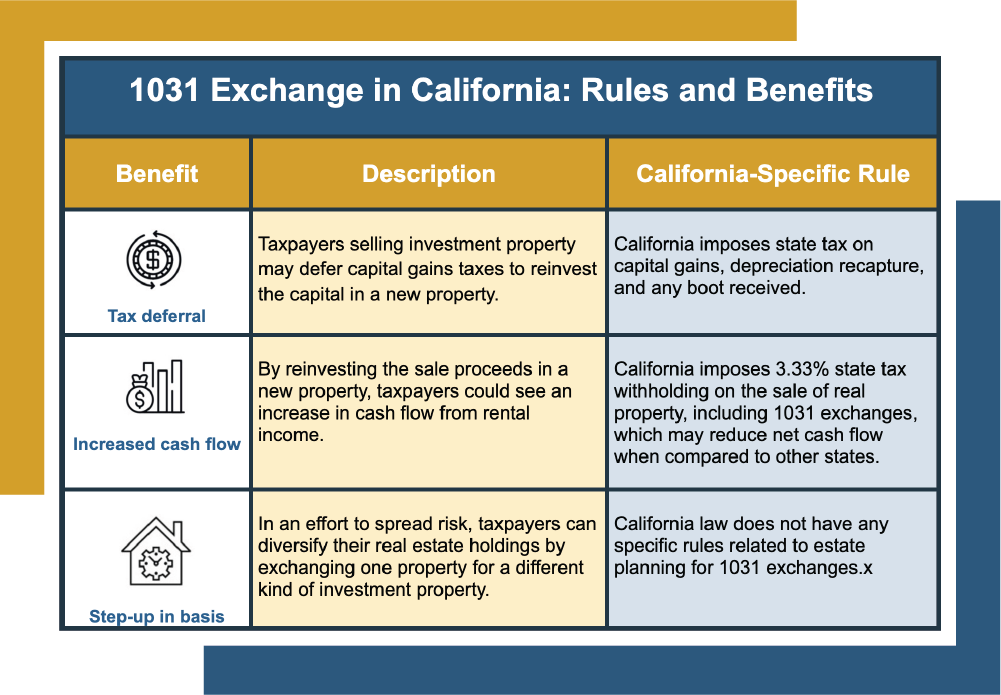

1031 Exchange California Rules Investors Should Know

As a real estate investor, you know that selling a property is a big decision. You may be ready to move on from a long-held property or look for a new opportunity in a different area. Whatever the case, a downside to selling an investment property is the capital gains taxes that come with it. […]

