Many savvy investors have become privy to the idea of utilizing real estate as an investment vehicle in their portfolio. Like any investment, it is an ever-evolving landscape of opportunities that requires a nuanced understanding of the various strategies and approaches to investing.

In this article, I will delve into the different types of real estate investing strategies and help you understand the unique advantages and challenges associated with each.

| Discussion Topics |

What are the Different Types of Real Estate Investing Strategies?

Like any investment avenue, many different strategies have been developed over time. This is due to various factors, such as investors’ different financial goals, risk tolerances, time horizons, and simple preferences.

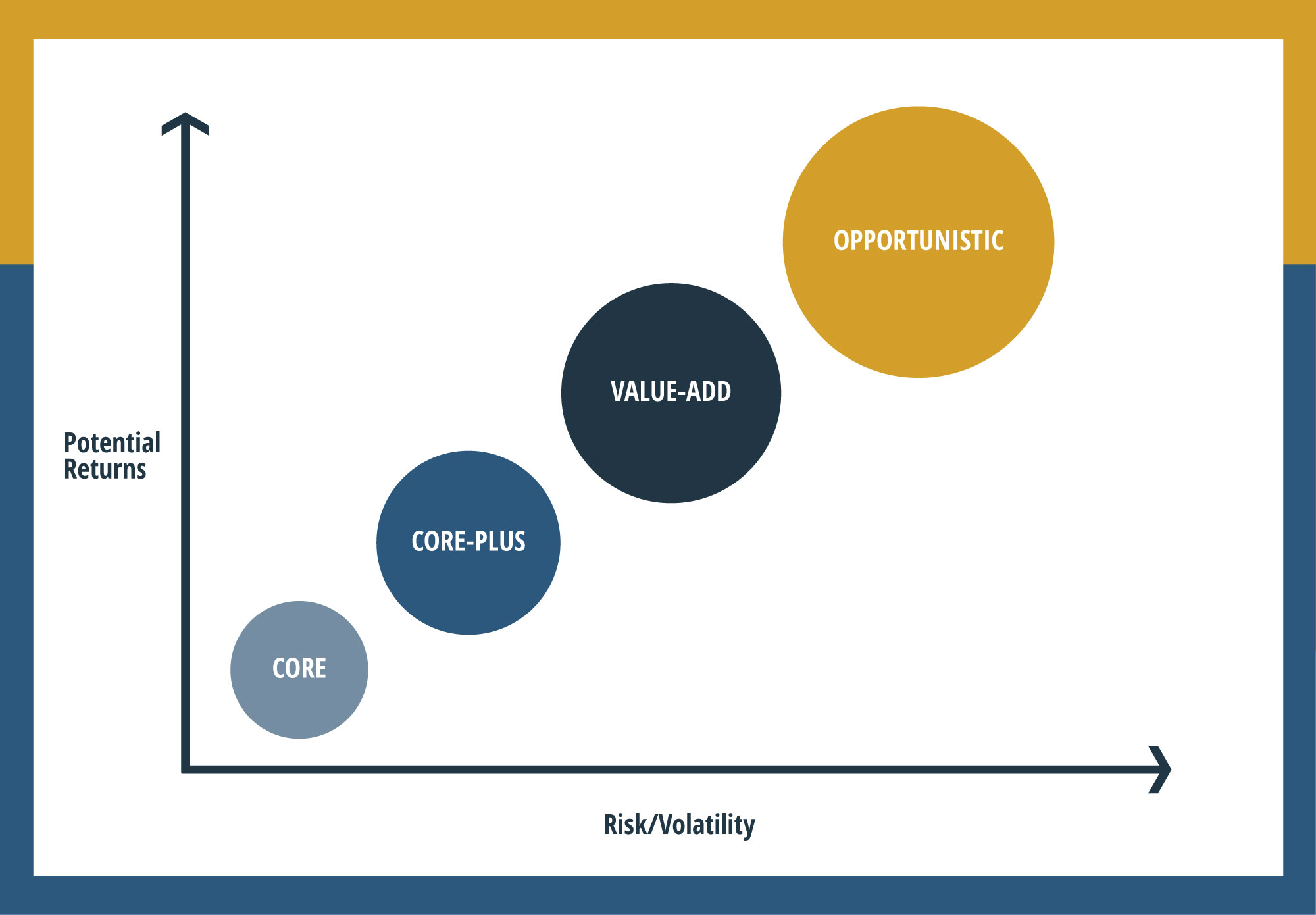

No investor is the same; each inherently needs different approaches to help increase the potential for successful investing. Whether your goals are stable, long-term income or high-risk, high-reward ventures—or something in between—it’s likely that they’ll be met using one (or more) of the four real estate investing strategies: core, core-plus, value-add, and opportunistic.

