A common concern for many Americans progressing through their careers is how to prepare for the transition from actively working to “retired” — emotionally and financially. If you’re one of the millions of people with an employer-sponsored retirement plan, you’re probably wondering if you’ve saved enough — and may be curious about the returns you’re getting on those savings.

A recent Investment Company Institute report on the $37 trillion US retirement market indicates 401(k)s make up just over $7 trillion, or roughly one-fifth of the total assets. The rest includes individual retirement accounts (IRAs), pensions, and annuities for private and public sectors.

Aside from increasingly rare pension funds, 401(k)s considered a “simpler” approach to investing because contributions come out of your paycheck automatically. Such regular deposits in investment options can offer many people a sense of security — especially when compared to other savings vehicles, like certificates of deposit (CDs), bonds, or keeping it under your mattress. While recent market downturns, higher fees, and periods of recession could deflate the perceived stability of 401(k)s, a bigger issue is how much flexibility such savings allow.

But there is another way—if you have money in a 401(k), that doesn’t necessarily mean it’s completely tied up! If you’re reading this post, you’ve probably got a solid start on your retirement savings, and now you want it to work for you. If you’re looking for ways to diversify your investment portfolio with alternative options like real estate, this discussion on 401(k) real estate investment rules can help you get started. Use the links below to jump ahead to different sections.

| Discussion Topics | |||||||

Why Investing for the Future Matters

Almost everybody wants to enjoy a relaxing, stable retirement — barring a few special exceptions. When it’s time to move on to the chapter beyond your career, how much you manage to save until that point can strongly influence the quality of your retirement.

Your dreams don’t end just because you retire. When you’ve successfully invested in your future, you want the ability to realize those aspirations, along with new goals developed along the way. More importantly, you want to maintain financial independence long after stepping away from an active career. For a lot of people, such independence comes from a retirement fund, the most commonbeing 401(k)s and IRAs.

401(k)s Explained

401(k)s are defined contribution plans typically used by US employers as retirement funds. These funds offer tax advantages for employees, who can designate a pre-tax amount of each paycheck for deposit. In some cases, employers can opt to match employee contributions.

As an example, if an employee elects to deposit 5% of every paycheck into a 401(k), their employer can choose to match that dollar amount. If an employee’s contribution amounts to $500 per paycheck and their employer opts to match it, another $500 is deposited in the employee’s retirement account.

Depending on the plan, it can take some time before you are fully vested in your employer’s contributions, meaning that you own them outright. If you leave a job before you’re vested, you could forfeit some or all matching contributions to your 401(k).

Deposited funds are typically invested in a number of different savings vehicles that, together, make up the entire 401(k). With some 401(k) funds, you can choose how to allocate your savings from a list of stocks, bonds, mutual funds, and CDs.

Because traditional pre-tax retirement contributions are deducted from an employee’s gross income, the deposited amount reduces taxable income. And, as no taxes are due until the money is withdrawn, these savings can grow tax-deferred.

ROTH 401(k)s

The ROTH 401(k) is another type of retirement fund, but with one key difference from traditional models: this species of savings uses post-tax deductions. The deposits are deducted from net income (unlike traditional 401(k)s), but there are no taxes due for withdrawals after age 59 ½.

Regardless of the type, all 401(k)s have limits on the maximum amount of annual contributions (for 2023, the max amount is $22,500).

401(k) Types | ||||

Name | Summary | Withdrawal Rules | Contribution Taxes | Withdrawal Taxes |

Traditional 401(k) | Standard pre-tax employee savings plan. A percentage of each paycheck (gross earnings) is deposited in investments. | Earnings are taxed when withdrawn. Withdrawals before age 59 ½ are penalized unless they meet an IRS exception. | Pre-tax contributions reduce taxable income. | Withdrawals are taxed as ordinary income. |

ROTH | Post-tax employee savings plan. Similar to traditional 401(k)s but deposits are made as post-tax contributions (from net income). | No tax on withdrawn earnings meeting the following requirements:

| Post-tax contributions lower your weekly paycheck. | Withdrawals are not taxed if they meet IRS stipulations. |

401(k) Real Estate Investment Rules You Should Know

Now that you have a better understanding of 401(k)s, you’ll likely want more information about managing the funds you’ve contributed. There are some individual plan guidelines that determine what you can and can’t do with the money once it leaves your paycheck and is deposited in retirement savings. There are also a few 401(k) real estate investment rules that must be followed when moving that money into real estate.

Often, when you start contributing to a 401(k), you’ll be allowed to choose how the money is invested or if it will just sit in a money market account. In general, 401(k)s tend to have rigid guidelines on how funds are invested. Some of those rules specify:

- You cannot invest in individual companies.

- You may select one or more mutual funds or exchange-traded funds (ETFs) that invest in sectors or in a variety of companies.

- You cannot pull money out of a 401(k) before age 59 ½ for traditional 401(k)s without meeting one of the IRS exceptions — or from ROTH 401(k)s before age 59 ½ unless you become disabled — without suffering a penalty.

- When you leave one job for another, there is a 60-day window wherein the IRS allows you to move your money from a 401(k) into an IRA.

