When it comes to real estate investing, astute investors often seek ways to amplify profits while reducing tax liabilities. When contemplating selling properties to venture into fresh opportunities or alleviate managerial responsibilities, the 1031 exchange is a popular option.

This IRS-code section allows the deferral of capital gains taxes, enabling investors to transfer tax basis and defer gains from one property into another. Doing so will enable them to keep the full proceeds from a real estate transaction within their investment portfolio, which can be is a significant advantage!

However, all good things come with some considerations. A challenge for investors using this tax deferral tool comes from 1031 exchange deadlines.

| Discussion Topics |

1031 Exchange Deadlines

While 1031 exchanges can be excellent tools that allow investors to retain capital gains within their portfolio, it is imperative that they be aware of these deadlines, as there are strict timelines that must be followed to ensure the validity of an exchange.

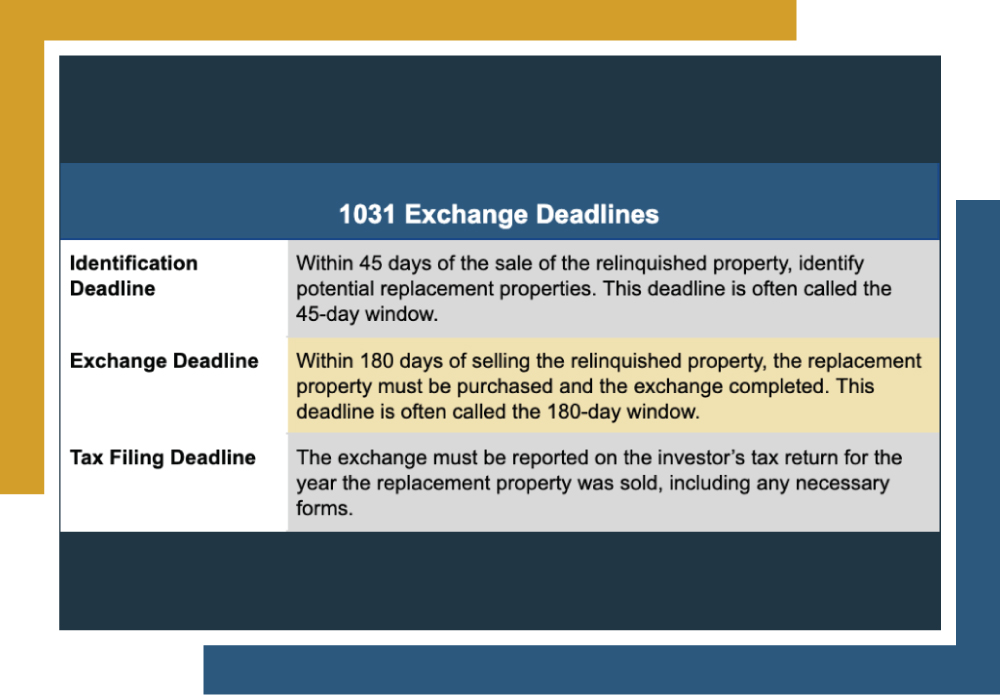

There are three primary 1031 exchange deadlines that all investors need to be mindful of: the identification deadline, exchange deadline, and tax filing deadline.

| |

Identification Deadline | Within 45 days of the sale of the relinquished property, identify potential replacement properties. This deadline is often called the 45-day window. |

Exchange Deadline | Within 180 days of selling the relinquished property, the replacement property must be purchased and the exchange completed. This deadline is often called the 180-day window. |

Tax Filing Deadline | The exchange must be reported on the investor’s tax return for the year the replacement property was sold, including any necessary forms. |

It’s crucial to adhere to these deadlines, as failure to do so could result in the 1031 exchange being nullified. It’s also worth noting that the IRS is typically uncompromising on these deadlines and rarely offers extensions outside specific examples.

1031 Exchange Deadline Examples

The following scenarios show where being aware of 1031 exchange deadlines is pivotal.

1031 Exchange Deadline Examples | |

Scenario 1 | Amber is a real estate investor who faces a critical deadline when considering selling one of her rental properties. With a 1031 exchange, she has just 45 days from selling her current property to pinpoint potential replacements.

However, Amber encounters a setback. After selling her property, she procrastinates on finding a suitable replacement. It’s not until 50 days later that she starts the search.

Unfortunately, this delay has consequences. Missing the 45-day deadline means Amber loses the chance to defer capital gains taxes through the exchange. Now, she must pay taxes on the sale proceeds to the IRS, adding unexpected financial strain. |

Scenario 2 | Richard, a real estate investor looking to expand his portfolio, opts for a 1031 exchange to trade his multifamily property for a larger one. He meets the initial deadline, identifying a replacement property within 45 days of selling his current one.

However, unexpected delays in the closing process of the new property throw a wrench into Richard’s plans. Despite his efforts, he struggles to complete the exchange within the 180-day timeframe.

Ultimately, Richard misses the deadline to acquire the replacement property. As a result, he forfeits the tax-deferred benefits of the 1031 exchange. Now, he faces the prospect of paying capital gains taxes on the transaction, leading to a significant financial setback. |

How to Stay on Track with 1031 Exchange Deadlines

Successfully navigating the stringent timelines of a 1031 exchange ensures the deferral of capital gains taxes and the optimization of returns from investment property sales.

By diligently meeting these deadlines, investors can set the stage for enduring financial prosperity. Effectively navigating these deadlines requires careful planning and execution. Here are some steps to help investors stay on track.

- Understand the Deadlines: Investors should familiarize themselves with the specific deadlines, such as the identification, exchange, and tax filing deadlines.

- Create a Timeline: Drafting a detailed timeline outlining key milestones and deadlines for each stage of the 1031 exchange will help investors stay organized.

- Work with Experienced Professionals: Consulting with qualified professionals, such as qualified intermediaries (QIs), accomodators, tax advisors, real estate attorneys, and specialized intermediaries experienced in 1031 exchanges, offers valuable expertise and support throughout the process.

- Start Early: Beginning the exchange process as soon as possible allows ample time to identify properties and close on the exchange. Investors should avoid procrastinating.

- Stay Proactive: Monitoring the progress of the exchange and taking steps to address any potential issues or delays before they arise is crucial. Investors need to communicate effectively with all parties involved to ensure they are all on the same page.

- Document Everything: Keeping thorough records of all transactions, communications, and deadlines related to the exchange can help ensure compliance in the event of an audit.

It’s crucial to recognize that, like any investment strategy, 1031 exchanges have inherent risks due to their inflexible timelines and stringent deadline demands. Investors should seek guidance from tax experts or financial advisors before proceeding.

Canyon View Capital offers potential solutions for those seeking assistance with streamlining the 1031 exchange process.

Canyon View Capital Helps Ease the Burden of 1031 Exchange Deadlines

1031 exchange deadlines often challenge investors looking to use these powerful tax deferral tools. Canyon View Capital can help streamline the 1031 exchange process, particularly the tiny, 45-day identification window with our extensive portfolio of multifamily properties.

By exchanging into one or more of our readily available properties as Tenants in Common, you can enjoy the benefits of a 1031 exchange and passive income and tax benefits without having to manage properties yourself.

Ready to upgrade your portfolio with diversified, stable investments?

For over 40 years, the principals at Canyon View Capital have worked in real estate, with a portfolio currently valued at over $1B1. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

For more information on how CVC helps with 1031 exchange deadlines, reach out today!

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.