American investors have many options to expand their investments and increase their cash flow, with many investment vehicles at their disposal. The abundance of options can sometimes make it challenging to determine the most suitable choice for their next investment venture.

In this article, I will focus on one such option—multifamily investing, a type of real estate investing—and explain the potential passive investment component of multifamily investing that allows you to enjoy the benefits of multifamily investing without some of the operational responsibility. Read on to learn more about the potential for multifamily investing passive income.

| Discussion Topics |

What is Multifamily Investing, and How is It Different?

Real estate investing is an investment wherein the investors purchase properties and rent them out to tenants, typically charging them a monthly fee to maintain their residence.

Within the real estate umbrella are a few investment vehicles, each with distinguishing characteristics. The three most common types of real estate investments are single-family, multifamily, and commercial.

- Single-family: These are single-unit properties such as a house or specific condominium unit where one group of occupants reside.

- Multifamily: These are larger properties designed to accommodate multiple living units within a single building or complex. Depending on the size of the operation, they can house up to thousands of tenants, each with their own self-contained living space.

- Apartments

- Condominiums

- Two- to four-unit properties

- Duplexes

- Townhouses

- Commercial: Commercial real estate refers to renting out spaces designed specifically for business use instead of tenant use. Such locations include retail spaces, office buildings, hotels, and industrial warehouses.

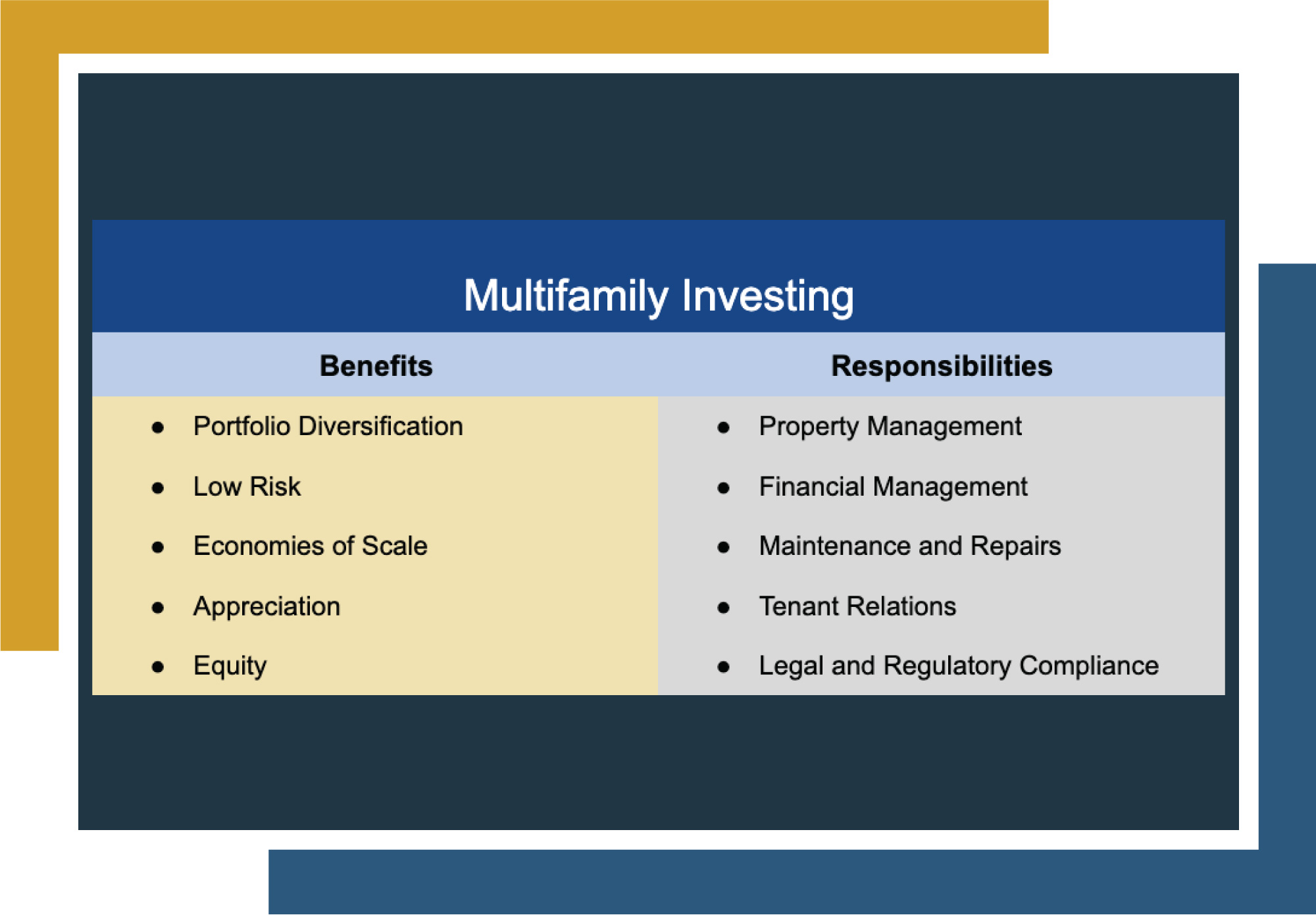

Multifamily investing could be an enticing option for investors exploring ways to add the following benefits to their existing portfolio’s:

- Portfolio diversification: Diversifying your portfolio is often seen as a good practice because it ensures different income streams and lowers your risk of exposure to external forces1. It also helps offset when other investments aren’t performing well.

- Lower risk than other options: Unlike other real estate investment options, multifamily investing is often considered relatively safe. When renting out multiple units, you’re receiving numerous income streams, which means you’re less likely to experience financial setbacks from vacancies or non-payments than renting out a single unit.

- Economies of scale: Managing properties can often be costly. Maintenance fees, operational costs, and labor can add up, especially if you manage multiple properties. When you consolidate those units into one property, like with an apartment building, you can often see savings in areas like insurance, repairs, or supplies.

- Appreciation and equity: Like other real estate types, multifamily properties generate income from rent payments and tend to increase in value over time, meaning you can enjoy the revenue stream from rent payments and ideally sell the property for a profit if you decide to move on. You can also use other tools, such as 1031 exchanges, to increase the proceeds from selling a property.

Is Multifamily Investing Passive Income?

Since real estate investing may require less responsibility from investors than other options, is multifamily investing passive income?

While real estate investing carries less individual burden than other options, it isn’t what many consider truly passive as it still requires a lot of hands-on commitment and responsibility. When you purchase a property and rent it out to tenants, you assume responsibility and accountability for managing it and ensuring you know applicable laws and regulations.

| |

Responsibility | Description |

Property Management | Investors manage their properties, including collecting rent, handling maintenance and repairs, ensuring compliance with local regulations, and finding tenants. |

Financial Management | Investors must handle potentially complex financial aspects such as budgeting, accounting, and tracking expenses and income related to the property. They need to monitor cash flow, calculate returns on investment, and pay property taxes, insurance premiums, and mortgage payments if applicable. |

Maintenance and Repairs | Property owners are responsible for maintaining the property and ensuring it is in good condition for tenants. This includes addressing repairs, regular upkeep, and necessary renovations to maintain the property’s value. |

Tenant Relations | Investors need to establish and maintain positive relationships with tenants because there’s no income without tenants. This involves addressing tenant concerns, resolving disputes, and ensuring a safe and comfortable living environment. Clear communication and timely responses to tenant needs are essential. |

Legal and Regulatory Compliance | Real estate investors must stay informed about local, state, and federal laws and regulations pertaining to property ownership and rental activities. This includes understanding fair housing laws, landlord-tenant regulations, and property safety codes. |

Risk Management | Investors need to assess and manage risks associated with their investments. This involves obtaining appropriate insurance coverage, conducting regular inspections, and implementing safety measures to protect tenants and mitigate potential liabilities. |

Market Monitoring | Investors should keep an eye on the market trends and property values in the areas where they have investments. Understanding the market conditions helps make informed decisions regarding property acquisitions, rental rates, and potential property sales. |

As you can see, real estate and multifamily investing is very involved, although depending on your investment partner/structure, a more passive investment with less hands-on management might be an option. Investors can pay a property management company to assume the role of property manager for them and take on some or all of these responsibilities, but this will come at a cost.

It’s important to note that the level of passivity within any investment vehicle can vary and is influenced by factors such as investment strategies, individual goals, and the level of control an investor wishes to maintain. You should always consult with your financial advisor before making an investment decision.

Canyon View Capital Brings the Potential Opportunity of Truly Passive Multifamily Income to Investors

Is multifamily investing passive income? While it brings potentially higher levels of passivity than other investment opinions, without hiring a property manager, investors should expect some active involvement and effort.

But what if we told you there’s another option? At Canyon View Capital, our principals have managed a portfolio of over $1 billion2 in multifamily real estate and shared our experience with investors. We utilize a “buy-and-hold” strategy instead of “buy-and-flip,” allowing our investors to enjoy multifamily income streams from rent payments without worrying about the hassle of property management, giving them a passive multifamily investment option.

Ready to learn more about Multifamily Investing?

Citations

1Maurice Dukes, “What It Takes To Diversify Your Investment Portfolio,” for Forbes. Jan 26, 2022, Forbes.com. Accessed July 1, 2023.

23$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.