Real estate investing offers diverse opportunities for those seeking financial independence. While many investors opt for the traditional approach of renting out properties, it’s crucial to explore alternative options such as Real Estate Investment Trusts (REITs) and private equity, both of which have gained significant popularity.

In this analysis, we will thoroughly examine REITs vs. private equity. By highlighting the benefits and challenges of each, our goal is to provide you with a comprehensive understanding, enabling you to make an informed decision that aligns with your financial strategy.

| Discussion Topics |

REIT vs. Private Equity

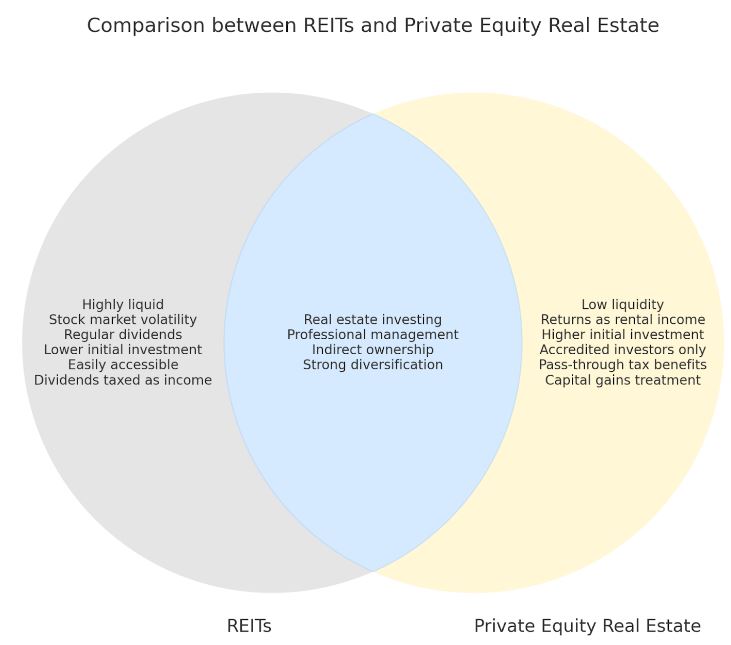

While REITs and traditional rental properties both serve as effective platforms for real estate investment, they operate in distinctly different ways.

Investing in REITs is like owning shares in a large, publicly traded corporation. You benefit from the expertise of experienced management and the ability to easily buy and sell your investment on the stock market.

On the other hand, private equity real estate is like becoming a partner in a private, high-end real estate venture. Investors benefit from exclusive access to premium properties and tailored investment strategies, with the potential for higher returns, albeit with less liquidity and higher entry requirements.

Understanding REITs

Though both involve real estate investment, REITs function differently from direct rental property investments. When investing in a REIT, you are not buying real estate directly. Instead, you acquire shares in a trust that owns and manages the real estate, with the REIT itself being the owner.

When you invest in a REIT, you have minimal influence over the trust’s properties. Your investment in a REIT is similar to holding stock in a company; you receive dividends when the REIT’s properties increase in value and generate profits.

Understanding Private Equity

Private equity real estate involves pooling your money with other investors to buy, develop, and manage real estate properties. Instead of owning the properties directly, you invest in a fund managed by professionals who handle everything from purchasing to improving and operating the properties.

This type of investment benefits from strategic upgrades and expert management. However, it typically requires a more significant initial investment and is more challenging to cash out than some other non-direct ownership real estate options. But for those willing to commit, it can be a rewarding way to invest in real estate without the day-to-day hassles.

REIT vs Private Equity | ||

REITs | Private Equity | |

| Highly liquid, shares can often be easily traded on stock exchanges. | Low liquidity, selling a property or shares in private equity can take time and incur significant costs. |

| Indirect ownership through shares, no direct control over properties. | Indirect ownership through pooled private and public investments in property markets. |

| Subject to real estate market, stock market volatility, and interest rate fluctuations. | Professionally managed to mitigate risks, with potential for higher returns compared to publicly traded REITs. |

| Regular dividend income, potential for share price appreciation. | Potentially higher returns due to strategic asset management and value-add opportunities in properties. |

| Built-in diversification across various properties and locations. | Offers strong diversification potential by pooling investments across various properties and locations. |

| Lower initial investment, shares can be bought at low prices. | Higher initial investment reflects access to premium property assets and sophisticated investment strategies. |

| Professionally managed, passive investment. | Professionally managed by private equity firms, passive for investors. |

| Easily accessible to all investors and can be bought through stock exchanges. | Exclusive access to accredited investors, ensuring a more controlled investment environment. |

| Dividends are taxed as ordinary income; some may qualify for deductions. | Potential for pass-through tax benefits and capital gains treatment. |

Exploring Other Options

Canyon View Capital offers an innovative approach to real estate investment that addresses the limitations of both REITs and traditional private equity. While we share some similarities with private equity, we are not a traditional private equity firm. Instead, we are a real estate investment firm specializing in acquiring, managing, and investing in multifamily properties.

We pool capital from investors and professionally manage these real estate assets. However, our exclusive focus on multifamily real estate enables us to tailor our strategy to capitalize on this specific sector’s most effective methods and trends. This laser focus allows us to optimize returns and target superior value to our investors.

Our strategy provides access to professionally managed real estate investment funds designed to deliver stable, passive rental income with potential tax advantages.

Critical benefits of investing with CVC:

- Passive Income: CVC’s investment funds provide investors with passive rental income from our multifamily properties, ensuring a steady revenue stream.

- No Property Management Hassles: Benefit from real estate investing without the burdens of property management, as our team handles all operational aspects.

- Tax Advantages: Our funds are designed to maximize tax efficiency, enabling investors to benefit from passive losses and leverage tax deferral strategies like 1031 exchanges.

Partnering with CVC Could Be a Great Fit for You

You’re probably considering your next move now that we’ve explored REIT vs. private equity.

What makes CVC different is our focus on multifamily real estate investments, offering a compelling alternative to other real estate investment options. We’re passionate about real estate investing, and with decades of experience, our leadership has built a portfolio exceeding $1 billion in value1.

We are excited to extend our expertise to accredited investors like you, guiding you into the multifamily real estate sector and helping you enjoy its benefits without the typical headaches. We manage all property operations throughout the Midsouth and Midwest, providing you with a seamless, passive income experience.

Need more information on a REIT vs private equity?

We’re happy to help! Call CVC today to learn more. Get Started

1$1B figure based on the aggregate value of all CVC-managed real estate investments as valued on March 31, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.