Investors are always looking for ways to get a leg up and enhance their investment strategy, and real estate investors are no different. Fortunately, there are many tools and tactics that real estate investors can utilize to do just that by deferring taxes, mitigating risk, and increasing returns.

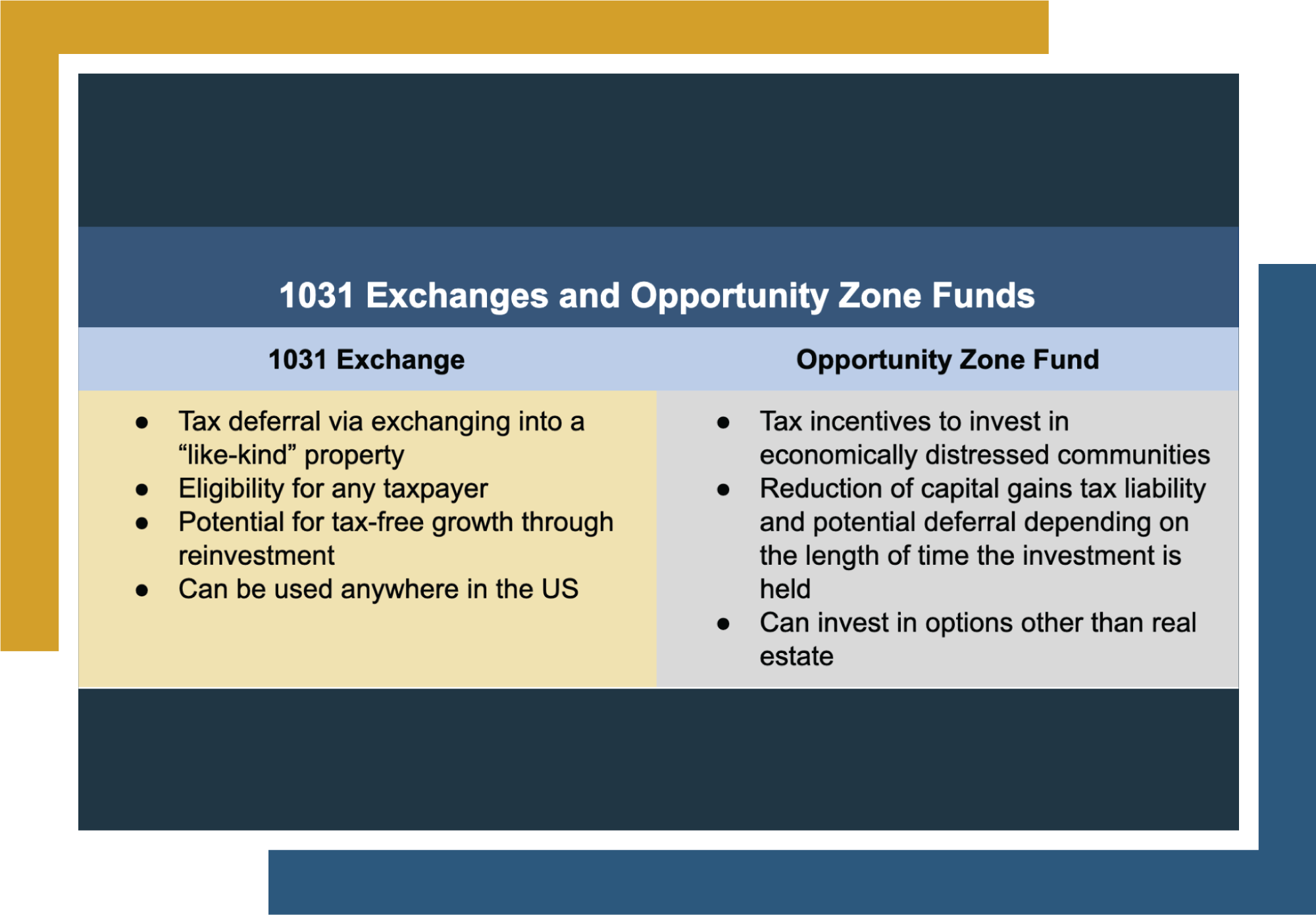

Two of these strategies are 1031 exchanges and Opportunity Zone Funds. While both strategies offer their comparative advantages and disadvantages, investors may wonder if it’s possible to take advantage of both with the same asset.

If you’re wondering if you can 1031 exchange into an Opportunity Zone Fund, you aren’t alone. While the short answer is “no,” that doesn’t mean that there aren’t other avenues that investors looking to do so can take advantage of.

Can You 1031 Exchange Into an Opportunity Zone Fund?

Since 1031 exchanges tax deferral tools that require the exchange of “like-kind” properties, Opportunity Zones unfortunately do not qualify. That means there is no way to 1031 exchange directly into an Opportunity Zone.

1031 exchanges and Opportunity Zones are different strategies with different purposes. While Opportunity Zones can use real estate as investment vehicles, they are funds, meaning they are not tangible assets like real estate, which 1031 exchanges require.

Why Can’t I 1031 Exchange into an Opportunity Zone

- Nature of Investments: 1031 exchanges require relinquishing one property in exchange for another real “like-kind” asset. Opportunity Zones are funds, not real assets, so they don’t qualify for 1031 exchanges. Opportunity Zones are not primarily capital gains deferral tools and are instead incentives to invest in specific economically distressed areas to promote economic growth.

- Timing and Requirements: 1031 exchanges have strict timing requirements that involve identifying a replacement property within 45 days and completing the process within 180 days. Opportunity Zones have their own set of time requirements. Still, they are much more protracted, with investors gaining better incentives the longer they invest in an Opportunity Zone fund and receiving the max after 10 years. 1031 exchanges can be exited after only about two years.

However, while it’s not possible to 1031 exchange into an Opportunity Zone, that doesn’t mean that the two cannot be used as part of the same investment portfolio. For example, one of the hurdles of a 1031 exchange is the tight windows and guidelines investors must follow to complete one successfully.

Since investors only have 45 days to identify replacement properties and 180 days to complete an exchange, Opportunity Zones can act as a second option for investors who may fail to complete the 1031 exchange process.

It’s important to note that while both options can be beneficial, like any investment, they carry risks. Check with a financial advisor before deciding to take on a 1031 exchange or invest in an Opportunity Zone.

If you’re interested in using a 1031 exchange to move funds into an Opportunity Zone, chances are you’re an investor looking for an exit strategy from direct property management. While you can’t 1031 exchange into an Opportunity Zone, other 1031 exchange vehicles may align with your investment strategy.

Exchange into One of Canyon View Capital’s Multifamily Properties

We understand that it may be frustrating to learn that you can’t 1031 exchange into an Opportunity Zone. That doesn’t mean you’re out of options; Canyon View Capital wants to help.

At CVC, we manage a multifamily real estate portfolio centered in America’s Heartland. Our principals have over 40 years of investing experience and have used that expertise to grow our multifamily investment portfolio to over $1 billion1 in aggregate value. By investing in one of our properties as tenants in common, you can benefit from many of the tax incentives and advantages of investing in real estate without the hassle of property management.

Still need more information on 1031 exchanges vs Opportunity Zone Funds?

Not being able to 1031 exchange into an Opportunity Zone doesn’t have to end your 1031 exchange journey. At Canyon View Capital, we will walk you through every step of your investment when using your 1031 exchange as a vehicle, and our staff will always answer your questions honestly, completely, and promptly. For more on investing using a 1031 exchange, contact Canyon View Capital.

Verified accreditation status required. LEARN MORE about our 1031 Exchange Program.

1$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.