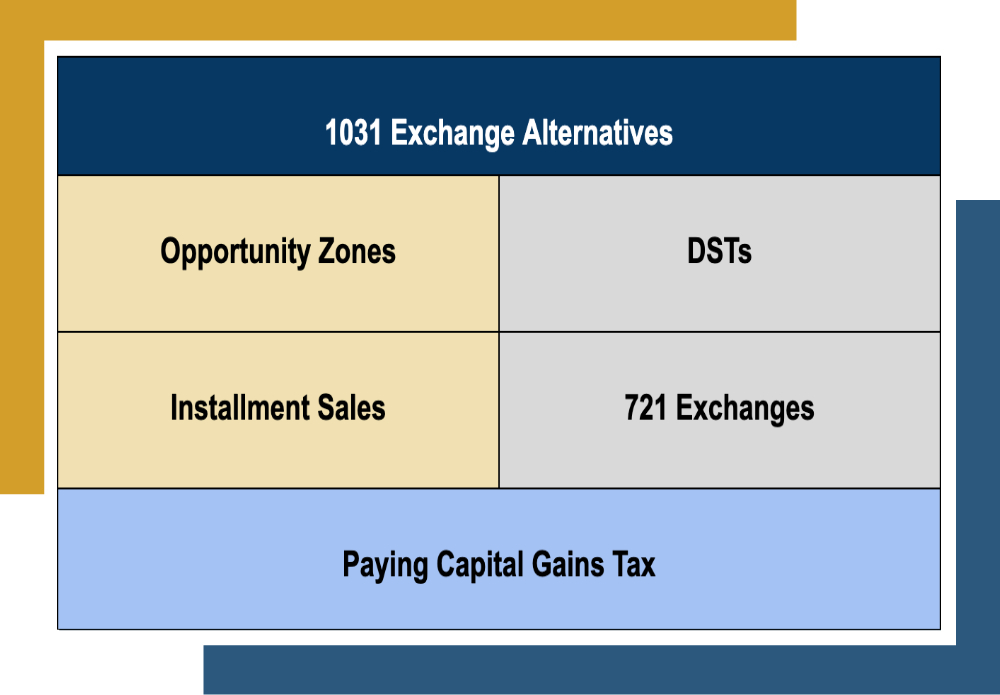

1031 Exchange Alternatives: A Comparison for Investors

Many property managers recognize the benefits of real estate investing, but shifting goals, property upgrades, or liability concerns may lead them to sell. Unfortunately, this often means facing 15-20% in capital gains taxes plus a possible 3.8% surtax for high-income earners. Thankfully, many property owners can turn to 1031 exchanges to defer these taxes and […]

