Investors often include real estate in their portfolios for its potential benefits. Real Estate Investment Trusts (REITs) are popular among various real estate investment options. Whether investors choose direct real estate or REITs, many consider using 1031 exchanges to defer capital gains taxes when selling investment properties.

Are you considering a 1031 exchange and wondering, “Do REITs qualify for a 1031 exchange?” The short answer is no. However, there are other options available that this article will explore.

Do REITs Qualify for a 1031 Exchange?

Do REITs Qualify for a 1031 Exchange? Unfortunately, they do not. The IRS regulates which properties or assets are eligible for 1031 exchanges. While they are technically a real estate investment, they are considered a different type of investment vehicle and are instead treated as personal property and not direct real estate ownership.

Personal property is excluded from 1031 exchanges because the substantial variations in its nature and character pose challenges in determining eligibility for such exchanges. Consequently, the IRS outright prohibits personal property from qualifying for a 1031 exchange. While these stringent regulations exist to maintain the integrity of the tax deferral tool, they also serve as one of the limitations within an otherwise potent tax strategy.

To understand why REITs do not qualify for 1031 exchanges, it’s crucial to grasp the underlying mechanisms of how REITs operate.

What Are REITs?

REITs are owned, operated, or financed by companies. They are designed to allow individuals to invest in large-scale income-producing real estate without needing to actually buy, manage, or finance the properties themselves.

