Real estate is a popular investment choice, but many investors have money locked in their 401(k) accounts, which don’t give much control over investments.

The good news is that it’s doable, but you need a specific type of account. If you’re wondering how to use a 401k to invest in real estate, our handy guide has you covered.

| Discussion Topics |

How to Use a 401k to Invest in Real Estate

While you can use funds from a 401(k) to invest in real estate, you cannot do so with a traditional company-sponsored 401(k). Conventional 401(k)s are typically limited to investing in investment vehicles such as stocks, bonds, and mutual funds, and the bank or brokerage in charge of the account makes all investment decisions.

You can use a self-directed 401(k) to invest in real estate because the account holder (you) is in greater control of how the money is invested—and one of the additional investment options afforded to account holders is the ability to use account funds to invest in real estate.

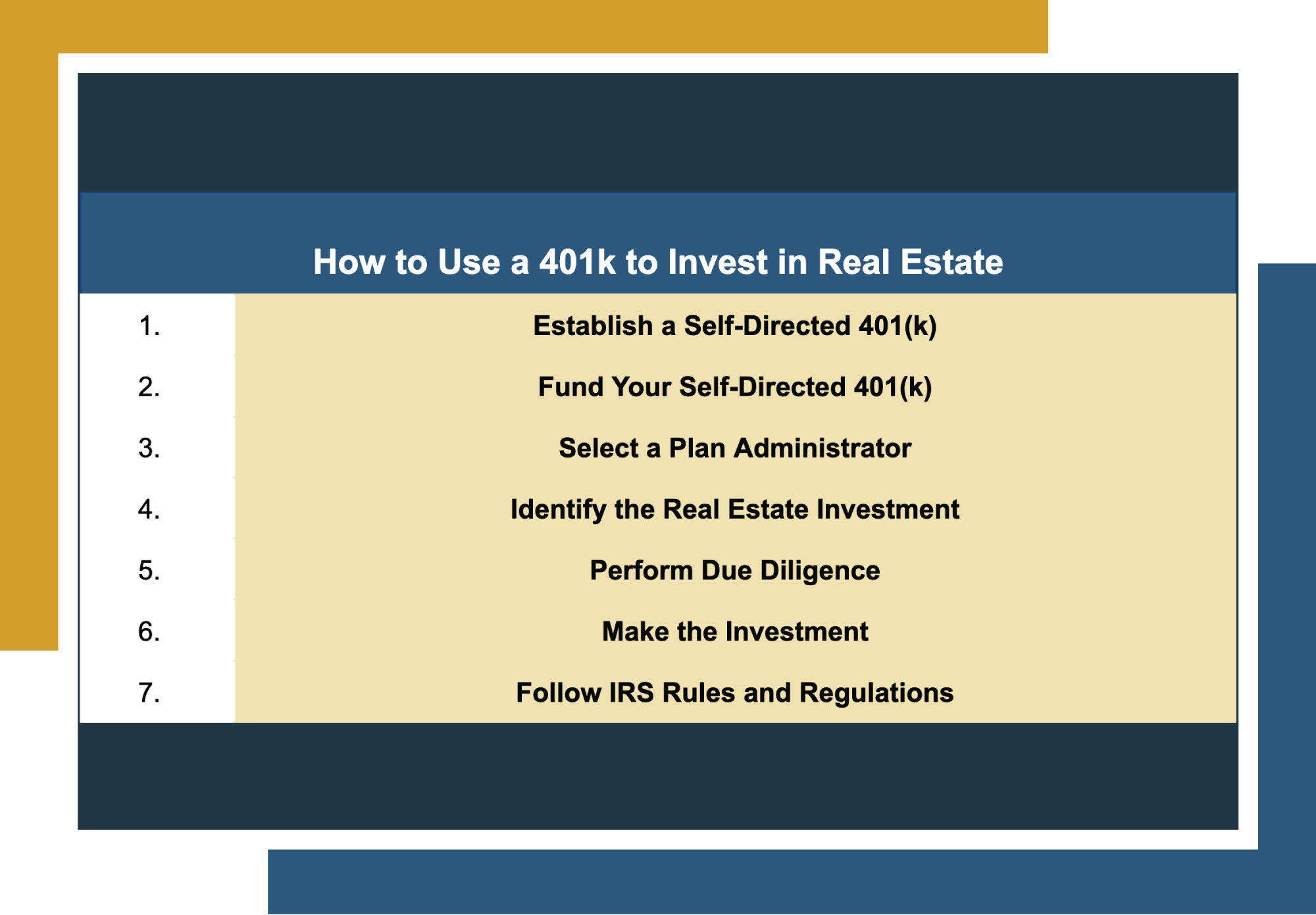

7 Steps for Using a Self-Directed 401(k) for Real Estate | ||

Establish a Self-Directed 401(k) | Set up a self-directed 401(k) through a specialized financial institution. | |

Fund Your Self-Directed 401(k) | Start contributing funds from self-employed income or employer contributions (if allowed). Alternatively, use direct rollovers from retirement plans like2:

Rolling over is exceptionally complicated and IRS-monitored2. Speak with your financial advisor. | |

Select a Plan Administrator | Choose a custodian to handle administrative duties and facilitate real estate investments. | |

Identify the Real Estate Investment | Decide on the type of real estate that aligns with your investment goals, whether multifamily, single-family, or commercial. | |

Perform Due Diligence | Consider factors like location, property size, condition, capital requirements, rental income, appreciation, and associated costs. | |

Make the Investment | Coordinate with your custodian to purchase real estate on behalf of your self-directed 401(k), with all expenses and proceeds managed within the account. | |

Follow IRS Rules and Regulations | Adhere to IRS guidelines, avoiding prohibited transactions and personal use of investment property. | |

It’s important to note that while self-directed 401(k)s allow investors to enjoy alternative investment options such as real estate, enhanced flexibility comes with greater complexity, a significantly increased burden of responsibility, and risk. Always consult your financial advisor before committing to a new investment plan to ensure it aligns with your investment goals.

