Real estate investors often contemplate property sales for various reasons, including relocation, upgrading, or divesting underperforming assets while grappling with tax complexities.

Investors increasingly recognize the value of 1031 exchanges, a tax-deferral tool. These exchanges enable the sale of investment properties without the burden of capital gains taxes, potentially saving up to 30% of the sale profits. Nonetheless, executing a 1031 exchange requires strict adherence to tight timelines and regulations.

In this article, I’ll detail the 1031 exchange timeline to help investors like you prepare to take advantage of this specialized tax deferral tool.

| Discussion Topics |

The 1031 Exchange Timeline

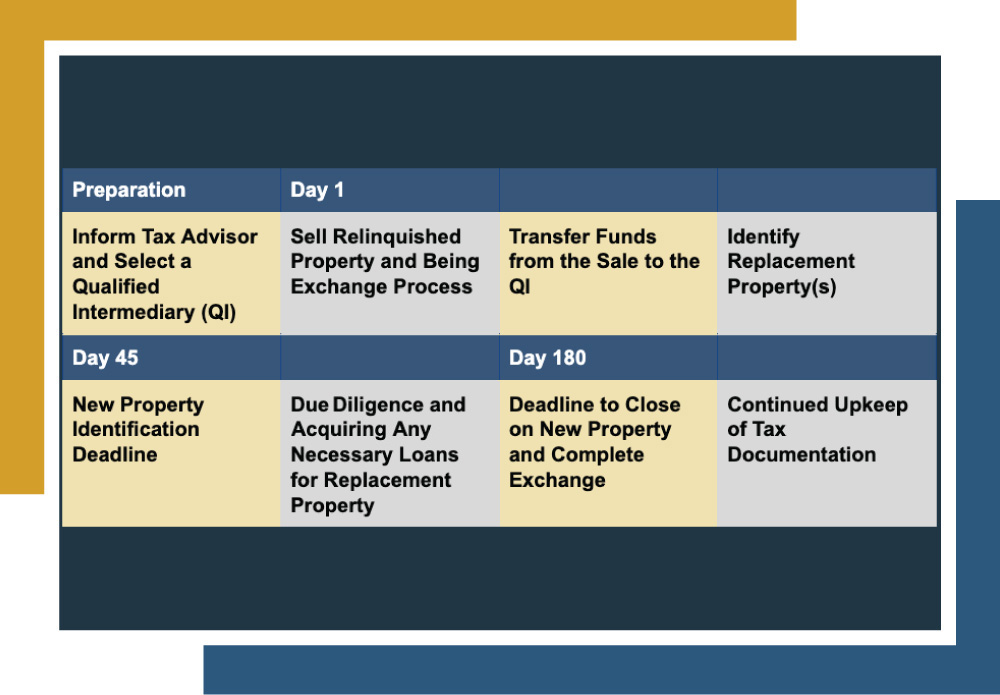

Preparation | Day 1 | ||

Inform Tax Advisor and Select a Qualified Intermediary (QI) | Sell Relinquished Property and Being Exchange Process | Transfer Funds from the Sale to the QI | Identify Replacement Property(s) |

Day 45 | Day 180 | ||

New Property Identification Deadline | Due Diligence and Acquiring Any Necessary Loans for Replacement Property | Deadline to Close on New Property and Complete Exchange | Continued Upkeep of Tax Documentation |

Although 1031 exchanges offer a potent strategy for postponing capital gains taxes on the sale of an investment property, they can be challenging for some investors due to the unwavering and stringent timelines and regulations that demand steadfast compliance.

Once you decide to initiate a 1031 exchange, the clock starts running, and you have two windows to be conscious of; the 45-day window and the 180-day window.

- 45-Day Window: This is the initial phase of the 1031 exchange timeline. From the day that you successfully sell your relinquished property, you have 45 calendar days to identify any potential replacement properties. During this phase, you must submit written identification of the replacement property(s) to the QI associated with the exchange.

- 180-Day Window: The 180-day window encompasses the entirety of the 1031 exchange process. After selling your relinquished property, you are granted 180 days to conclude the 1031 exchange successfully.

It’s important to understand that the 45-day and 180-day windows run concurrently and are reinforced by the IRS. Failure to complete the required steps within these windows will jeopardize your tax-deferral benefits, as the IRS does not offer extensions outside of very specific instances.

Steps of a 1031 Exchange Explained

Steps of a 1031 Exchange | |

| The IRS requires a QI to oversee the 1031 exchange to ensure compliance with all regulations. |

| Once you have sold the original property, both the 45-day and 180-day windows begin, and the 1031 exchange timeline has commenced. |

| Since the IRS does not allow investors to hold onto the proceeds from the relinquished property sale, you must transfer these funds to the QI from escrow when you close on the sale. The QI will hold these funds in a segregated account. |

| You must begin by identifying all potential replacement property(s) and have 45 days to do so. |

| The 45-day deadline for identification of the replacement property ends, and by now, you must have submitted written identification of the replacement property(s) to your QI. |

| The 180-day timeframe encompassing the entire 1031 exchange process has concluded, and by this point, you should have completed the purchase of the replacement property. If the exchange has been successful, you now own the replacement property without incurring capital gains taxes. |

| When closing on the replacement property(s) previously identified, you must use the funds from the relinquished property to purchase and close the new property. |

| After successfully concluding the 1031 exchange, it’s crucial to diligently uphold IRS compliance, maintain all pertinent exchange-related documentation, and prepare for the accurate reporting of the exchange on your tax return. |

Understanding the Complexities of the 1031 Exchange

While these steps may appear straightforward at a macro level, it’s imperative to realize that identifying suitable properties, managing the sale and acquisition of a new property, cooperating with a QI, and navigating the intricate rules and regulations of 1031 exchanges are challenging tasks in themselves. The additional pressure of stringent time constraints can make the process even more demanding.

This is why even the most learned and experienced investors should always consult with a tax professional before deciding to begin a 1031 exchange.

Additionally, for investors who may find it challenging to sift through the near-limitless amount of potential replacement properties or those who no longer wish to carry the burden of property management but would still like to defer capital gains taxes from the sale of their property, Canyon View Capital may have a solution.

Exchange into One of Canyon View Capital’s Multifamily Properties

Now that you understand the 1031 exchange timeline, it’s time to consider your options. Here at CVC, we manage a portfolio of multifamily real estate properties valued at $1 billion1. We offer investors like you the opportunity to exchange into one or multiple of our properties as Tenants in Common.

This allows investors like you to defer your capital gains taxes and potentially continue enjoying the benefits of real estate investing–such as passive rental income and passive losses–without worrying about managing properties yourself.

Still need more information on 1031 exchanges vs Opportunity Zone Funds?

1$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.