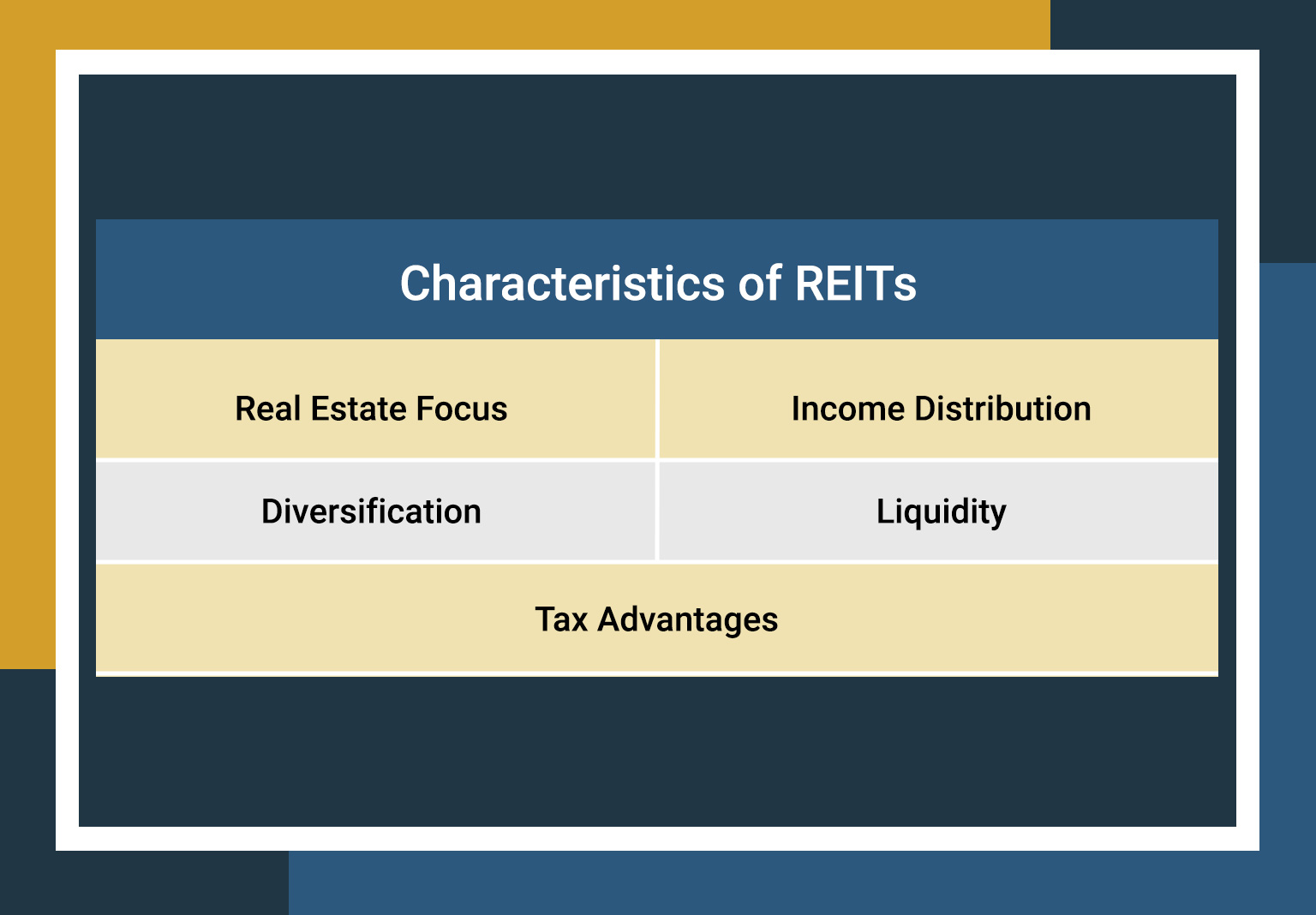

Investors who may otherwise need help to afford larger-scale investment property options like apartments or condominiums can benefit from real estate investment trusts. The critical characteristics of REITs include:

- Real Estate Focus: REITs predominantly allocate their investments to various real estate assets, encompassing commercial office buildings, shopping centers, apartment complexes, hotels, and other forms of income-generating real estate.

- Income Distribution: An essential characteristic of REITs is their commitment to distributing a substantial portion of their income, typically a minimum of 90%, to shareholders in the form of dividends. This quality enhances the appeal of REITs for investors seeking income.

- Diversification: REITs commonly possess a diversified portfolio of properties, mitigating the risk linked to the performance of individual assets. This diversification strategy enhances the resilience of REIT investments.

- Liquidity: Unlike the potential illiquidity of direct real estate ownership, REIT shares offer liquidity as they can be bought and sold on stock exchanges, allowing investors to trade their positions.

- Tax Advantages: REITs enjoy specific tax benefits, including exemption from federal income tax, contingent on the condition that they distribute a minimum of 90% of their taxable income to shareholders. This tax structure contributes to the appeal of REIT investments.

What are My Other Options?

If you’re disappointed by the inability to use a 1031 exchange on a REIT, know there are alternative options.

Eligible Investments for 1031 Exchanges | |

Residential Real Estate | Single-family homes and multifamily properties such as apartments, condominiums, and townhouses. |

Commercial Real Estate | Office buildings, retail properties, industrial warehouses, and hotels. |

Vacant Land | Undeveloped land that is held for investment or business purposes. |

Farm Properties | Farmland, ranches, agricultural properties. |

Mixed-Use Properties | Properties that combine residential and commercial elements. |

Industrial Properties | Manufacturing facilities, distribution centers, warehouses. |

Retail Properties | Shopping centers, strip malls, standalone retail buildings. |

Hotel and Hospitality Properties | Hotels, motels, resorts, other lodging establishments. |

Is There a Better Option?

Unlike REITs, these options allow investors to utilize a 1031 exchange to exchange out of or into. Yet, outright acquiring properties often demands a substantial capital investment. This somewhat contradicts the fundamental appeal of REITs, which is their ability to operate without necessitating a significant capital commitment from the investor.

Investors attracted to REITs are likely drawn by the absence of property management responsibilities and the ability to participate in significant real estate ventures without requiring substantial upfront capital.

Luckily, Canyon View Capital has real estate investment products that offer similar benefits to REITs, but in contrast their investments do allow for 1031 exchanges.

Canyon View Offers Real Estate Products That Allow for 1031 Exchanges

Do REITs qualify for a 1031 exchange? While the answer is no, you do have other options. Embarking on large-scale real estate operations may appear daunting for many investors. After all, such endeavors entail significant hands-on involvement in terms of property management and substantial upfront capital requirements.

Despite the potential challenges, the appealing benefits of investments such as multifamily real estate often attract many investors. This is precisely why Canyon View Capital offers alternative real estate investment options, allowing investors to enjoy the advantages of multifamily investing without the associated hurdles by exchanging into one or more of our multifamily properties as Tenants in Common.

Our portfolio of multifamily properties is now valued at over $1 billion dollars1, and we want to help investors like you get a piece of the pie.

Ready to upgrade your portfolio with diversified, stable investments?

Canyon View Capital manages, owns, and operates real estate valued at over $1B2. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

Still wondering, “Do REITs qualify for a 1031 exchange?” Call CVC today!

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.