Many investors decide to venture into real estate, as it can be very profitable. However, whatever the reason, sometimes you need to move on from a specific property. Unfortunately, you can expect to owe capital gains taxes when you sell an investment property.

Many savvy investors realize that 1031 exchanges can be a massive boon to their financial objectives by allowing them to defer those taxes, potentially or indefinitely, while upgrading or diversifying their investment portfolio.

However, there are costs and fees associated with 1031 exchanges that all investors should know about. How much does a 1031 exchange cost? In this article, I’ll answer that question and explain why you should consult an expert before seeking a 1031 exchange.

How Much Does a 1031 Exchange Cost? What Investors Need to Know

While 1031 exchanges offer many long-term benefits to real estate investors (more on that below), investors need to be aware of some associated costs and fees. Most of these fees will come from professionals or consults handling some of the process.

However, there are other considerations, such as if you fail to meet guidelines and nullify your 1031 exchange. So, how much does a 1031 exchange cost? Below are some of the costs and fees you need to consider.

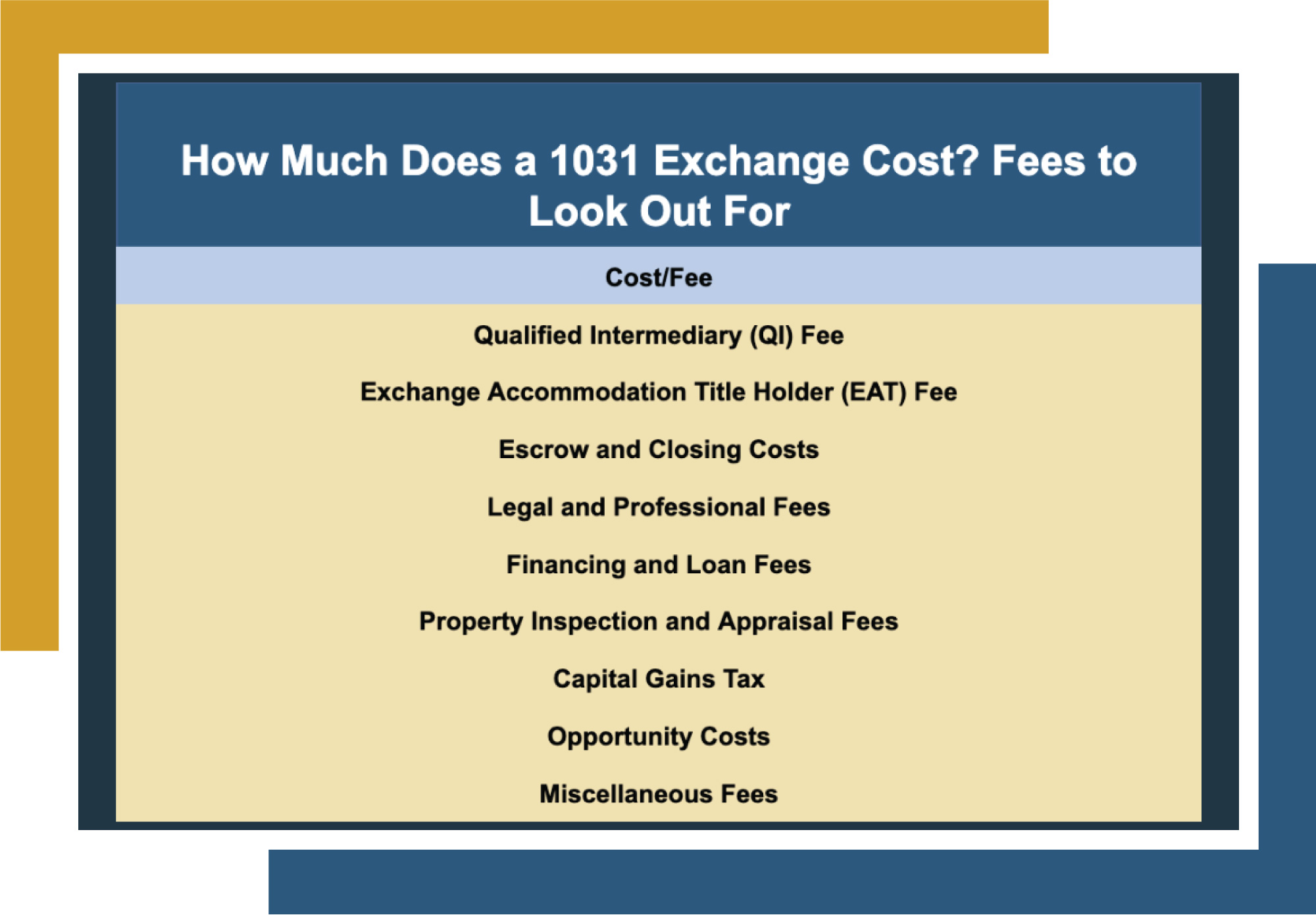

How Much Does a 1031 Exchange Cost? Fees to Look Out For | |

Cost/Fee | Description |

Qualified Intermediary (QI) Fee | Because they facilitate the exchange process and ensure compliance with 1031 exchange regulations, QIs often charge fees for their services based on the transaction’s complexity and fee structure. |

