Real estate is an alternative investment avenue that some investors have turned to for various reasons. Whether it’s property appreciation, a source of consistent cash flow, hedging against inflation, tax advantages, or portfolio diversification, real estate offers many potential benefits for investors of all experience levels.

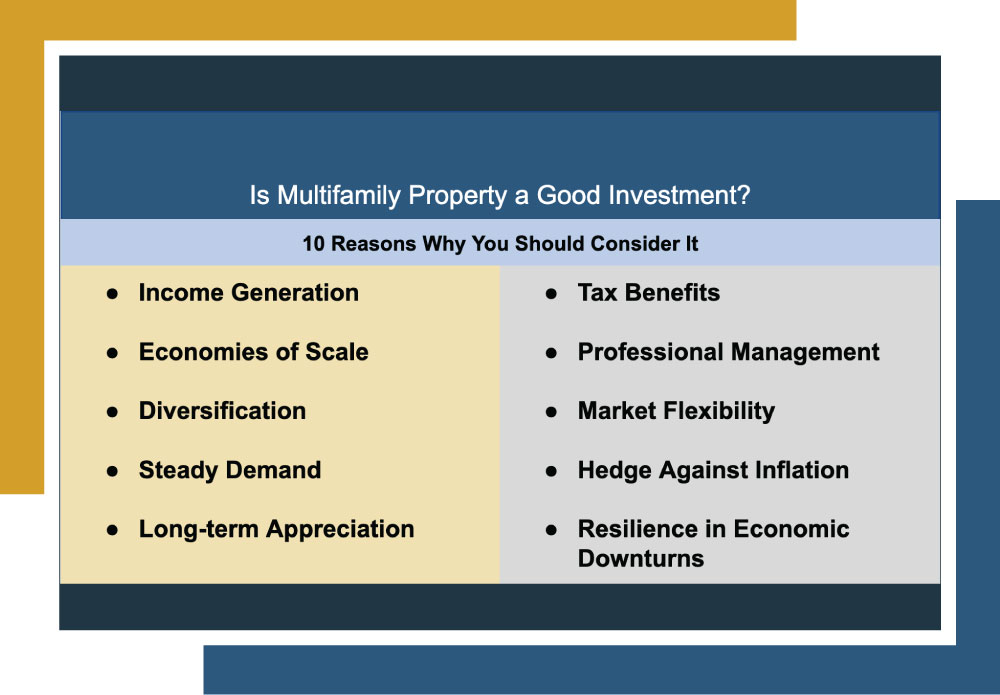

In this article, we’ll discuss multifamily real estate investing, help you answer the question, “Is multifamily property a good investment?”, and list ten reasons why you should have multifamily investing on your radar.

| Discussion Topics |

Is Multifamily Property a Good Investment?

The answer to that question depends on the investor. It’s crucial to emphasize that, as with any investment, results vary. While real estate has many potential benefits that are enticing for investors, there’s no singular approach to real estate investing, and there are multiple investment paths within real estate investing.

The three most common avenues for real estate investing include:

- Multifamily real estate

- Single-family real estate

- Commercial real estate

Multifamily real estate involves purchasing residential properties built to accommodate multiple families or tenants in separate housing units within a single building or complex. Think apartments, condominiums, townhouses, and duplexes or triplexes. This unique aspect and scale bring investors substantial potential benefits that may not be available to them with other real estate investment options such as:

- Income Generation: Because multifamily properties are rented out to tenants, investors benefit from cash flow as a baseline. Moreover, because multifamily properties house many tenants, investors benefit from multiple rental income streams, which can be a valuable and consistent source of income for investors.

- Economies of Scale: Due to multifamily operations being more significant in scale than single-family and commercial counterparts, the cost per unit to manage and maintain properties is typically lower, allowing for more efficient use of resources.

- Diversification: Multifamily properties house multiple tenants, which helps spread potential risk from vacancies or non-payments. For example, if one tenant misses a payment or one unit remains vacant, the income from other units helps to offset those potential losses.

- Steady Demand: The demand for rental properties, particularly multifamily units in urban areas, has exhibited historical stability and, in certain regions, is even on the rise1. This translates to a dependable stream of potential tenants for investors, ensuring a consistent customer base.

- Long-term Appreciation: On top of a source of consistent rental income, multifamily properties, like other forms of real estate, can appreciate over time, which means that investors can sell them for a profit later.

- Tax Benefits: Multifamily investors can take advantage of various tax benefits, including deductions for mortgage interest, property taxes, depreciation, and property-related expenses, as well as tax deferral tools such as 1031 exchanges.

- Professional Management: Multifamily properties often require a lot of due diligence and responsibility from the investor. However, investors can hire professional management companies to handle specific services, such as tenant relations and maintenance, at a cost.

- Market Flexibility: Multifamily properties can be adapted to various market conditions. For instance, during periods of higher demand, rental rates can be increased, potentially boosting income. Conversely, multifamily properties can still attract tenants during economic downturns due to their relative affordability compared to owning a home2.

- Hedge Against Inflation: Rental income from multifamily properties has historically been a great way to hedge against inflation, as rental rates tend to increase over time3. This allows investors to maintain or even increase their cash flow as the cost of living increases.

- Resilience in Economic Downturns: Multifamily properties tend to be more resilient during economic downturns when compared to other real estate investment products4. People will always need housing, and rental properties are often cheaper than home ownership which keeps demand strong even as the housing market experiences challenges.

Challenges and Considerations

Some challenges that overleveraging investors may face within the realm of multifamily investing include financing properties with a high level of debt, relying heavily on mortgages and loans, needing more cash reserves, overestimating rental income, poor property management, and struggling to manage interest rate increases.

Nevertheless, the promise of these benefits can align well with the goals of confident investors, making multifamily investment an attractive option. Success in multifamily investing depends on many variables, including location, property management, financing terms, risk tolerance, and market conditions.

Always seek guidance from your financial advisor to confirm that a new investment strategy aligns with your financial objectives.

Even with its potential benefits, some investors may need more time to wade the waters of multifamily investing due to concerns with the responsibility and due diligence often required. For those investors, Canyon View Capital may have a solution.

Contact Canyon View Capital About Multifamily Real Estate

Now that you know the answer to the question “Is multifamily property a good investment?”, you may be wondering about taking the next step in your multifamily investment journey. Here at Canyon View Capital, we’re passionate about multifamily investing and boast a multifamily portfolio valued at over $1 billion5.

Our investment strategy revolves around a solid “buy-and-hold” approach, providing conservative investors with an attractive multifamily investment opportunity. Our acquisitions target core and core-plus returns as opposed to more volatile investment strategies.

This approach can reap numerous benefits akin to personally managing multifamily properties, including passive income, passive losses, and valuable tax advantages—all while alleviating the burdens of day-to-day property management.

Still need more information on 1031 exchanges vs Opportunity Zone Funds?

1Barbara Ballinger, “Multifamily Demand Continues Its Climb,” for GlobeSt, July 5, 2023, GlobeSt.com. Accessed Sep. 14, 2023.

2“Multifamily More Resilient Than Other CRE Types During Economic Downturns” for Conti Capital, Jan. 18, 2023, conticapital.com. Accessed Sep. 15, 2023.

3Patrick Grimes, “Why Income-Generating Real Estate Is The Best Hedge Against Inflation,” for Forbes, April 14, 2023, Forbes.com. Accessed Sep. 1, 2023.

4Carter Evans, “Renting a home may be more financially prudent than buying one, experts say,” for CBS News, July 13, 2023, cbsnews.com. Accessed Sep. 15, 2023.

5, 6$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.