If you’ve owned or sold real estate properties, chances are you’re aware of the inevitable capital gains tax liability that awaits you at the end of a transaction. But consider this: What if there were a way to avoid parting with significant funds in the form of capital gains taxes payable to the IRS?

That’s exactly what a tax deferral tool, the 1031 exchange, can provide savvy investors. Although this powerful tool can be a great way to keep money in investors’ portfolios, it may not be for everyone.

Is a 1031 exchange worth it? The answer will depend on your priorities, specific financial goals, investment strategy, and other factors.

| Discussion Topics |

Is a 1031 Exchange Worth It?

1031 exchanges are outlined in section 1031 (hence the name) of the Internal Revenue Code. This designation signifies that the IRS officially sanctions them as a tax deferral strategy. The purpose is to encourage investors to persist in their real estate investments by providing a recognized and regulated avenue for deferring taxes.

But is a 1031 exchange worth it? That will depend mainly on how much the benefits and potential pitfalls overlap with your investment strategy.

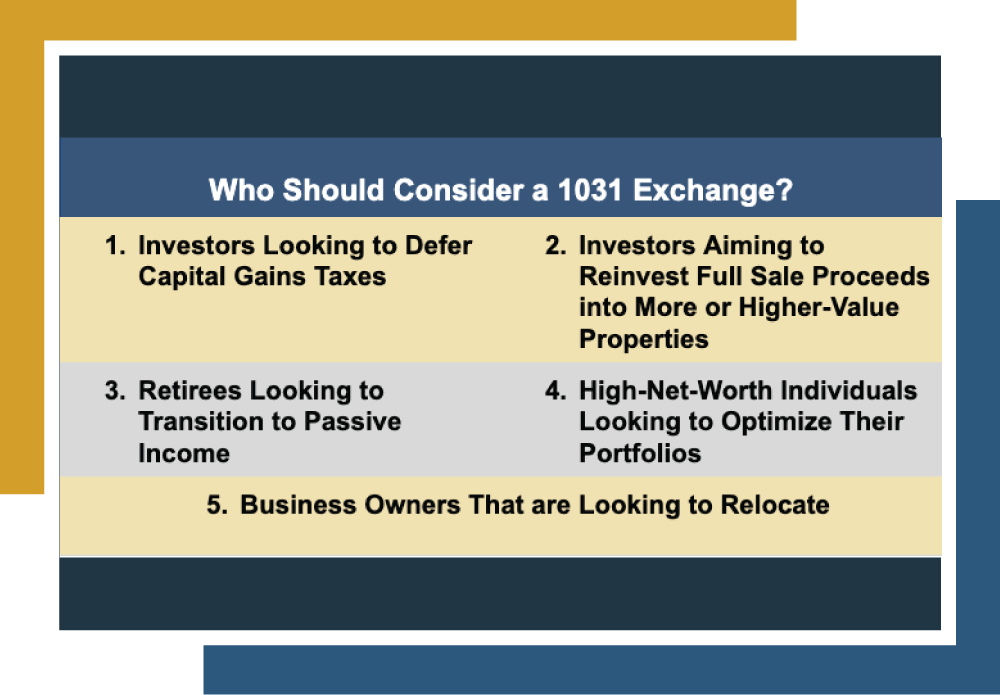

Generally, 1031 exchanges are beneficial for most investors. However, if you fall into one of the following archetypes, a 1031 exchange could be an excellent fit for you.

When a 1031 Exchange May Be Worth It | ||

| Considering the potential deferral of capital gains taxes until the sale of a newly acquired property, 1031 exchanges are worth exploring. Notably, the option for a subsequent exchange on the new property offers the potential for indefinite deferral of capital gains taxes. | |

| 1031 exchanges enhance purchasing power by enabling investors to utilize the sale proceeds to acquire new property. This flexibility allows them to purchase additional properties under the 200 rule or invest in higher-value properties that capital gains taxes would have constrained. | |

| With 1031 exchanges, investors can reinvest sales proceeds in alternative real estate options like private equity or REITs. This enables them to enjoy passive income without property management responsibilities and, importantly, without incurring capital gains taxes. This approach provides a less stressful retirement experience. | |

| 1031 exchanges offer high-net-worth individuals a valuable option for portfolio optimization. By preserving capital, providing enhanced flexibility, and enabling upgrades to higher-value properties, these exchanges cater to high-net-worth portfolios’ specific needs and objectives. | |

| For business owners who own their commercial properties and need to relocate, 1031 exchanges provide a smoother transition. These exchanges ease the process by allowing them to move without incurring a capital gains tax burden when acquiring their new commercial property. | |

To reiterate, whether or not a 1031 exchange is worth it will ultimately depend on the individual’s financial goals, investment strategy, risk tolerance, and other factors.

