If you’re reading this, chances are you’re already investing in real estate. It makes sense; real estate investing can bring many benefits to investment portfolios. However, you might be ready to move on from a specific investment property—maybe you’re tired of dealing with a problematic property, or perhaps you want to invest in other regions.

Regardless of the reason, investors can almost always expect to pay capital gains taxes on the sale of their investment property.

I say almost always because savvier investors are becoming more aware of a tax deferral tool called the 1031 exchange. But what exactly is a 1031 exchange, how does it work, and who is it suitable for?

In this article, we’ll explore 1031 exchanges before delving into the pros and cons of a 1031 exchange so you can figure out if this tax deferral strategy is the tool you need to keep money in your pocket.

| Discussion Topics |

Understanding 1031 Exchanges

Usually, when you sell an investment property, you are expected to pay capital gains taxes on the profits from the sale. This amount can range from 15-20% of your earnings (and some states impose a 3.8% surtax on high-income investors) paid as taxes to the Internal Revenue Ser. This can significantly cut into your profits.

For example, if you sold a property in California for a $250,000 profit, you’d likely be liable for more than $73,000 in taxes, or almost 30% of the entire profit from the sale.

1031 exchanges, outlined in section 1031 of the Internal Revenue Code (IRC), allow investors to defer paying capital gains taxes by reinvesting the money they make on the sale of an investment property into a new, “like-kind” property of equal or greater value (i.e., another investment property).

However, there are a few factors that you need to be aware of:

- The requirements and timelines for 1031 exchanges are stringent and must be followed closely.

- Besides being a “like-kind” property, 1031 exchanges must be executed within a 180-day window of selling the initial property.

- Additionally, the replacement property must be identified within a 45-day window of the sale of the initial property.

- These two windows run concurrently.

This is a very abridged summary of the 1031 exchange process. You can explore the 1031 exchange process more deeply by clicking here.

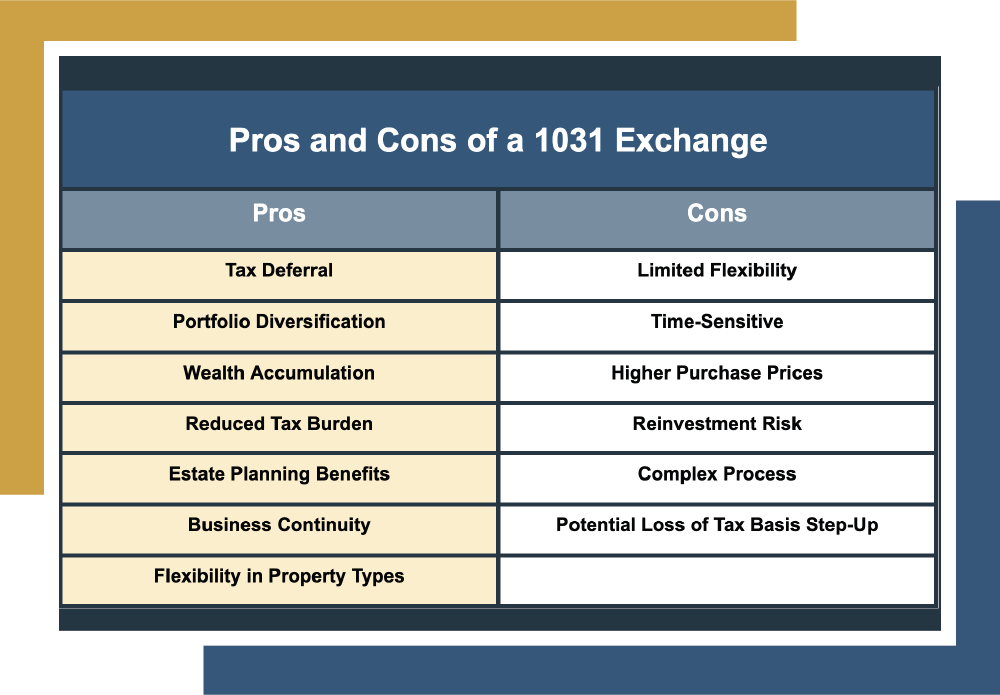

What Are the Pros and Cons of a 1031 Exchange?

Below, I discuss some pros and cons of a 1031 exchange.

Pros and Cons of a 1031 Exchange | |

Pros | Cons |

|

|

1031 exchanges provide many benefits to investors. They keep the money you earned from selling an investment property out of the hands of the IRS and inside your investment portfolio instead.

With a lower tax burden, you have more money to reinvest in other properties. Moreover, 1031 exchanges can be done to perpetuity when done correctly. For example, if you sell a property that you used a 1031 exchange on, you’ll likely be able to do it again for another property.

Also, you can “swap ‘til you drop,” meaning you can continue exchanging properties and deferring your capital gains taxes for the entirety of your life. Furthermore, you can leave these properties to your heirs, and they won’t be required to pay the total accumulation of deferred taxes because they inherit the properties as assets.

However, there are also a few challenges and stipulations to consider. A 1031 exchange is an often convoluted process with multiple requirements and guidelines that must be met for a 1031 exchange to succeed within extremely tight windows.

This is why you should always consult with a professional, even if you’re a seasoned real estate investor.

Canyon View Capital Takes the Hassle Out of 1031 Exchanges

At Canyon View Capital, we understand the pros and cons of a 1031 exchange better than most. We also know that every investor’s situation is unique. That’s why we want to use our expertise to help you figure out if a 1031 exchange is the right option for you.

If it is, we want to make your 1031 exchange easy by simplifying the process while ensuring you meet the requirements. Our principals have been managing multifamily real estate for more than 40 years, and we’ll use that experience to help you enjoy the benefits of a successful 1031 exchange without the hassle.

At CVC, we are committed to being your guide through the process of a 1031 exchange while answering any questions you may have.

Still Hazy on the Pros and Cons of a 1031 Exchange?

Canyon View Capital Can Show You the Way! We will walk you through every step of your investment when using your 1031 exchange as a vehicle, and our staff will always answer your questions honestly, completely, and promptly. CVC will help you cut through the red tape, no matter how sticky it gets. For more on how you can invest using a 1031 exchange, contact Canyon View Capital.

LEARN MORE about our 1031 Exchange Program.

Verified accreditation status required.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.