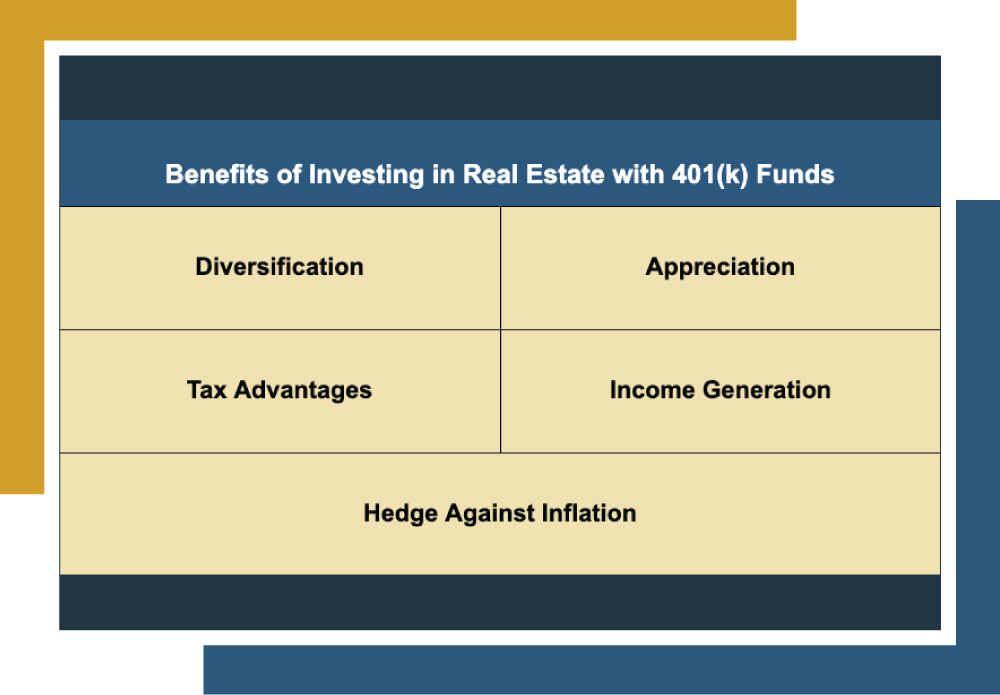

401k Withdrawal for Real Estate Investment

The trusty 401(k) has long been considered a de facto success route for retirement savings. However, recent economic trends and headwinds have caused many investors to seek alternative options. But what if they have a large amount of most of their retirement savings tied in a 401(k) and want to explore an option such as […]

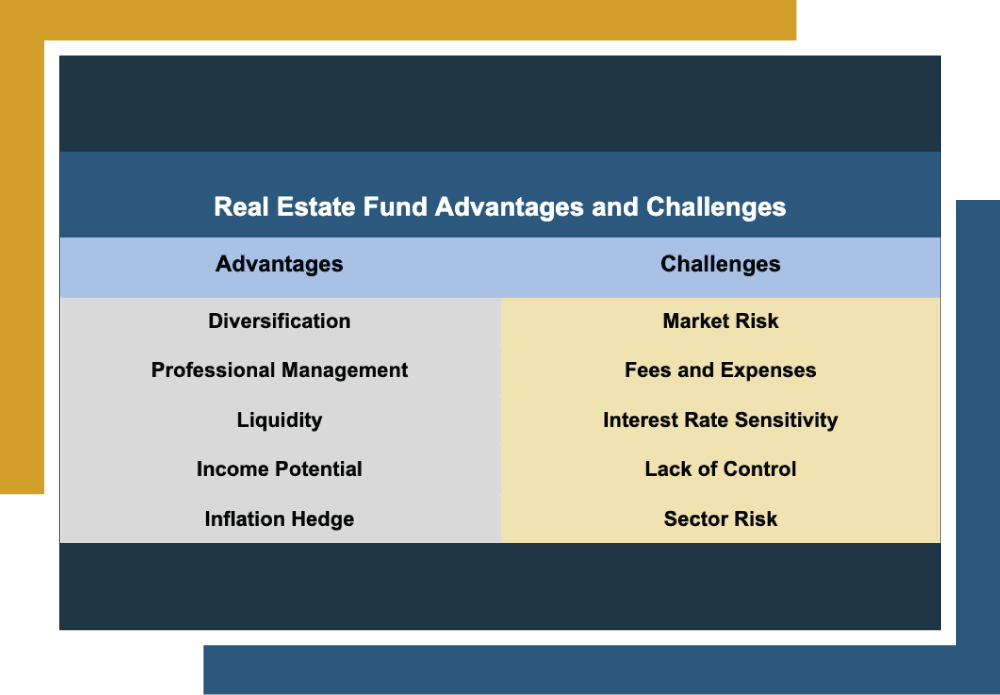

Are Real Estate Funds a Good Investment?