Real Estate Investment Risk Spectrum | ||||

Investment Strategy | Core | Core-Plus | Value-Add | Opportunistic |

Risk Level | Low | Moderate | High | Very High |

Property Type | Stable and high-quality assets | Stable assets with some upsides | Assets that often require improvement | Distressed or undervalued assets |

Cash Flow | Steady and predictable income | Moderate cash flow | Potential for increased income | Highly variable |

Capital Appreciation | Moderate | Moderate to high | High | High |

Holding Period | Long-term (5+ years) | Medium-term (3-5 years) | Medium-term (3-5 years) | Short-term (1-3 years) |

Investor Involvement | Limited | Moderate | High | Extremely High |

- Core: The core investment strategy centers around stability. A core strategy typically involves investing in income-producing properties in prime markets with low vacancy rates, long-term tenants, and steady cash flow. This strategy is for investors prioritizing safety and consistency over potentially higher returns1.

- Core-plus: For those looking to increase the potential for higher returns while maintaining a certain degree of stability, core-plus is a viable choice. Core-plus involves investing in properties that share many characteristics with a core strategy but with the twist that core-plus properties may require minor enhancements or leasing efforts to unlock their potential. These targeted improvements can potentially increase property value but come at the cost of increased capital requirements and risk2.

- Value-add: Investors willing to roll their sleeves up a bit more may find the value-add strategy better fits their goals. This approach entails purchasing underperforming or distressed properties with the sole intention of revitalizing them. While this further increases the potential for higher returns, it also requires an even higher capital investment and, thus, greater risk3.

- Opportunistic: An opportunistic approach may appeal to the boldest investors with an even higher appetite for high-risk, high-reward ventures. This strategy involves purchasing heavily distressed or speculative properties, ground-up developments in emerging markets, or completely redeveloping unique but neglected assets. Success in this arena brings the highest potential for returns but also carries significant risk, making it a fit for those with a high tolerance for risk4.

These different real estate investment strategies exist on a spectrum of least risky and most predictable to most risky and most volatile. However, it should be noted that while one method may be riskier than another, all investment strategies carry risk. That’s why you should consult with your financial advisor before engaging in any new investment approach.

Why Real Estate Investing?

Now that you know a bit more about the different types of real estate investing strategies, you may need affirmation on why you might want to invest in real estate in the first place. Real estate brings many potential benefits to investors that make it an attractive investment option worth considering, such as:

- Diversification: Adding real estate to your investment portfolio adds another wrinkle with a low correlation with other popular investment vehicles such as stocks and bonds. This means that the performance of real estate may not always move in tandem with these options, which helps spread risk and reduces portfolio volatility5.

- Potential for appreciation: It’s possible for real estate assets to increase in value over time, which means that they can potentially be sold at a later date for a profit.

- Hedge against inflation: One of the most common contemporary concerns regarding financial outlooks is inflation. Real estate can offer a potential hedge against inflation because as inflation occurs, property values and rental income tend to rise, which helps protect your investment and portfolio6.

- Cash flow: Because real estate investments generate monthly income via rental payments, as long as you don’t have vacancies or significant expense loads, you’ll benefit from a stable source of income, unlike some other options, such as stocks and bonds.

- Asset tangibility: A perhaps underrated aspect of real estate is that it is a tangible asset you can see and touch. While many options are ephemeral in nature, some investors benefit from a sense of security simply by knowing that your asset is an actual thing that exists in the physical world.

- Tax benefits: One unique feature of real estate is its specific and various tax advantages. When you own a property, you may be able to take advantage of mortgage interest deductions, property depreciation, and 1031 exchanges, which can significantly reduce your overall tax liability and save you money.

It’s important to note that these benefits are associated with real estate; they are not guaranteed factors. Moreover, real estate also comes with its own set of challenges, such as property management, market volatility, and illiquidity. Again, make sure you consult with your financial advisor before making any investment decisions.

Suppose you’re one of the many investors who want to test the waters of a new real estate investment strategy or real estate as a whole but are hung up on some caveats, such as property management and the time investment that comes with it. In that case, Canyon View Capital may have options for you!

Contact Canyon View Capital About Real Estate Today

Now that you know about the different types of real estate investing strategies and their advantages and disadvantages, it might be time to take the next step. Here at Canyon View Capital, we’re passionate about multifamily real estate. Our leadership has over 40 years of real estate experience and now manages a portfolio valued at over $1 billion.

We seek to leverage our experience to help investors like you enjoy the benefits of real estate investing without worrying about some of the potential hangups. For more conservative investors, we offer an option backed by our “buy-and-hold” strategy, which provides the potential for passive real estate income and passive losses to reduce your tax burdens.

Still need more information on 1031 exchanges vs Opportunity Zone Funds?

For over 40 years, CVC has managed, owned, and operated real estate valued at over $1B7. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns. To learn more about different types of multifamily investing strategies, call CVC today! Get Started

1, 2, 3, 4James Nelson, “Considering Risk Profiles When Making Real Estate Investments,” for Forbes, May 12, 2023, Forbes.com. Accessed Sep. 1, 2023.

5James Royal, Ph.D., “Why is portfolio diversification important for investors?,” for Bankrate, June 16, 2023, bankrate.com. Accessed Sep. 1, 2023.

6Patrick Grimes, “Why Income-Generating Real Estate Is The Best Hedge Against Inflation,” for Forbes, April 14, 2023, Forbes.com. Accessed Sep. 1, 2023.

7$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.