compared to other investment options, such as limited investment control, fees and expenses, and market volatility.

That’s why many investors are turning to alternative investment options like real estate to fill in the gaps left by other investment vehicles. For those with savings tied up in savings accounts like IRAs, real estate benefits, such as rental income, may seem out of reach. However, while traditional IRAs don’t allow for real estate investment, a specific kind of IRA does.

In this article, we’ll explore how to use a self-directed IRA for rental income generation through real estate and how Canyon View Capital can help you enjoy passive real estate income.

Self-Directed IRA Real Estate Rental Income: How to Get Started

Unlike traditional IRAs, which limit your investment choices to conventional options like stocks and bonds, self-directed IRAs offer significantly greater control over your investment decisions, allowing you to manage and diversify your portfolio as you see fit.

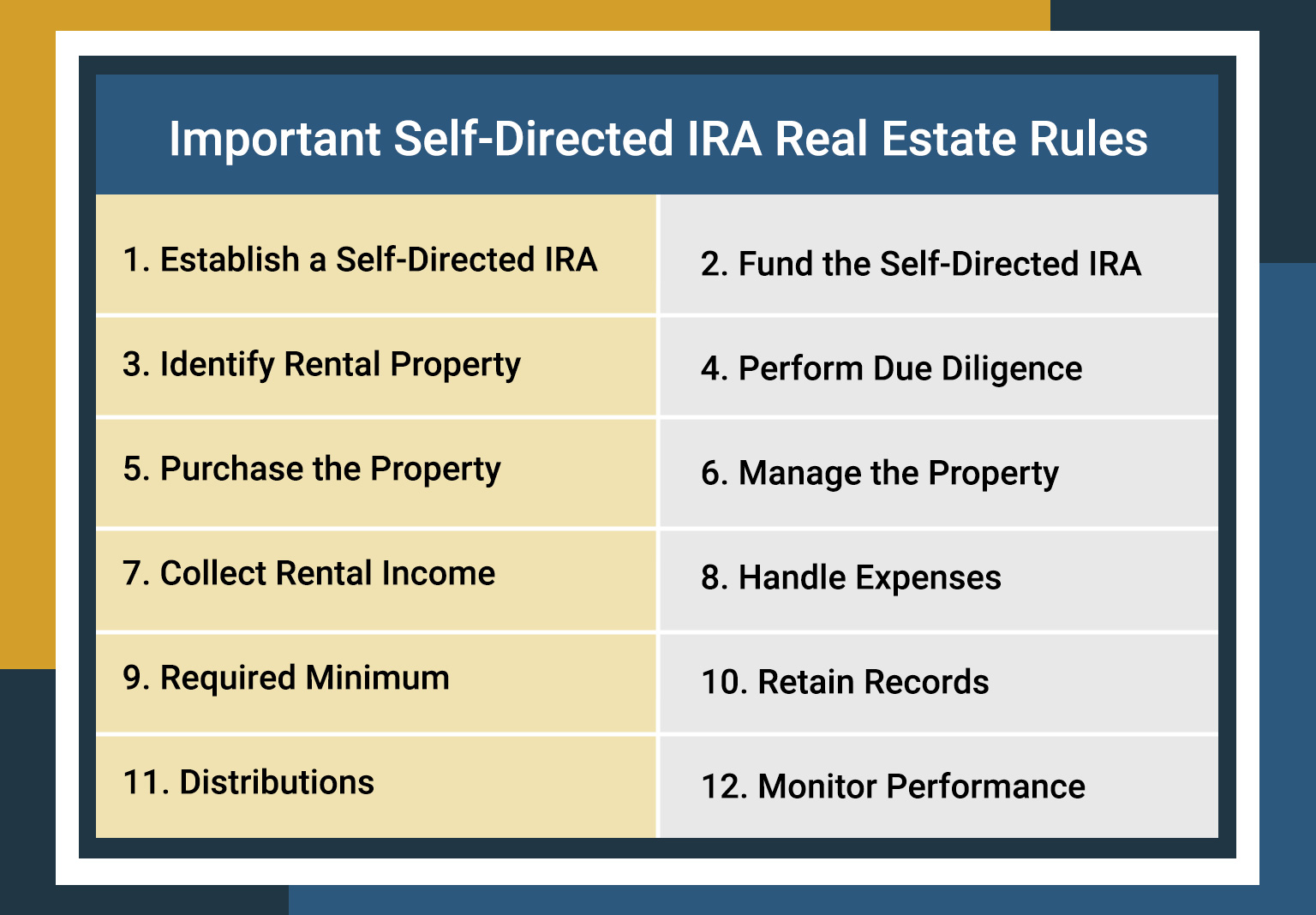

In order to do so, you’ll have to follow a few steps very closely.

Steps to Using a Self-Directed IRA for Rental Income | |

| Open a self-directed IRA with a qualified custodian who allows for real estate investments. Ensure compliance with IRS regulations for self-directed IRAs. |

| Contribute funds to your self-directed IRA. This can be done through contributions, transfers, or rollovers from other retirement accounts. |

| Research and identify your rental property. This should be one that fits within the criteria allowed by your self-directed IRA. |

| Conduct thorough examinations of the property and aspects of the transaction. This includes property inspections, reviewing financials, and assessing the potential rental income and any expenses. |

| Inform your self-directed IRA custodian to use the IRA funds to purchase the identified rental property. All transactions must go through the IRA custodian to ensure compliance. |

| As a property manager, you will manage the rental or hire a property management company to handle day-to-day operations. All income and expenses related to the property must flow through the self-directed IRA. |

| When you receive income from a property, it must be deposited and held directly in the self-directed IRA. |

| Ensure that you pay for all property-related expenses. This includes maintenance, property taxes, and insurance, which must be paid directly from the self-directed IRA. |