Savvy investors understand the importance of diversifying their portfolios, exploring new investment avenues to increase their income potentially, and spreading risk across multiple sectors. One popular investment sector is real estate. However, like any investment, there are various paths investors can take, each with its advantages and disadvantages. Real estate funds are a favored option […]

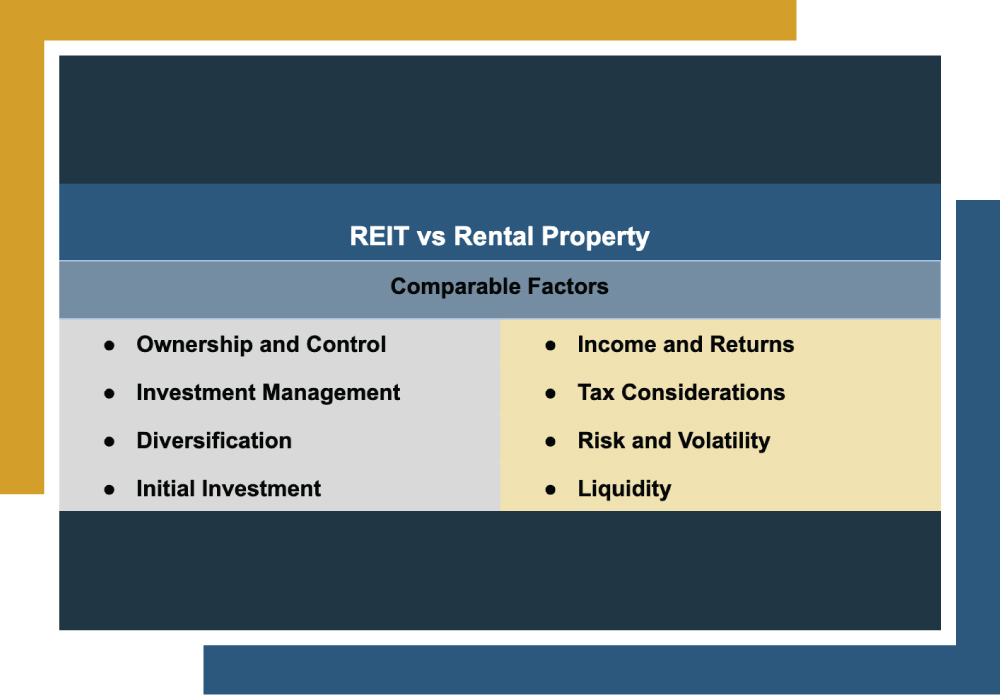

REIT Vs Rental Property

Much like other investment avenues, real estate investing offers diverse opportunities for investors seeking financial freedom. While many opt for the traditional approach of rental properties, it’s essential to be aware of alternative options, such as Real Estate Investment Trusts (REITs), which have gained popularity. This analysis will delve into the distinctions and commonalities between […]

