Like many generations of Americans, you’ve probably been told how important it is to save for the future. As fewer contemporary employers offer pension benefits to employees, investing in a trusty 401k fund has become one of the most common methods for putting money aside. While these and other retirement-focused savings accounts1 have historically provided steady, consistent gains2, recent factors like market volatility and rising inflation3 have cast doubt on their reliability.

Many seeking portfolio diversification feel constrained by savings tied up in a 401k or IRA until retirement. But here’s the secret: Most 401ks (and some other retirement funds) can be rolled into real estate investments, regardless of age. Diversifying your investment strategy could potentially yield more stable returns, though investing always carries risks.

Below, we’ll explore how exploring 401k investment options could liberate you from a single investment path and enhance your portfolio.

| Discussion Topics |

401K Real Estate Investment Options to Consider

If you’re reading this article, chances are you’ve already done the math and realized that relying on a single retirement savings vehicle may not be enough to meet your financial goals — even with the best planning available. Market factors heavily sway traditional retirement investments, therefore, it’s nearly impossible to predict what the market will be like when you’re ready to retire and pull those funds out.

If you’ve been contributing consistently, maxed out your allowances, and still haven’t come up with the returns you need to see, these 401k real estate investment options could be an alternate path to success.

Roll It Over

![]() Before you start viewing properties to buy, you need to make sure you can access the capital you want to invest. For so many people, that money is just sitting in a 401k — or more than one, if you left one behind with a previous job. That’s why you need to know how to roll your 401(k) account(s) into the more flexible format of an IRA. Since 401(k) funds are essentially fixed in their application, you can’t really move the money around. This is where rollover 401(k)s — 401(k) funds from previous employers — come into play.

Before you start viewing properties to buy, you need to make sure you can access the capital you want to invest. For so many people, that money is just sitting in a 401k — or more than one, if you left one behind with a previous job. That’s why you need to know how to roll your 401(k) account(s) into the more flexible format of an IRA. Since 401(k) funds are essentially fixed in their application, you can’t really move the money around. This is where rollover 401(k)s — 401(k) funds from previous employers — come into play.

- When you leave a job or find new employment, the IRS gives you 60 days, starting when you receive a new IRA or retirement plan, to roll those funds into your new plan or a different kind of IRA. Image link

- Rolling 401k funds into a self-directed IRA increases the liquidity and gives you greater flexibility in deciding how to use them. If, for example, you opt to use the capital from your former 401k (from a previous employer) for real estate investments, it could untether you from your current financial plan so you can start earning more consistent, passive returns.

- Such alternatives could allow for better performance than traditional retirement funds and, potentially, more stability. You’ll also benefit from having a more diversified portfolio rather than keeping all your (nest) eggs in one basket.

Considering investing your 401(k) in real estate? Remember to roll it over into a self-directed IRA. Conduct thorough research and consult a licensed financial advisor for guidance.

Popular alternative investment options include Real Estate Investment Trusts (REITs). REITs offer traditional real estate benefits without the operational hassles. Whether public or private, a broker can assist in getting you started.

If we have your attention but are hesitant about trusting someone you don’t know with your life savings, that’s good! You should always be careful about making such big decisions.

That’s where Canyon View Capital comes in.

Our principals have been doing this particular type of real estate investing for over 40 years now. While other investment managers may list similar fund options, the descriptions below detail some of the private equity investment funds CVC has developed, which are only available to experienced, sophisticated investors.

CVC Funds

Our private real estate funds are specifically designed to use beneficial tax laws while investing in multifamily real estate properties that can generate passive investment income. The operating funds that accumulate from these investments are also liquid and thus benefit from a similar level of flexibility as IRAs. CVC also offers an option to accommodate your self-directed IRA, should you wish to use it for real estate.

While typical retirement funds might be invested in an array of financial vehicles, including equity funds, bond funds, money market funds, and hedge funds, CVC focuses on multifamily real estate. Our CVC funds allow potential investors to own portions of real estate through a pooled investment vehicle. The Income Fund seeks real estate investments that increase the potential for:

- Positive cash flow

- Capital appreciation thru value added by management or physical improvements

- Long-term equity growth

One of the biggest challenges in the world of investing is the difficulty of predicting market forces and determining what the economic future may bring. Investing in real estate can help buffer public market uncertainty by increasing diversification and spreading the risk of an investment portfolio.

The Importance of Investing for Retirement

When you decide it’s time to stop working, your future will rely on whatever financial security your retirement accounts can provide. It’s difficult to overstate the importance of such assets, though many Americans4 rely — almost unconsciously — on their employer’s plan to set money aside for retirement.

Retirement accounts make sense. Social Security alone is not likely to provide the income level you need to sustain yourself in retirement. Instead, you can designate a pre-tax percentage of your paycheck for retirement. Depending on the plan’s details, some employers offer to match your contributions up to a certain percentage.