While the benefits are significant across diverse investor profiles, conducting a thorough analysis and due diligence remains imperative. Seeking guidance from a financial advisor or tax professional is essential to stay informed about the latest market conditions and tax regulations. This approach ensures the decision aligns with one’s circumstances and contributes to informed and strategic investment choices.

Benefits and Challenges of 1031 Exchanges

Deciding whether or not a 1031 exchange is worth it means understanding why you would want to engage in a 1031 exchange in the first place and any potential shortcomings that may not make them a good fit.

1031 exchanges come with a slew of benefits that make them enticing propositions for investors, such as:

- Tax Deferral: The primary purpose of 1031 exchanges is to defer the capital gains taxes on the sale of investment properties by reinvesting the proceeds into the newly acquired property(s). By doing so, investors can postpone their tax liability, allowing them to use the entire sale proceeds to acquire the new property.

- Preservation of Capital: Deferring capital gains taxes with a 1031 exchange preserves capital, boosting purchasing power for new properties and enabling potential acquisition of more valuable assets.

- Wealth Accumulation: Investors can defer taxes over multiple 1031 exchanges, aiding wealth accumulation. Reinvesting tax savings in each exchange has the potential for higher returns and increased wealth.

- Portfolio Diversification: Investors can leverage 1031 exchanges for portfolio diversification, allowing them to swap properties across various locations or types. This approach mitigates risk and fosters a more balanced investment portfolio.

- Property Consolidation or Upgrading: Utilizing 1031 exchanges, investors can consolidate or upgrade their real estate holdings. Doing so involves exchanging multiple properties for a single, larger property or trading up to a potentially more valuable and income-generating asset.

- Estate Planning Benefits: In the context of estate planning, a 1031 exchange presents certain advantages. When heirs inherit a property acquired through such an exchange, the property’s cost basis is adjusted to its fair market value, potentially reducing capital gains taxes upon inheritance.

- Flexibility: The flexibility inherent in a 1031 exchange empowers investors to adjust their investment strategy in response to shifting market conditions or evolving personal financial goals without facing immediate tax consequences.

- Stimulating Real Estate Transactions: By encouraging investors to reinvest in real estate, 1031 exchanges boost real estate transactions and overall market activity. This positive impact can reverberate throughout the entire real estate market.

On the flip side, there are also some essential caveats of 1031 exchanges that every investor needs to be aware of.

- Strict Rules and Tight Deadlines: 1031 exchanges are highly regulated by the IRS and require adherence to strict rules and deadlines. These constraints can challenge and demand meticulous planning and quick decision-making to ensure compliance.

- Potential Challenges with Identification and Acquisition: Replacement properties must be identified within a 45-day window, and the entire process must be completed in 180 days. Investors may find significant challenges in promptly finding replacement properties, especially in competitive markets.

- Risk of Financial Loss if Not Executed Properly: While the benefits of 1031 exchanges can be massive, failure to follow the process can result in financial loss due to tax consequences.

- Market Conditions and Property Values: Market conditions are constantly in flux, and shifting values can challenge 1031 exchanges. These fluctuations can impact the availability and pricing of suitable replacement properties, meaning investors need to be mindful of these external factors.

If you’re an investor attracted to the benefits of 1031 exchanges but are uncertain of some of the potential challenges, Canyon View Capital may be able to help.

Make Your 1031 Exchange Easier with Canyon View Capital

Is a 1031 exchange worth it? In most cases, yes. This tax deferral tool proves highly beneficial for accredited investors seeking to retain funds within their portfolio rather than remitting them to the IRS.

Regardless of whether you fit into the investor profiles mentioned earlier, Canyon View Capital could assist you in reaping the benefits of 1031 exchanges without the associated hassle. By exchanging into one or more of our multifamily properties (as Tenants in Common) located in America’s Heartland, you can sidestep some of the challenges of the 1031 exchange process, such as identification and acquisition.

You’ll also enjoy genuinely passive real estate income and tax benefits such as passive losses without managing properties yourself.

Ready to upgrade your portfolio with diversified, stable investments?

For over 40 years, Canyon View Capital has managed, owned, and operated real estate, now valued at over $1B1. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

Still asking yourself, “Is a 1031 exchange worth it”? Reach out today!

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.