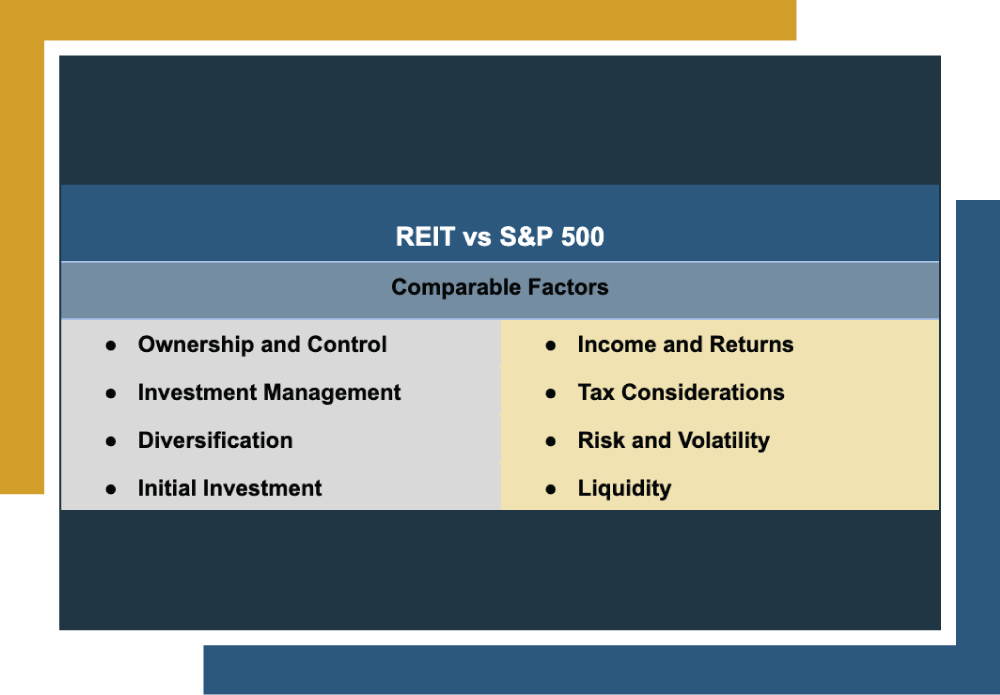

REIT Vs S&P 500

Like other investment options, real estate provides various opportunities for those seeking financial freedom. While many investors choose the traditional route of rental properties, it’s important to consider alternatives like Real Estate Investment Trusts (REITs), which have gained significant popularity. But how do real estate investments, particularly REITs, compare to traditional investment vehicles like the […]

How to Analyze Multifamily Investment Opportunities

Real estate investing can be a powerful tool for building wealth, with multifamily properties such as apartment buildings, condominiums, or duplexes offering many unique advantages. To make informed decisions and maximize your investment potential, it’s essential to understand how to analyze multifamily investment opportunities effectively. This guide outlines the critical steps in analyzing multifamily investment […]

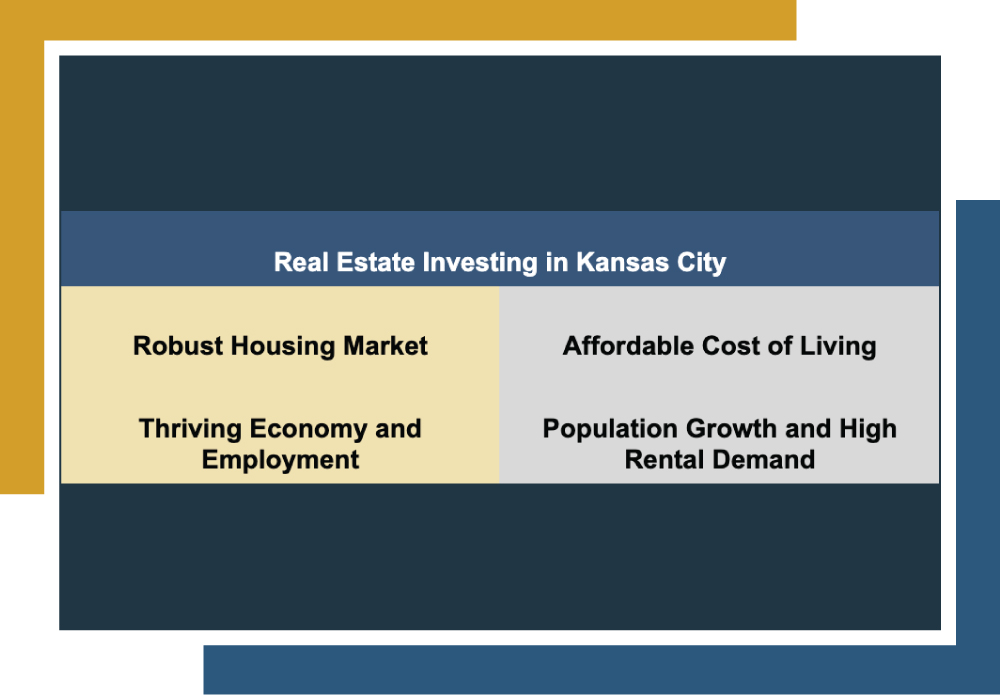

Is Kansas City a Good Place to Invest in Real Estate?