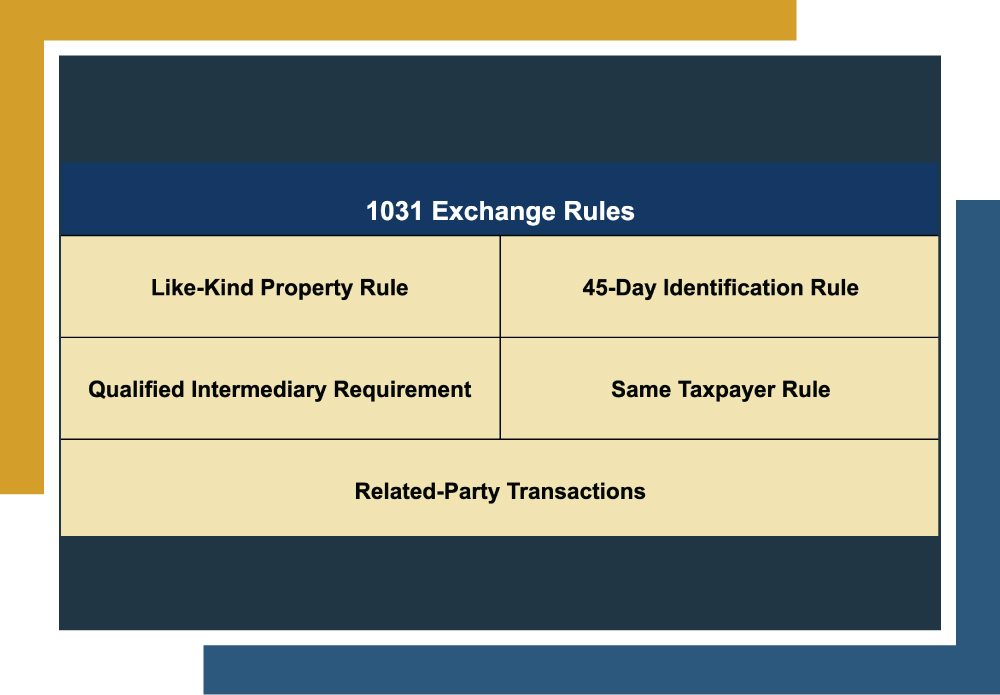

1031 Exchange Guidelines for 2025

Welcome to the world of 1031 exchanges! If you’re a real estate investor, you may already know the sting of capital gains taxes when selling an investment property. But with a 1031 exchange, you can defer those taxes and keep more capital working for you. In 2025, the guidelines for 1031 exchanges are as strict […]

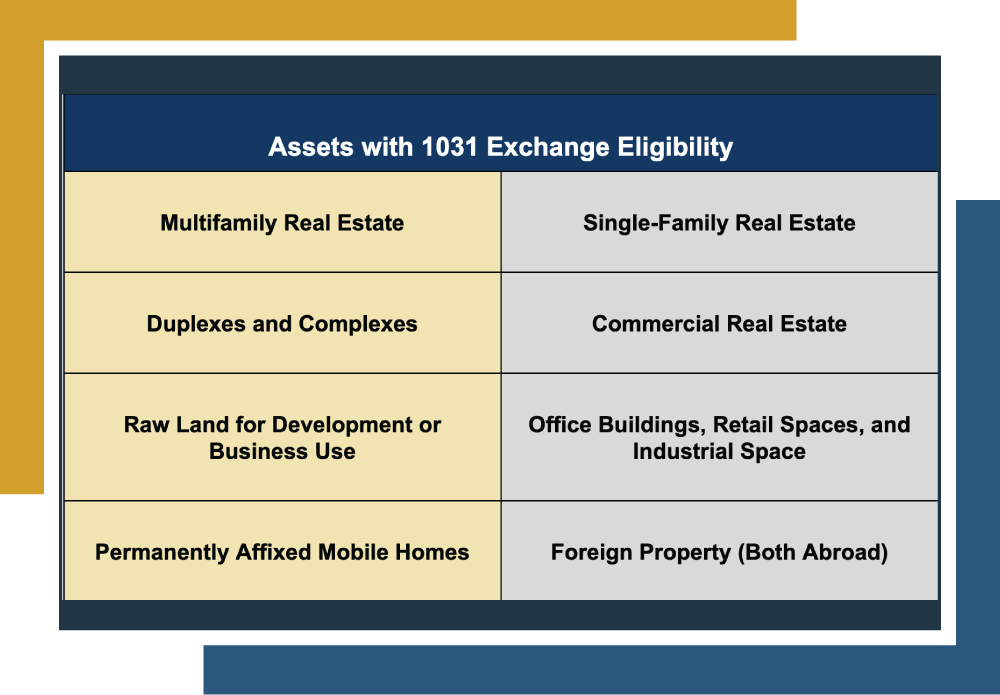

1031 Exchange Eligibility

Many investors know the frustration of selling an investment property at a profit, only to hand over 20% or more of those gains to the IRS in capital gains taxes. The good news? It doesn’t have to be this way. Savvy investors are turning to the 1031 exchange, a powerful tax-deferral tool that allows them […]

1031 Exchange 5-Year Rule

Taxes are one of life’s few certainties, and capital gains taxes, especially on real estate sales, can be among the most burdensome. Fortunately, many savvy investors turn to a popular tax-deferral tool: the 1031 exchange. This strategy allows investors to defer capital gains taxes on investment property sales, making it a valuable option in real […]