Exchange Accommodation Title Holder (EAT) Fee | EATs typically charge fees for holding the title of the replacement property and the original property during the exchange window. |

Escrow and Closing Costs | These are the average costs associated with the purchase of the new property, including:

|

Legal and Professional Fees | When you use professionals such as attorneys, accountants, or tax progressions, you can expect to pay fees for their advice and assistance through the exchange process. |

Financing and Loan Fees | If you use a loan to purchase the new property, you may have specific fees for the loan or refinancing. |

Property Inspection and Appraisal Fees | You may need to pay for the inspection and appraisal of the replacement property to determine its value and condition. |

Capital Gains Tax | If you decide to forgo the 1031 exchange process or fail to comply with 1031 exchange regulations, you must pay the capital gains taxes on selling the original property. |

Opportunity Costs | If you decide to forgo the 1031 exchange or fail to comply with 1031 exchange regulations, you may miss out on potential profits that you would have benefited from with a successful 1031 exchange process. |

Miscellaneous Fees | Various other fees may arise during the exchange process, such as:

|

The specific costs and fees associated with a 1031 exchange can vary depending on the complexity of the transaction, properties involved, service providers chosen, and any professional or legal guidance utilized.

QIs play the most significant role in the 1031 exchange process, as they cover the qualifying and administrative work during the exchange. How much they charge and the fees associated with a 1031 exchange depends on various factors, such as how many properties are being exchanged.

Investors of all experience levels should seek professional guidance to ensure they follow 1031 exchange regulations and make the best decision for their financial objectives.

Fully Understanding 1031 Exchanges

Under most circumstances, when you sell a property for a profit, you are expected to pay a capital gains tax. Capital gains taxes for investment properties can result in anywhere from 15%, 20%, or even 30% of the profits from the sale owed to the government on your annual tax return. That’s a lot of money! Moreover, as a rule of thumb, higher earners will pay more significant percentages of their profits and a 3.8% surtax in capital gains taxes.

For instance:

- You purchased a property in 2018 for $500,000.

- After managing the property for a few years and enhancing it with renovations, its value increased to $800,000.

- You decide to sell the property and complete its sale for the market value of $800,000.

- The IRS determines you owe the maximum 30% capital gains tax and the additional 3.8% surtax due to being a high earner.

- Although you made a $300,000 profit on paper, you now owe $101399.99 to the government.

That’s more than a third of your earnings!

Luckily, 1031 exchanges—covered in section 1031 of the Internal Revenue Code (IRC)—allow investors to defer their capital gains tax on selling their investment property by exchanging it for a “like-kind” property. While the IRC does not clearly define what constitutes a “like-kind” property, it is generally accepted that the original property must be exchanged for property of the exact nature or asset class (i.e., for investment purposes), meaning you can sell your property and purchase a new one while using the proceeds from the sale, including profits, towards the new property without owing capital gains taxes. This allows investors to enjoy many benefits, such as exchanging into higher-value properties and diversifying their portfolios.

However, 1031 exchanges are complex, with rigid timelines and guidelines that must be strictly followed to ensure your exchange qualifies. That’s why you should always consult a professional.

How Canyon View Capital Helps Investors Like You

At Canyon View Capital, we understand that every investor’s strategy is unique, so we want to help you decide if a 1031 exchange is right for you.

Because our team has participated in many 1031 exchanges, we understand their nuances and complexities. We want to leverage that knowledge and experience to help you realize similar success. Moreover, you’ll have someone in your corner who thoroughly understands real estate and multifamily investing.

At CVC, we’re dedicated to ensuring that you know the costs and fees associated with 1031 exchanges before you commit to a financial decision, and we look forward to being at your side during your investment.

Still wondering, “How much does a 1031 exchange cost?”

At Canyon View Capital, we will walk you through every step of your investment when using your 1031 exchange as a vehicle, and our staff will always answer your questions honestly, completely, and promptly. For more on investing using a 1031 exchange, contact Canyon View Capital.

Verified accreditation status required.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.