In recent years, many investors have realized that real estate could be an excellent addition to their investment portfolio. It makes sense—real estate increases your cash flow, tax breaks, and hedges against inflation1 while giving you access to an asset that doesn’t need to be constantly monitored like others.

However, there are multiple types of real estate investment, each with its own characteristics. Multifamily investing is one such option and could be the perfect entry into real estate investing for many would-be real estate investors.

In this article, I will break down the benefits of multifamily investing to help you determine whether this option is right for you and explore why it’s important to weigh your risk when making investment decisions.

| Discussion Topics |

What Makes Multifamily Investing Different?

While you may know what real estate investing is, you may not be as knowledgeable on the specific types of real estate investing. For the most part, real estate investing can be classified under three main categories: multifamily, single-family, and commercial.

Multifamily real estate involves purchasing and using properties designed and built to accommodate multiple living units within a single building or complex. These properties typically house multiple tenants ranging from a few to hundreds or even thousands, depending on the size of the operation. Each unit has a self-contained living space with a kitchen, bedrooms, bathrooms, etc.

Multifamily real estate property types include:

- Duplexes, Triplexes, Fourplexes

- Condominiums

- Townhouses

- Apartments

Conversely, single-family real estate is exactly what it sounds like—a single unit, such as a house. Where multifamily properties have multiple units, single-family properties have one.

The final form of real estate investing is commercial real estate. Commercial real estate is distinct from both multifamily and single-family because the units are properties reserved for business use.

Commercial real estate property types include:

- Retail spaces

- Office buildings

- Industrial warehouses

- Restaurants

- Hotels

Benefits of Multifamily Investing: What You Need to Know

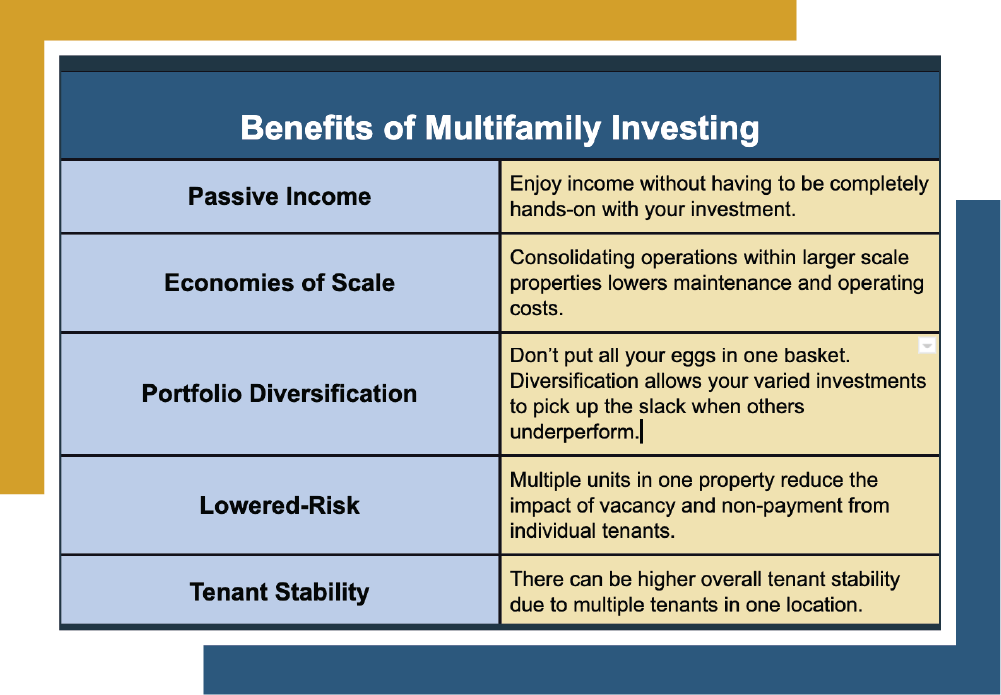

When you invest in multifamily properties, you open the door to an investment vehicle that allows you to rent out the properties to tenants. This investment comes with a myriad of unique advantages, such as:

- Passive income: Investing in multifamily real estate adds a passive cash flow generator to your investment portfolio via income from rent payments, meaning that after the initial setup of a property, you can enjoy income from an investment option that doesn’t require round-the-clock upkeep. If managing a property is too much, you can hire property managers to do the heavy lifting. However, there are still responsibilities just like with any other investment option, there may just be fewer when compared to some others.

- Economies of scale: When you consolidate units under one roof, you can utilize the advantages of economies of scale. Operating and maintenance costs such as insurance, repairs, and supplies can be much cheaper since they’re used on the same property.

