1031 exchanges are unique tax deferral tools increasingly used by investors to maintain capital within their real estate portfolios. Instead of paying capital gains taxes on the sale of an investment property, investors can defer their tax burden and use the proceeds to acquire a replacement property.

Navigating 1031 exchanges poses a challenge, particularly in determining where to reinvest the proceeds from the sale. The IRS permits investors to exchange into various investment vehicles beyond direct property ownership for management.

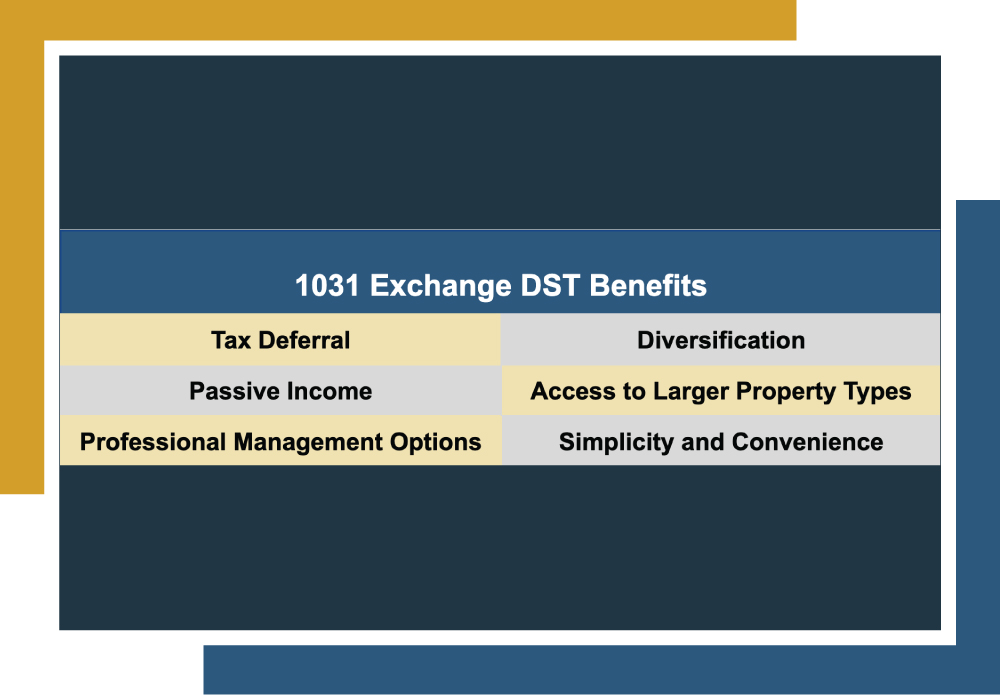

A standard investor choice is the Delaware Statutory Trust (DST), which offers fractional ownership in professionally managed properties. In this article, I’ll explore 1031 exchange DST investments to aid in deciding whether a DST aligns with your investment objectives.

1031 Exchange DST Investments

A Delaware Statutory Trust (DST) is a legal entity created under Delaware law, enabling multiple investors to combine their funds to own a partial share of real estate. Rather than individually managing a single property, DSTs offer investors simplified management and convenience by aggregating real estate income from smaller contributions.

Despite their namesake, DSTs can hold properties anywhere in the US.

Regarding 1031 exchange DST investments, these trusts are commonly used in 1031 exchanges as a replacement property option. When an investor sells their property, they can use the proceeds to invest in a DST, becoming a beneficial owner of the real estate held within the trust. The DST holds the property title and is responsible for management, leasing, maintenance, and property management.