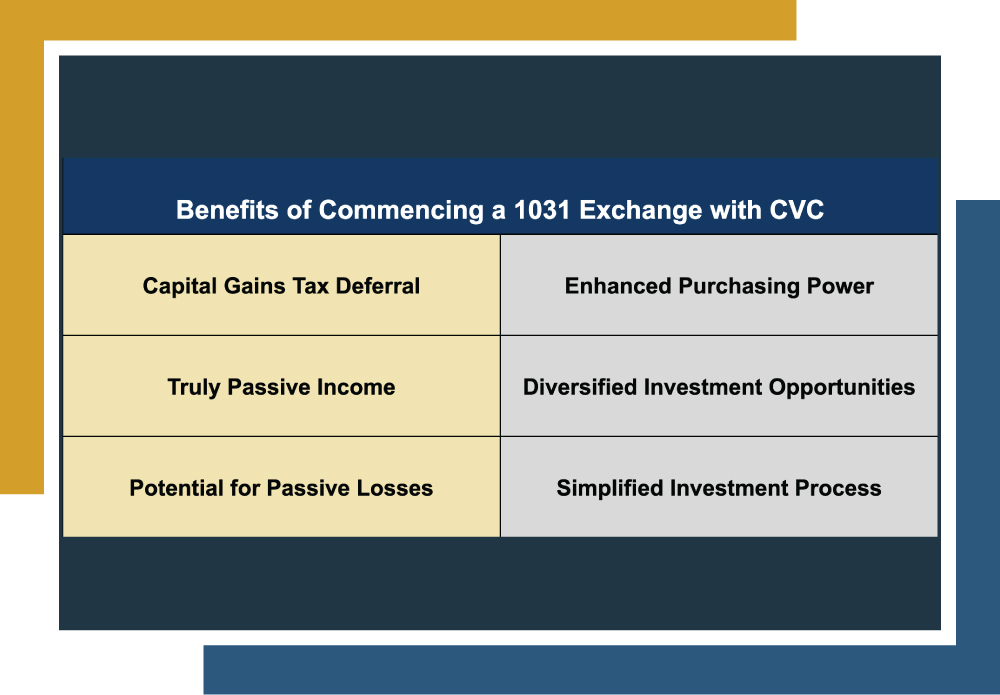

1031 Exchange Guidelines for 2025 – Canyon View Capital

Welcome to the world of 1031 exchanges! If you’re a real estate investor, you may already know the sting of capital gains taxes when selling an investment property. But with a 1031 exchange, you can defer those taxes and keep more capital working for you. In 2025, the guidelines for 1031 exchanges are as strict […]

1031 Exchange vs. Opportunity Zone Fund: Pros and Cons of Each

Investors continually seek ways to enhance their investment strategies and capitalize on available opportunities. In the realm of real estate investment, two prevalent methods that can potentially enhance investment prospects are 1031 exchanges and Opportunity Zone Funds. While these investment tools do share commonalities, their distinct contrasts indicate that choosing a straightforward path between the […]