If you’re an investor with a self-directed 401(k) or potentially opening a 401(k) to invest in real estate, Canyon View Capital may have options for you.

Eligibility Requirements for a Self-Directed 401(k)

To be eligible for a self-directed 401(k), you must be one of the following1:

- Self-employed

- Actively generating a portion of income through self-employment

- A small business owner with no employees

- Independent contractor with part-time employees

- An owner of a dormant 401(k) that is able to be rolled over into a self-directed 401(k)

By opting for a self-directed 401(k), you expand your investment horizons significantly, allowing for a broader range of options, including real estate investments.

If you’re considering opening or already have a self-directed 401(k) for real estate investment, Canyon View Capital offers options that may suit your investment strategy.

Canyon View Capital Offers Investment Options for Self-Directed 401ks

At Canyon View Capital, our deep-rooted passion lies in multifamily real estate, which forms the core of our every endeavor. This commitment is precisely why we offer investment avenues for those wondering how to use a 401k to invest in real estate.

Whether you’re an investor ready to jump in head first or one that wants to use their 401(k) for real estate but is wary of the increased complexities and nuances, our investment products— backed by our portfolio of multifamily properties—offer potentially passive real estate income as well as tax advantages via passive losses which can potentially lower tax burdens. In addition, you may enjoy greater liquidity versus traditional 401(k)s and traditional real estate investing.

Still need more information on 1031 exchanges vs Opportunity Zone Funds?

For over 40 years, the principals at Canyon View Capital have worked in real estate, with a portfolio currently valued at over $1B3. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

To learn more about how to use a 401k to invest in real estate, call CVC today! Get Started

1, Troy Segal, “What Is a Solo 401(k) or Self-Employed 401(k)? Contribution Limit,” for Investopedia, Nov. 28, 2022, Investopedia.com. Accessed Sep. 8, 2023.

2Miranda Marquit, Benjamin Curry, “How To Roll Over Your 401(k) To A New 401(k),” for Forbes, Oct. 23, 2022, Forbes.com. Accessed Sep. 1, 2023.

3$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.