Utilizing a DST in a 1031 Exchange | |

| Select a Qualified Intermediary (QI) to facilitate the 1031 exchange process and hold sale proceeds in escrow. |

| Sell the relinquished property and ensure that the sales proceeds are transferred to the QI. |

| Research and identify suitable DST properties based on investment objectives, risk tolerance, and desired returns. |

| Choose a DST option that aligns with investment goals, considering factors such as location, asset class, and sponsor reputation. |

| Enter into a 1031 exchange agreement with the QI, specifying the intent to defer capital gains taxes by investing in the selected DST. |

| Transfer the sale proceeds from the relinquished property held by the QI to the DST to acquire fractional ownership interests. |

| Become a beneficial owner of the real estate held within the DST, with professional management handling property operations. |

| Receive passive income distributions from the DST while deferring capital gains taxes on the exchanged property sale. |

Is a DST Right for Me?

It’s crucial to recognize that while DSTs offer benefits, they represent just one of numerous choices for 1031 exchanges. Therefore, it’s advisable to thoroughly compare DSTs with alternative 1031 exchange options to ensure you make an informed investment decision aligned with your objectives.

DSTs | Owner-Operator | Tenancy in Common Interests | Public Real Estate Investment Trusts (REITs) | |

Ownership Structure | Fractional ownership in professionally managed real estate assets. | Direct ownership of another investment property. | Co-ownership of real estate with other investors. | Ownership of shares in a publicly traded real estate company. |

Management | Professionally managed by a trustee or sponsor. | The owner is responsible for managing the property. | Co-ownership may involve shared management responsibilities. | Managed by a dedicated third-party. |

Control | Little to no control over property management decisions. | Complete control over property operations and decisions. | Shared decision-making among co-owners. | Little to no control over specific property investments. |

Diversification | Provides diversification across multiple properties and locations. | Limited diversification unless multiple properties are acquired. | May offer diversification if investing in multiple TICs. | Offers diversification across various real estate assets. |

Accessibility | Available to investors with varying investment amounts. | Suitable for investors with sufficient capital for property purchase. | Available to investors with varying investment amounts. | Accessible to investors through stock market trading. |

Liquidity | Limited liquidity, typically illiquid until property sale or DST termination. | Relatively illiquid, but properties can be sold individually. | May offer liquidity through the sale of TIC interests. | Highly liquid due to publicly traded shares. |

Tax Benefits | Enables tax-deferred exchange of relinquished property for fractional ownership. | Defers capital gains tax by exchanging one property for another. | Allows tax deferral through exchange into TICs | Potential tax advantages but need to pass 90%+ of their income to ensure tax benefits. |

Investor Involvement | Passive involvement with professional management handling property operations. | Active involvement in property management and decision-making. | Co-owners may have varying involvement levels unless done through a third party. | No involvement with REIT management handling operations. |

It’s crucial to recognize that while DSTs offer benefits, they represent just one of numerous choices for 1031 exchanges, such as Tenancy-in-Common Interests and real estate investment trusts (REITs). Therefore, it’s advisable to thoroughly discuss DSTs and alternative 1031 exchange options with your financial advisor or a tax professional to ensure you make an informed investment decision aligned with your objectives.

For investors looking for a 1031 exchange option that offers genuinely passive income, similar to what a DST offers, with some distinct differences, such as flexibility in selling ownership, Canyon View Capital may be able to help

Canyon View Capital Offers Unique 1031 Exchange Opportunities

Now that you better understand 1031 exchange DST investments, it’s time to consider the next steps on your investment journey. At Canyon View Capital, we don’t offer DSTs. Instead, we offer a unique opportunity.

By exchanging into one of our many multifamily properties across the Midsouth and Midwest as Tenants in Common, you can enjoy benefits similar to DSTs, such as passive real estate income without managing properties yourself.

We’re passionate about multifamily real estate and our principles and have worked in real estate for over 40 years. We want to use that experience to help you complete your 1031 exchange with convenient replacement options.

Still need more information on the best 1031 exchange investments?

For over 40 years, the principals at Canyon View Capital have worked in real estate, with a portfolio currently valued at over $1B1. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

For more information on 1031 exchange DST investments, reach out today!

1$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.