| It’s imperative that you adhere to IRS regulations and guidelines for self-directed IRAs. All transactions should be for the benefit of the IRA. |

| Keep detailed accounts of all transactions, income, and expenses associated with the property. This is important for tax reporting and compliance. |

| Be aware of RMD requirements, especially if you are near the age where distributions are mandatory. Consult with a financial advisor or tax professional. |

| Keep track of your property’s performance and ensure that you are making strategically sound decisions to enhance returns or address any issues that pop up. |

Once you’ve followed the steps, you’ll be well on your way to using your self-directed IRA for real estate rental income. However, it should be noted that, like any investment, real estate carries some level of risk.

Also, keeping up with current trends and market fluctuations and effectively managing your property can be demanding. If the steps listed in the table seem like a lot to keep track of, that’s because they can be.

If you’re an investor who likes the idea of expanding your portfolio using a self-directed IRA to invest in real estate but is hesitant due to the increased responsibility and risk, the good news is other options can help you have your cake and eat it, too.

That’s where Canyon View Capital comes in.

Canyon View Capital Offers Real Estate Investing Options for Self-Directed IRAs

If you’re looking to leverage self-directed for real estate rental income, you’ve come to the right place. At Canyon View Capital, we managed a portfolio of multifamily real estate valued at over $1 billion1, and we want to use that to help you enjoy the benefits of real estate investing.

We understand that many investors with self-directed IRAs may like expanding their portfolio but may be deterred by the commitment often required to manage investment properties successfully. That’s why we offer real estate investment options that allow investors like you to use their self-directed IRAs to invest in real estate without having to manage properties.

We do the heavy lifting for you while you enjoy passive rental income and other tax benefits through one of our real estate investment funds.

Ready to upgrade your portfolio with diversified, stable investments?

For over 40 years, Canyon View Capital has managed, owned, and operated real estate now valued at over $1B2. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

Want to learn more about self-directed IRA real estate income? Reach out today!

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.