- Portfolio diversification: You’ve likely heard the phrase, “Don’t keep all your eggs in one basket.” It may sound passé, but it’s true. It’s commonly accepted that a diversified portfolio is something that every investor should strive for2 because it lowers your risk exposure and ensures you’re taking advantage of the benefits of multiple income streams. Also, if one is underperforming, chances are you can count on another to pick up the slack. Multifamily investing can further diversify your portfolio even if you already invest in other property types.

- Lower risk: Multifamily investing is often considered a relatively safe investment option, even compared to other real estate property types. This is because people will always need somewhere to live, even during economic downturns. Moreover, multifamily investors benefit from having multiple income streams in one property. You’re less likely to feel the effects of a vacancy or tenant non-payments when multiple units bring in money.

- Appreciation and equity: Multifamily properties don’t just provide a source of rental income—they also have the potential to appreciate over time. This is driven by factors such as market demand, location, and property enhancements. When the property appreciates, you build equity, unlocking opportunities for refinancing at better rates or selling properties for potentially substantial profits later.

- Tax benefits: Multifamily properties can be structured as tax-advantaged investment vehicles. Investing in properties allows you to use many tax advantages, such as deducting mortgage interest from your taxes, utilizing depreciation, or using tax deferral tools such as 1031 exchanges to keep more money in your pocket.

- Ability to leverage: When investing in real estaet, you can typically use a mortgage to finane it. This allows you to leverage your capital and buy an asset that is worth more than the capital you have on hand.

- A diverse array of property types: Compared to single-family, multifamily real estate offers many more property types. For example, you may decide that an apartment complex suits your investment goals better than duplexes because you want dozens or even hundreds of units. With single-family, you’re locked into investing in one property type, even if there are slight differences.

Multifamily Investing vs. Other Real Estate Options | |||

Benefit | Multifamily Investing | Single-Family Investing | Commercial Investing |

Cash Flow Potential | Multiple rental units to generate consistent cash flow | Rental income comes from a single property | Potentially high rental income from commercial tenants |

Appreciation Potential | Long-term value appreciation due to market demand | Potential for value to increase over time | Potential for value to appreciate over time, especially in prime commercial locations |

Diversification | Multiple units in one property reduce the impact of vacancy and non-payment from individual tenants | Only one tenant per property, which opens the investor to more risk from vacancy or tenant non-payment | Few tenants, and often only one, per property, which opens the investor to more risk from vacancy or tenant non-payment |

Economies of Scale | Operating efficiencies due to managing multiple units reduce maintenance and operating costs | Increased burden from maintenance and operating costs due to managing fewer units overall | Typically shared operating costs between owner and tenants |

Tenant Stability | High tenant stability due to multiple tenants in one location | Less tenant stability, as one vacancy at a location halts cash flow | Less tenant stability, as one vacancy at a location halts cash flow |

Understanding Investment Risks

It’s worth noting that even if multifamily investing is more risk-averse than other real estate investment options, it still carries some risk, and many factors can influence the levels of risk you may be exposed to.

A risk spectrum consists of Core, Core Plus, Value Add, and Opportunistic investment options. The spectrum involves potentially higher rewards for investing but comes with increased risk, with Core being the most risk-averse and Opportunistic being the riskiest.

While investment vehicles can fall on different points of this spectrum, the spectrum is also relative to individual investment vehicles. Multifamily properties can fall anywhere on this spectrum, depending on the approach. For example, the market where the property is located can influence its level of risk. Some markets may have more competition than others, which can drive speculation and increase volatility, risk, and potential rewards.

It’s also worth noting that the higher an investment goes on the spectrum, the more hands-on the investor will need to be.

Many investors will find that they prefer more stable, reliable returns that are more risk-averse than those that are highly volatile. If that sounds like the path you want to take, Canyon View Capital might be a good option for you to consider with your financial advisor.

Canyon View Capital Brings You the Benefits of Multifamily Investing Without a Lot of the Hassles

At Canyon View Capital, we utilize a “buy and hold” strategy instead of a short-term “buy and flip” strategy that allows investors to enjoy income streams from rent payments over a consistent, long-term horizon.

At CVC, we’re enthusiastic about real estate investing and love answering our client’s questions. If you’re ready to enjoy the benefits of multifamily real estate without having to do the heavy lifting, CVC is who you want in your corner.

Ready to learn more about Multifamily Investing?

For over 40 years, CVC has managed, owned, and operated real estate valued at over $1B3. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns. To Learn More About the Benefits of Multifamily Investing, Call CVC Today!

Citations

1Patrick Grimes, “Why Income-Generating Real Estate Is The Best Hedge Against Inflation,” for Forbes. April 14, 2022, Forbes.com. Accessed June 16, 2023

2Maurice Dukes, “What It Takes To Diversify Your Investment Portfolio,” for Forbes. Jan 26, 2022, Forbes.com. Accessed June 16, 2023.

3$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.