.

The last rule is crucial to giving you greater investing flexibility with your 401(k) funds. That’s because unless you want to pay a steep 10% fee on funds you withdraw (unless you meet an exception), it’s the only leeway the IRS gives you.

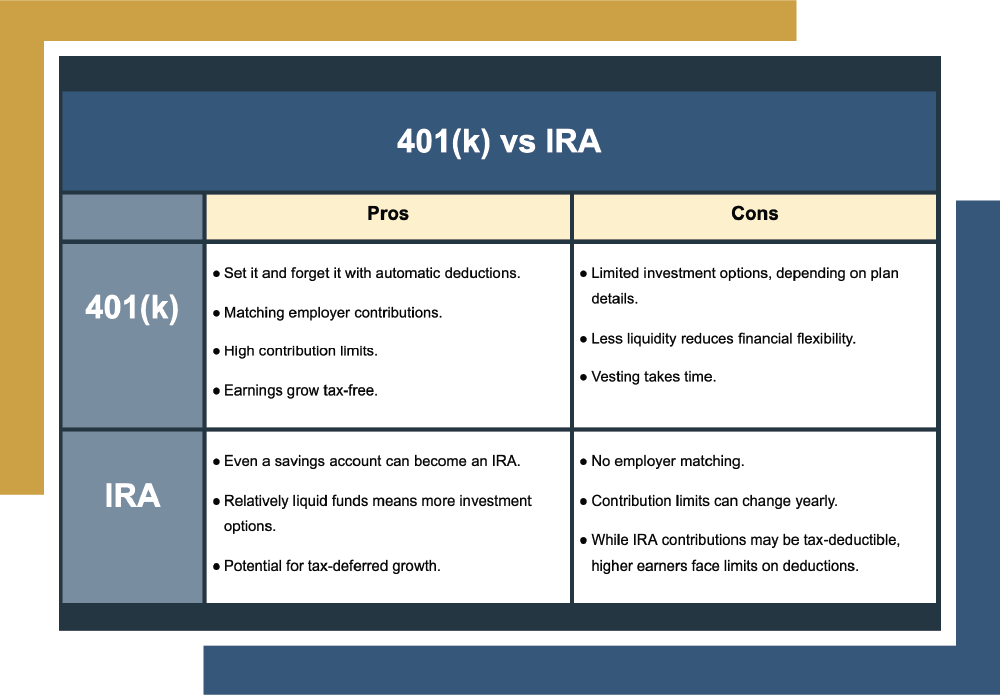

IRAs are another kind of pre-tax retirement savings account but they differ from 401(k)s in that they have no employer sponsors. As indicated by the name, “individual account,” investors have more agency in deciding where the money goes.

If, for instance, you wanted to take money out of your IRA and invest it in a wider universe of investment options, including real estate, you can do so! IRAs do come with a few caveats, compared to 401(k)s. They have lower contribution limits and are not eligible for matching employer contributions.

401(k) vs IRA | |||

Type | Summary | Pros | Cons |

401(k) | Standard employee savings plan. Accessible option to deposit a percentage of each paycheck. Employers may match contributions. |

|

|

IRA | Pre-tax savings plans available to anyone. Similar to 401k, but lower contribution limits. More flexible option offered by banks, brokerages, or investment firms. |

|

|

Despite some limitations, IRAs are a valuable tool to have in your retirement planning toolkit because you can invest money from an IRA directly into real estate. Conversely, a crucial 401(k) real estate investment rule to remember is that you cannot invest money from a 401(k) directly into real estate.

Instead, you must roll your 401(k) funds over into a self-directed IRA. Using the 60-day window allotted by the IRS to move money from a 401(k) to an IRA is called a rollover. This strategy can be used to free up money that may otherwise be “stuck” in the more restricted investment opportunities that 401(k)s offer.

There is also a standard process that you must follow.

By taking advantage of a self-directed IRA, you can explore a wider range of investment options like real estate that may not be available through your 401(k). This can be especially useful if you’re concerned that external factors may impact your 401(k) and want to try and further diversify your portfolio to better protect your retirement savings.

If the thought of mixing up your investments alternatives like real estate options piques your interest, you might be wondering about the next steps you can take. That’s where Canyon View Capital comes in. A phone call is all it takes for us to provide you with expert assistance.

Canyon View Capital Offers Options for Real Estate Investment

Congratulations, you’ve taken the first step toward a clearer financial future! Now you’ll want to partner with experts that are not only focused on bringing investors like you financial strategies that could be a good fit for your investment strategy.

At CVC, we eat, sleep, and breathe real estate investing. With decades of experience under our belt and investments throughout the Midwest and Midsouth, we’re here to offer you funds that make your money work for you without worrying about getting caught up in the confusing details.

If you’re new to real-estate investing, but keen to get started?

For 40+ years, CVC professionals have managed, owned, and operated various types of real estate. Now, we co-own and manage a portfolio of multifamily properties valued at over $1 billion1. Our buy-and-hold strategy rooted in America’s heartland is designed to give investors consistent returns. Contact CVC today—it just takes a phone call!

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.