When considering real estate investments, the differences between regions and markets can significantly impact their success. Choosing the right location is crucial. So, is Kansas City a good place to invest in real estate? Absolutely! Kansas City, renowned as the BBQ capital of the world and home to the Chiefs and Royals, is more than […]

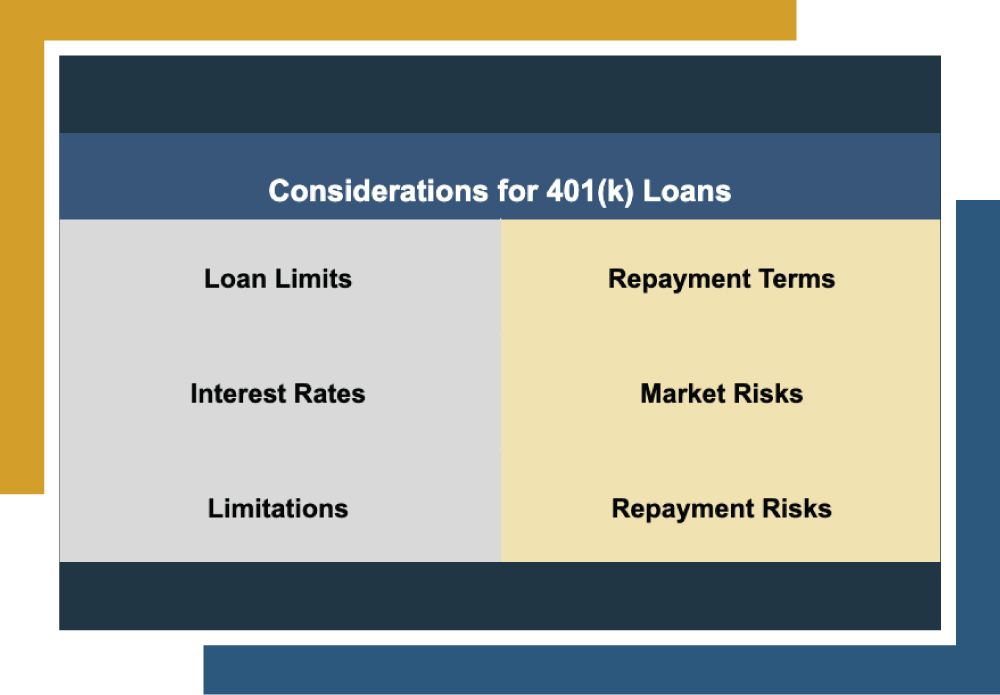

Can You Use a 401k Loan for Real Estate Investment?

Investors continually seek to diversify their portfolios and enhance returns, often exploring new investment avenues. One intriguing option is using a 401(k) loan for real estate investment. Typically, 401(k) accounts offer limited control over specific investments, prompting some investors to consider leveraging these funds for alternative investments like real estate. A 401(k) loan can be […]