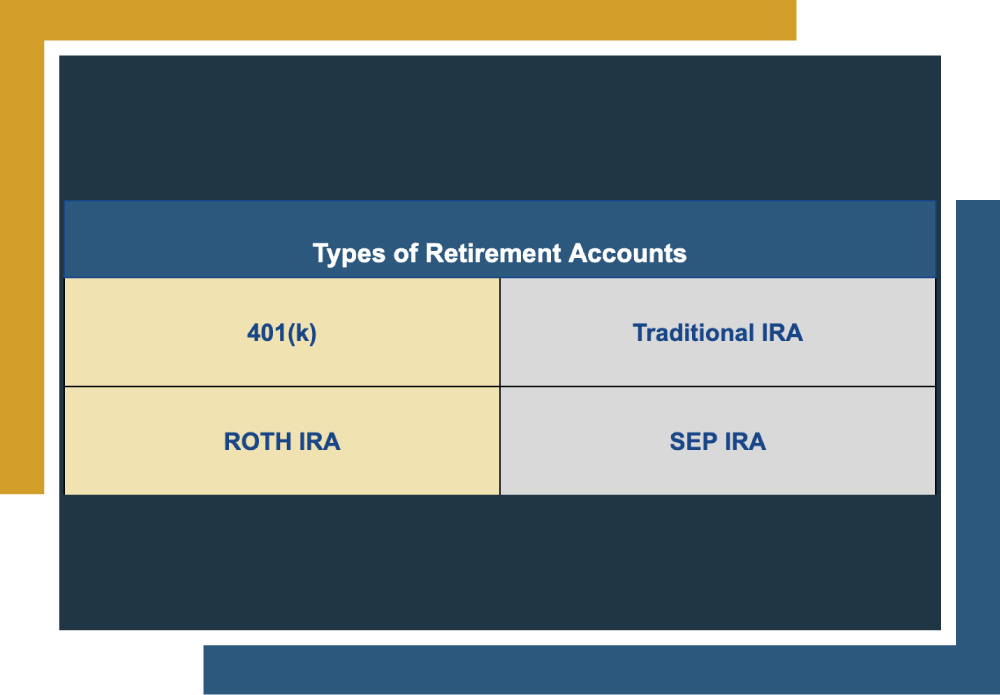

Retirement accounts also let you defer paying (income) tax on your contributions until they are withdrawn, which can help reduce your annual tax bill. Some of the most popular retirement accounts include 401ks, traditional IRAs, ROTH IRAs (named for late Delaware Senator William Roth), and Simplified Employee Pension (SEP) IRAs. The table below should help you make better sense of this alphabet soup.

Retirement Account Types | |||

Account Type | Summary | Pros | Cons |

401(k) | Standard employee savings plan. Accessible option that contributes a percentage of each paycheck. Employers may match contributions. |

|

|

Traditional IRA | Pre-tax savings plan, available to anyone. Similar to 401k benefits, but lower contribution limits. More flexible option: offered by banks, brokerages, or investment firms, they can use your savings to invest (in stocks, bonds, or real estate). |

|

|

ROTH IRA | Similar to traditional IRA, but with inverse tax benefits. You only pay tax when you take money out of savings with traditional, pre-tax IRAs. With a ROTH IRA, you pay tax on contributions but can withdraw money without a tax penalty. |

|

|

SEP IRA | SEP IRAs suit self-employed and small businesses, functioning like traditional IRAs but allowing larger contributions. Employers can contribute up to 25% of an employee’s income (max $61,000), and self-employed individuals up to 25% of their net income. Employees are fully vested in contributions, unlike 401(k) plans. |

|

|

Canyon View Capital Works With You

Now that you know some of the available 401k real estate investment options, you’ll want to partner with experts who can help you get your foot in the door. At Canyon View Capital, we have over four decades of real estate investment and property management experience, with properties in markets throughout the US Midwest and Midsouth.

CVC professionals understand different aspects of real estate, accounting, and taxes. Our goal is to guide you through all the intricacies of real estate investing so that it’s as easy as it is effective. We do the heavy lifting of property management to take the headache out of real estate investing.

Our goal is to help you enjoy the highly sought-after benefits of real estate investing without the hands-on responsibilities. It’s sort of like having your cake and eating it too!

If you’re feeling trapped by traditional retirement accounts, let our real estate investment professionals shine a brighter light to help you get to the end of the tunnel.

New to real estate investing, but want to learn more about 401k real estate investment options?

For over 40 years, the principals at Canyon View Capital have worked in real estate, with a portfolio currently valued at over $1B2. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

To learn more about 401k real estate investment options, call CVC today! Get Started

Citations

1Shunsuke Managi, Mohamed Yousfi, Younes Ben Zaied, et al., “Oil price, US stock market and the US business conditions in the era of COVID-19 pandemic outbreak,” Economic Analysis and Policy, Vol. 73, 2022, pgs. 129-139. ISSN 0313-5926. https://doi.org/10.1016/j.eap.2021.11.008.

2Mateo Tonello, Stephan Rabimov, “The 2010 Institutional Investment Report: Trends in Asset Allocation and Portfolio Composition,” for The Conference Board. https://ssm.com/abstract=1707512

3Monthly 12-month inflation rate in the United States from February 2020 to February 2023. Statista.com. Accessed April 13, 2023.

4US Bureau of Labor Statistics. “67 percent of private industry workers had access to retirement plans in 2020.” March 1, 2021, www.bls.gov.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.