Whether you’re a seasoned investor or just getting started, the idea of having a source of income that doesn’t require a significant time investment may be enticing. While real estate can be a hugely beneficial investment option, it often involves a lot of hands-on management that can be quite time-consuming.

While multifamily investing is no different, it may demand less time from investors than other investment options, which we will discuss. But what if I told you there is a unique way that you can target genuinely passive multifamily investing.

In this article, I’ll explore the realm of multifamily investing, explain why it might be a good option for you to consider, and explain how working with someone like Canyon View Capital can bring investors like you truly passive cash flow from multifamily investing.

| Discussion Topics |

Understanding Multifamily Investing

Real estate investing offers a range of opportunities, with three primary categories: single-family, commercial, and multifamily. Single-family investing involves leasing individual houses, townhomes, or condo units to tenants. Commercial real estate focuses on leasing warehouses, office buildings, and retail spaces to businesses. Multifamily real estate presents a unique avenue by renting out entire properties with multiple units to multiple tenants simultaneously.

Single-Family

|

Commercial |

Multifamily |

|

|

|

While no form of real estate is inherently better than another since they all depend on individual goals, preferences, and market conditions, some substantial potential advantages and benefits offered by multifamily investing include:

- Economies of scale: Managing multiple units under one property means that any associated costs and efforts are spread out across multiple tenants, consolidating labor, maintenance, and operating expenses and making them more efficient than splitting them across individual units scattered across numerous properties.

- Lower potential risk: When you manage a multifamily property, you benefit from having more tenants at a single location. This means that vacancies and non-payments don’t affect you as much because more than a single income stream comes from the property.

- Potential for appreciation: While all forms of real estate have the potential to increase in value over time, multifamily properties may experience higher appreciation potential depending on the location due to factors such as population growth, increased demand for rental housing, and housing and land availability.

To summarize, when you manage a multifamily property, you’ll benefit from multiple sources of rental income because you’re generating rent from multiple tenants while increasing your potential cash flow, among other advantages.

Understanding Multifamily Investing Responsibilities and Unlocking Passive Multifamily Investing

Like any investment vehicle, multifamily investing requires due diligence and a hands-on approach from the investor. However, it often requires less personal time invested from the investor than other popular investment options such as:

- Entrepreneurship: Starting and running a business usually demands significant time and effort from the investor. You are responsible for day-to-day operations, decision-making, strategy development, and handling or overseeing nearly every aspect of the business, such as marketing, financing, etc.

- Venture capital: Early-stage startups often exchange a percentage of company equity and decision-making for an influx of capital from an investor. However, this means that the investor is expected to actively participate in the startup with mentoring, advising, and providing strategic guidance and development.

- Active stock trading: Active stock trading, such as day trading, requires an exceptional awareness of market trends and conditions to be profitable. You must constantly monitor the stock market and research individual stocks to make good trading decisions.

- Franchising: If you decide to open a franchise, you will actively manage and operate the specific franchise according to the franchise agreement set by the company, which includes overseeing daily operations, hiring and training new staff, managing the inventory, marketing the location, and ensuring compliance with the franchise’s guidelines and standards.

Again, while multifamily investing is often considered less demanding than certain investment options such as those detailed above, it is important to note that it is not inherently passive. Although other investment avenues may require more time and effort, multifamily investors still bear responsibilities that can be more demanding than other alternatives.

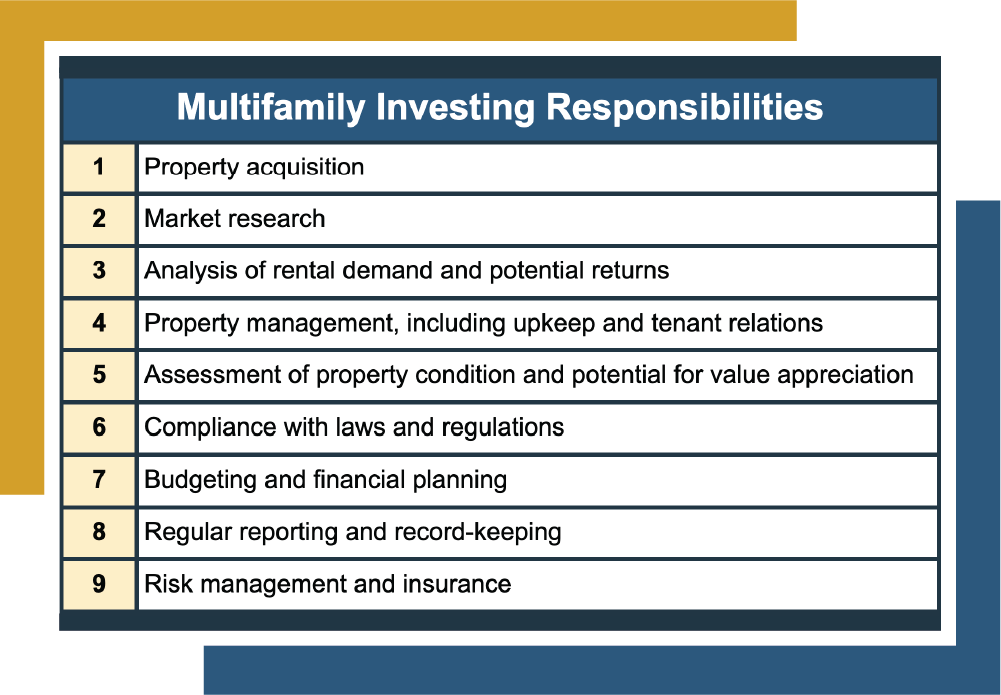

Such things to consider include:

Multifamily Investing Responsibilities | |

Property acquisition | |

Market research | |

Analysis of rental demand and potential returns | |

Property management, including upkeep and tenant relations | |

Assessment of property condition and potential for value appreciation | |

Compliance with laws and regulations | |

Budgeting and financial planning | |

Regular reporting and record-keeping | |

Risk management and insurance | |

These responsibilities will vary depending on the property size, location, and management structure. For example, you can sidestep many obligations by hiring a property manager or property management company to handle things like record-keeping, compliance with laws, and tenant relations.

However, you will be sacrificing some of your profits to pay for their assistance, and you will still need to take on many of these responsibilities, such as property acquisition, market research, and property assessment, yourself.

Thankfully, there is a way to enjoy the benefits of multifamily investing without all the responsibilities. Canyon View Capital has you covered if you’re looking for a truly passive multifamily investing option.

Canyon View Capital Targets Truly Passive Multifamily Investing to Investors

Investors are always looking for a new source of income to add to their portfolios. Still, only some options are suitable for some investors. Depending on their experience or how much spare time they have, some options, like real estate, may seem too overwhelming, even if they offer potentially incredible benefits.

At Canyon View Capital, we provide a different option to our investors that leverages our experience in multifamily investing to target truly passive multifamily investing income.

Our principals have over 40 years of real estate experience and now manage a portfolio of real estate aggregated at over $1 billion1 in value. We want to work with you so that you can enjoy many of the benefits of multifamily investing without worrying about the responsibilities that generally come with it. At CVC, we know that time is money, but that doesn’t mean you must sacrifice one for the other.

Still wondering about self directed IRA Real Estate?

To Learn More About Passive Multifamily Investing, Call CVC Today!

Verified accreditation status required.

1$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.