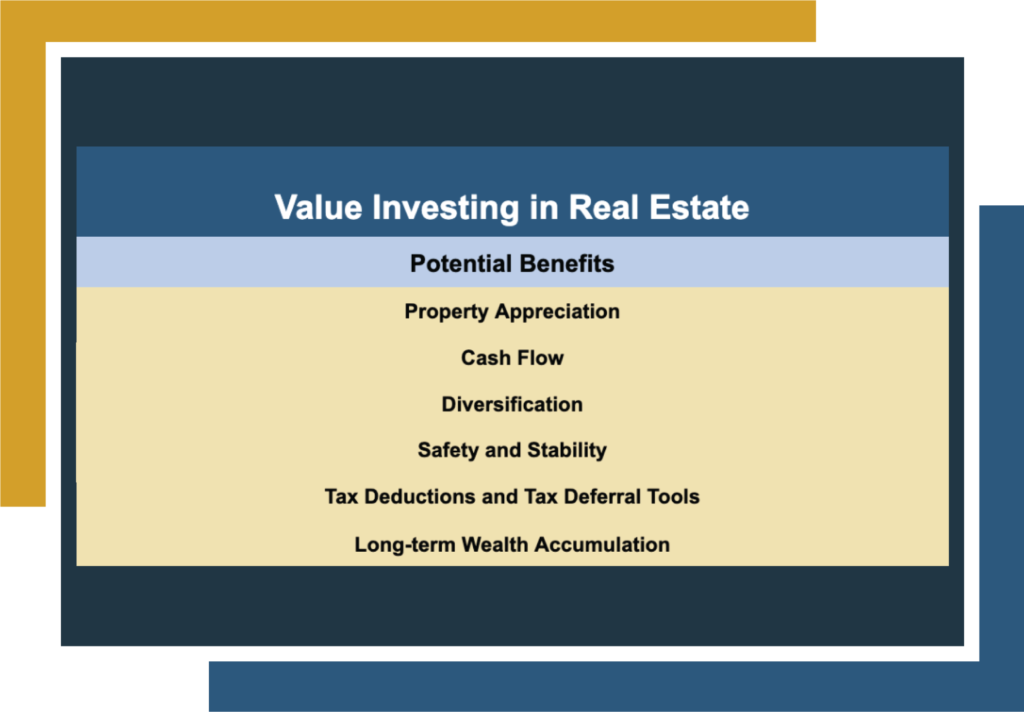

Multifamily Investing Made Simple: The Steps to Success

Real estate investing can benefit the portfolios of investors of all ranks and experience levels. In real estate investing, investors should consider a few options. One of these options is multifamily investing, or purchasing properties designed to house multiple living units within a single building or complex, instead of single-family investing, which involves utilizing traditional […]

Extension on 1031 Exchange: Info Investors Need to Know

Suppose you’re one of the many wise investors looking to commence or have already engaged in a 1031 exchange. If that’s the case, you’ve already made the first step toward reinvesting some serious cash from your investment property sale. Whether it’s to upgrade a property, spread risk by diversifying their real estate portfolio, or move […]