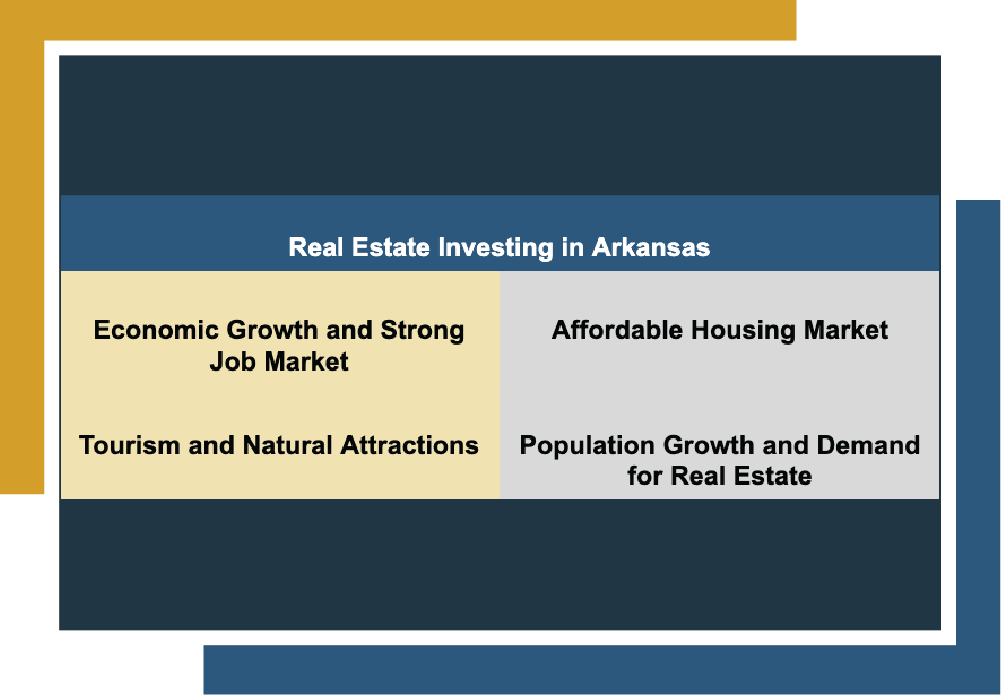

Is Arkansas a Good Place to Invest in Real Estate?

For real estate investors, the differences between regions and markets can significantly impact the success of their investments. They understand the importance of choosing the right location for real estate investments. But is Arkansas a good place to invest in real estate? You’ll be pleased to know that Arkansas is indeed a promising area for […]

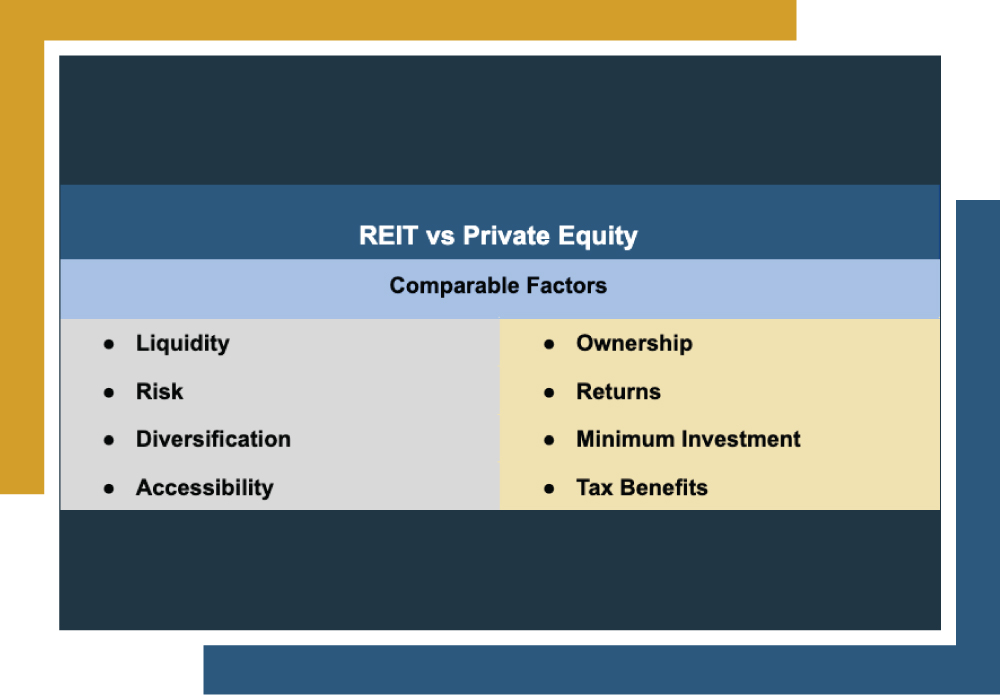

REIT vs Private Equity

Real estate investing offers diverse opportunities for those seeking financial independence. While many investors opt for the traditional approach of renting out properties, it’s crucial to explore alternative options such as Real Estate Investment Trusts (REITs) and private equity, both of which have gained significant popularity. In this analysis, we will thoroughly examine REITs vs. […]