It’s probably not a controversial statement to say that many investors enjoy having real estate properties in their investment portfolio due to the many potential benefits of this asset class. However, just like any investment vehicle, there are caveats.

One of the potential hangups with real estate investing is its potential tax burdens, such as capital gains taxes. Usually, when investors sell an investment property, they are expected to pay a relatively large sum of the profits as taxes.

However, many savvy investors use a powerful tax deferral tool, a 1031 exchange, to limit their overall tax burden when selling property. In this article, we’ll show you how to set up a 1031 exchange.

| Discussion Topics |

How to Set up a 1031 Exchange

1031 Exchanges are an excellent way for investors to defer their capital gains tax liability on the sale of an investment property. Instead of paying the IRS a percentage of your profit, you’ll reinvest the total proceeds from selling the original property into purchasing a new “like-kind” property.

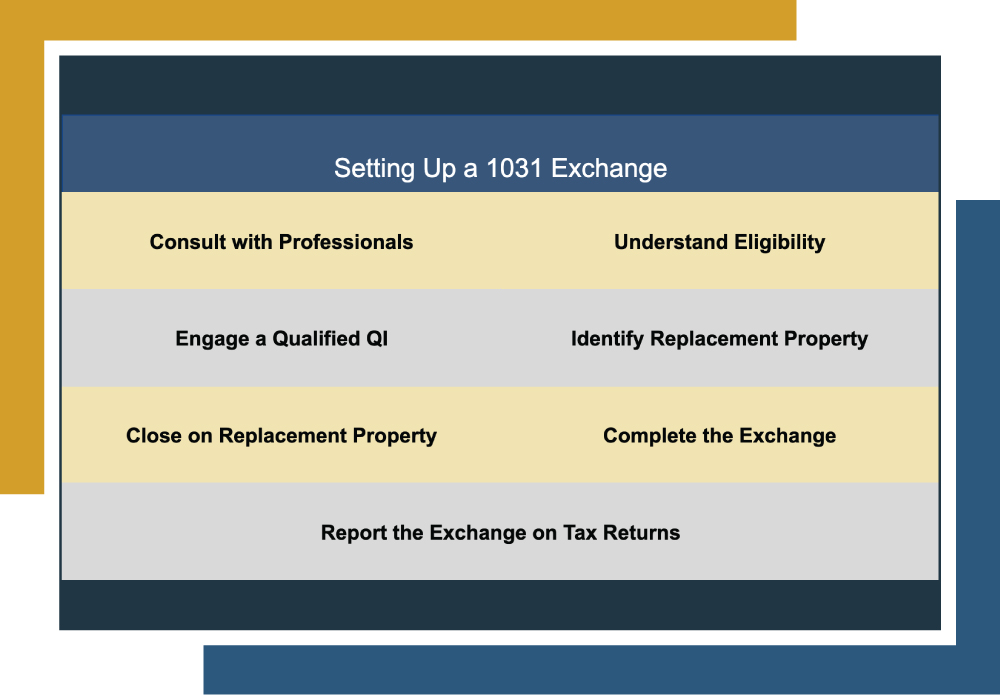

You may be wondering how to set up a 1031 exchange. Although 1031 exchanges involve intricate processes and demand precision within tight timelines, grasping their fundamental workings is easier.

How to Set Up a 1031 Exchange | |

| Before you embark on a 1031 exchange journey, you’ll want to be sure it’s the right move for your investment strategy. Always consult with a financial advisor or tax professional. Doing so can also help ensure compliance with current tax laws and regulations. |

| The property you’re selling (relinquished property) and the property you’re buying (replacement property) must be held for business or investment purposes. They also need to be considered “like-kind,” a broad term outlined by the IRS that generally means they are of the same nature or character. I.E., you can’t replace an investment property with personal property. |

| You cannot directly receive or handle the sales proceeds. They are required to go through a QI. Ensure that you choose a reputable QI to facilitate the exchange, as they will hold the proceeds in escrow and ensure the exchange meets IRS requirements |

| Within 45 days of closing the relinquished property, you must identify potential replacement properties in writing to the QI. You can identify up to three properties without regard for their market value, or you can identify more if the fair market value doesn’t exceed 200% of the value of the relinquished property. |

| The replacement property must be identified and acquired within 180 days of the sale of the relinquished property. Work with your QI and complete the purchase of the replacement property. |

| The QI will facilitate the exchange by transferring the funds from the sale of the relinquished property to the purchase of the replacement property. Make sure all transactions are appropriately documented to satisfy IRS requirements. |

| Disclose the 1031 exchange on your tax return. While the exchange is tax-deferred, you must comply with IRS reporting requirements. This includes filing IRS Form 8824 and state equivalent forms. |

Understanding 1031 Exchanges

Why do 1031 exchanges matter? As stated earlier, they are unique tax deferral tools that allow investors to limit their tax liability when selling investment properties. Instead of paying 20% or more of profits from the sale of an investment property, investors can reinvest the total sale proceeds into a replacement property.

Here’s an example:

Without 1031 Exchange | With 1031 Exchange | |

Sale Price | $500,000 | $500,000 |

Capital Gains Tax Rate | 20% | 0% (Deferred) |

Capital Gains Tax Amount | $100,000 | $0 (Deferred) |

Net Proceeds After Tax | $400,000 | $500,000 |

This can be useful for many reasons, such as wanting to invest in different real estate types, moving on from problematic properties, diversifying a portfolio by selling one property and replacing it with multiple, or the desire to manage properties themselves no longer.

Canyon View Capital may have a solution for you if you’re among the many investors who find a 1031 exchange appealing.

Canyon View Capital Offers Unique 1031 Exchange Replacement Property Options for Investors

Now that you know how to set up a 1031 exchange, it’s time to consider your next steps. At Canyon View Capital, multifamily real estate is our passion. It’s what’s led us to manage a portfolio of multifamily properties throughout the Midsouth and Midwest that is now valued at over $1 billion1.

We recognize that certain investors prefer to avoid property management responsibilities and may seek alternatives demanding less hands-on involvement. That’s why we offer a unique opportunity to initiate a 1031 exchange, allowing investors to utilize one or more of our multifamily properties as replacement property.

In this arrangement, investors can be listed as Tenants in Common, providing a streamlined and potentially less burdensome investment option that defers capital gains taxes while allowing them to still benefit from passive real estate income and other tax benefits.

Ready to upgrade your portfolio with diversified, stable investments?

Canyon View Capital manages, owns, and operates real estate valued at over $1B2. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

Want to learn more about how to set up a 1031 exchange? Reach out today!

1,2$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.