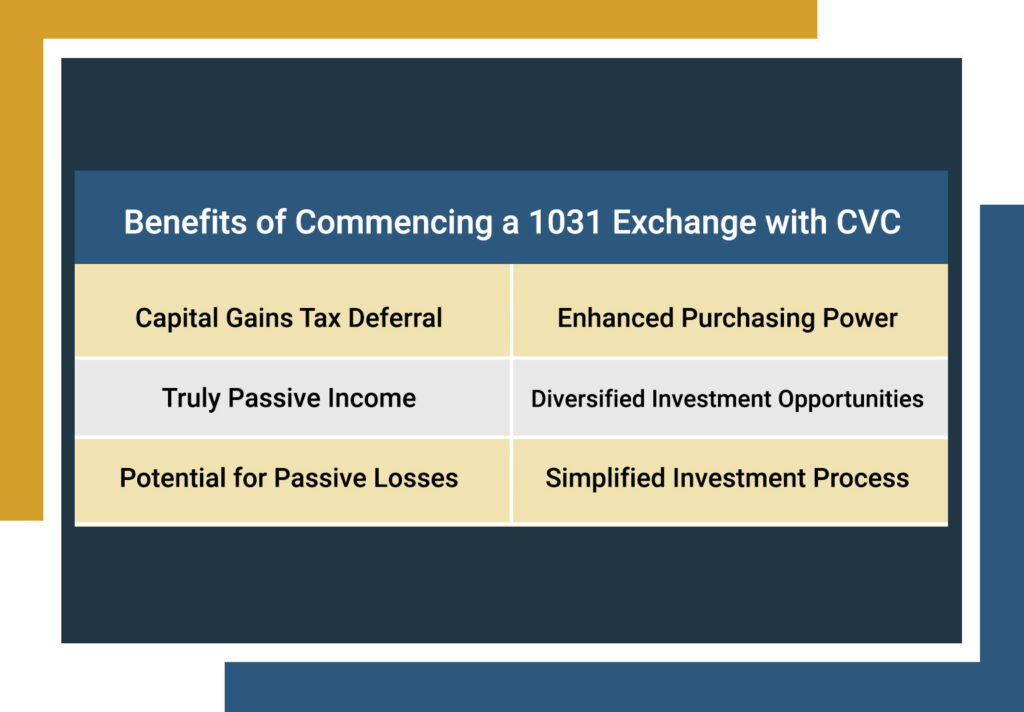

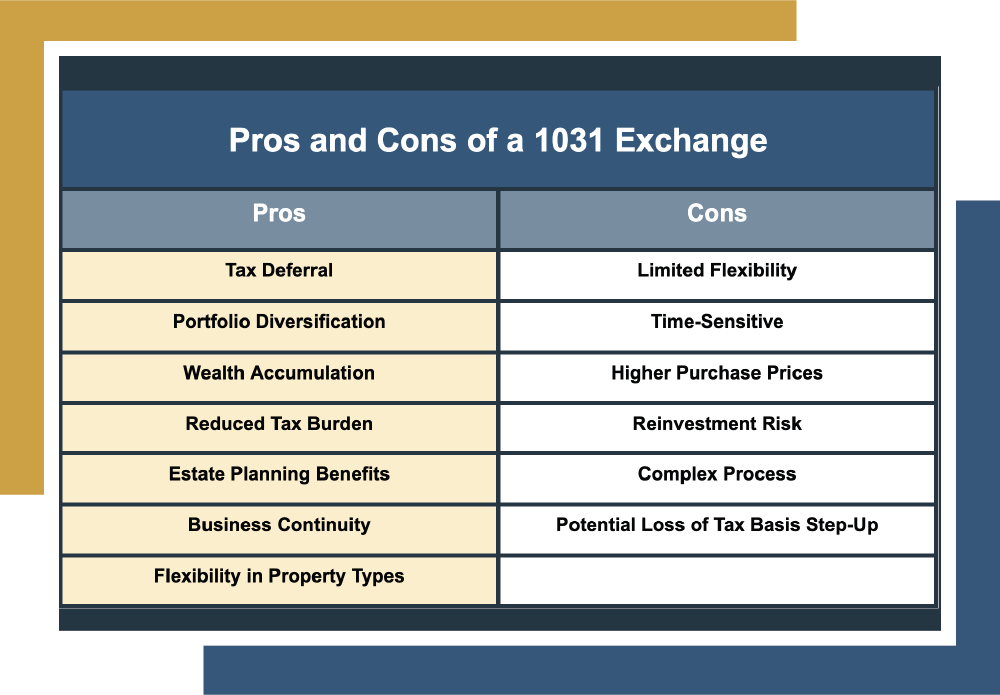

Pros and Cons of a 1031 Exchange for Investors

If you’re reading this, chances are you’re already investing in real estate. It makes sense; real estate investing can bring many benefits to investment portfolios. However, you might be ready to move on from a specific investment property—maybe you’re tired of dealing with a problematic property, or perhaps you want to invest in other regions. […]

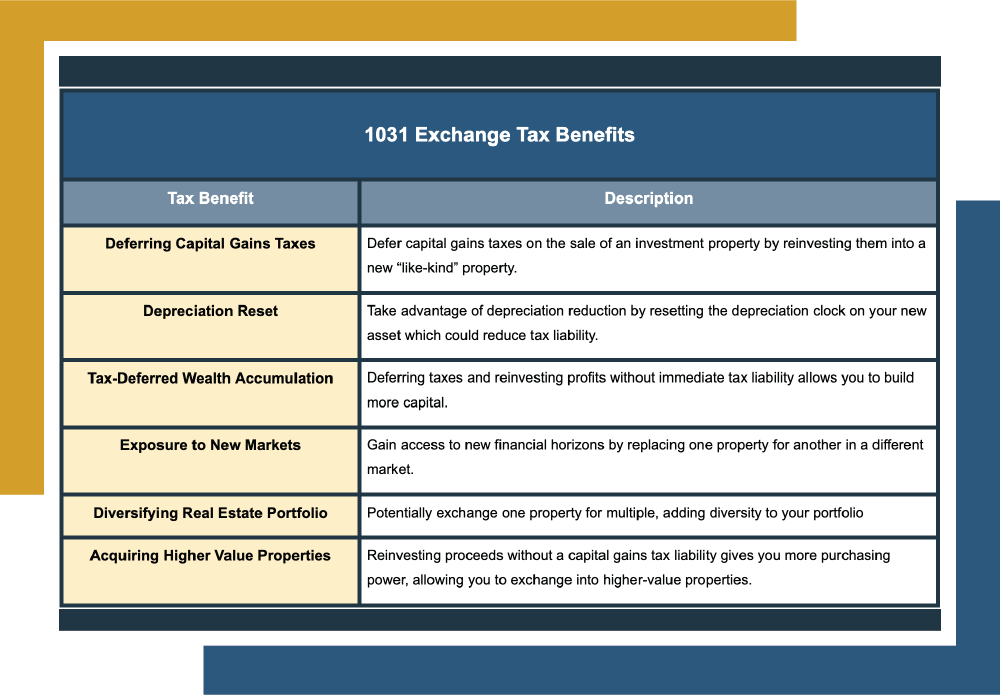

1031 Exchange Tax Benefits Investors Should Know

Real estate investors and property managers understand the appeal of passive income and the possibility of long-term wealth accumulation that can come with real estate investments. However, when it’s time to sell an investment property, the burden of capital gains taxes can put a damper on your finances, potentially depriving you of as much as […]