In recent years, a common investment strategy called “house flipping” has captured the public eye. House flipping involves buying a cheap property that requires improvements, making those improvements to add value, and then selling the house at a higher price for profit. It may sound great on paper; however, if it were this simple to make consistent profits, everyone would do it.

Truthfully, flipping real estate is often extremely risky and requires significant diligence from the investor. That said, proper execution can often bring respectable profits, making it an alluring option for investors.

If you have a self-directed IRA and are looking for alternative investment options, flipping real estate may be one you’ve considered. But is it a good idea for you? In this article, we’ll explore whether or not using a self-directed IRA for flipping real estate is a strategy that you should consider.

| Discussion Topics |

Understanding Self-Directed IRAs

IRAs are retirement savings accounts that offer investors several tax advantages while saving and investing money. The purpose of these accounts is to incentivize individuals to save for retirement via these avenues.

With traditional IRAs, you contribute money to a tax-deferred account that allows funds to grow. Traditional IRAs are often managed by banks or brokerage firms that choose where to invest the money deposited into the account, such as stocks or bonds. This makes for a relatively simple investment process, as investors can set money aside and expect it to grow without much involvement from themselves.

Conversely, self-directed IRAs offer investors a more hands-on approach to retirement savings. As opposed to the streamlined nature of traditional IRAs, self-directed IRAs allow investors more agency over where to invest money that is contributed to their IRA because the onus is placed on the investor to make investment decisions (hence the name).

Some of the investment options available to self-directed IRAs include:

- Real estate

- Private equity

- Precious metals

- Cryptocurrency

- Farmland

- Promissory notes

Instead of having a bank or brokerage take charge of investments, self-directed IRAs utilize the guidance of a custodian who handles transactions and financial reporting. While investors have more flexibility and options with self-directed IRAs, they also require more personal responsibility. They open the investor up to increased responsibility and ensure compliance with Internal Revenue Service (IRS) regulations, even if they come with some guidance via the custodian requirement.

Is Using a Self-Directed IRA for Flipping Real Estate a Good Idea?

Real estate is often seen as an excellent addition to many investment portfolios because it can provide passive income, stable cash flow, tax advantages, hedging against inflation, and portfolio diversification.

However, some investors may be enticed by the prospect of “house flipping,” a real estate investment strategy that involves purchasing undervalued or distressed properties, improving or renovating them, and then selling them for a profit within a short window.

This strategy can be utilized via the funds from a self-directed IRA. But is it a good idea to use a self-directed IRA for flipping real estate? Well, it depends.

While this can sometimes be a lucrative strategy, would-be investors would do well to consider the significant risk of house flipping. Purchasing an undervalued property and significantly improving its condition and value requires a substantial financial investment. It’s also imperative to the strategy that the property sells quickly.

If the investor cannot make the quick sale, they could sit on the property for enough time to severely cut into their profits. It can be a hazardous strategy that is not too dissimilar from day trading stocks.

Some potential downsides that all investors should consider when deciding whether or not to use their self-directed IRA for flipping real estate include:

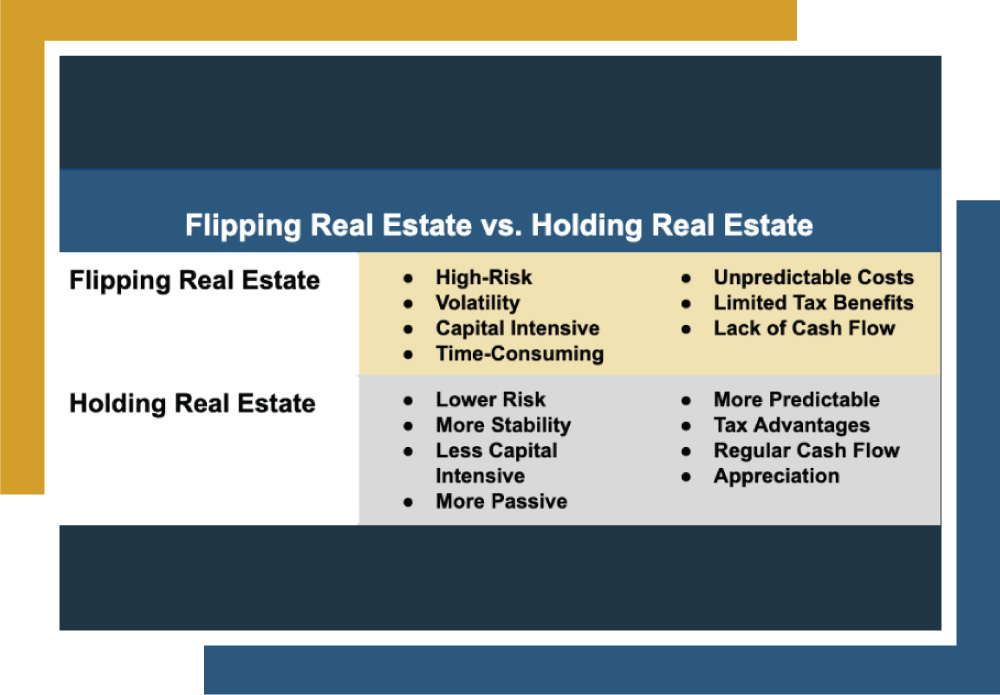

Flipping Real Estate vs. Holding Real Estate | |

Flipping Real Estate | Holding Real Estate |

|

|

As you can see, while flipping real estate can lead to significant profits when done correctly, it is also a risky investment strategy that often requires perfect execution to obtain said profits.

Buy-and-Hold Strategies Could Be a Better Alternative to Flipping Real Estate

While all investment strategies carry some risk, the increased risk of flipping real estate may be too much for some investors. Factors such as demand for housing, house prices, interest rates, and inventory all contribute to the likelihood of profit and success1, and many less experienced or financially constrained investors may find that other strategies provide a more stable and less risky approach to wealth accumulation through real estate.

These factors can be doubly troubling when utilizing funds that are intended to be used for retirement. There aren’t many things that may feel worse than losing money set aside to be enjoyed in the future.

As with any significant financial decision, investors should consult guidance from a financial advisor or tax professional.

For those deterred by the risky nature of flipping real estate, a more conservative investment path, such as managing properties and renting them to tenants, could be a better solution. Moreover, other options go a step further and provide many of the same benefits and cash flow from managing properties without worrying about the stressors of being a landlord.

That’s where Canyon View Capital can help.

Enjoy the Benefits of Conservative Real Estate Investing With Canyon View Capital

The needs, goals, available resources, and risk tolerances of every investor differ. For many, using a self-directed IRA for flipping real estate isn’t the best solution.

Here at Canyon View Capital, we understand that a conservative approach is better for many investors. That’s why we utilize a “buy-and-hold” strategy to manage many properties within America’s Heartland.

With over 40 years of experience among our principals, CVC manages over $1 billion2 in multifamily real estate. We want to help investors like you use self-directed IRAs to enjoy the benefits of multifamily real estate investing, all in a passive investment vehicle, without worrying about minor details like property management or keeping up with market conditions and regulations.

Ready to upgrade your portfolio with diversified, Self-Directed IRAs?

To Learn More About using Self-Directed IRAs for Flipping Real Estate, Call CVC Today!

1Babich, Luke, “4 Biggest Risks of Real Estate Investing in 2023 and How to Minimize Them”, for Coloradobiz. Feb. 8, 2023. cobizmag.com. Accessed July 20, 2023.

2$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.