In the ever-evolving landscape of investing, savvy investors constantly look for ways to grow their portfolios while minimizing their hands-on involvement. One path that many investors have become enticed by is real estate investing.

However, like any investment, real estate often requires significant hands-on time, and there are many investing strategies to choose from. Also, some avenues are more demanding than others. In this article, we’ll explore some of the more passive real estate investing examples to help you start your real estate investing journey.

| Discussion Topics |

Passive Real Estate Investing Examples You Need to Know

In the expansive domain of real estate, a multitude of avenues beckon investors. While some opt for direct involvement in their real estate ventures, engaging in activities like construction, development, or hands-on property management for rental properties, others might hesitate due to the substantial responsibilities of active real estate investing.

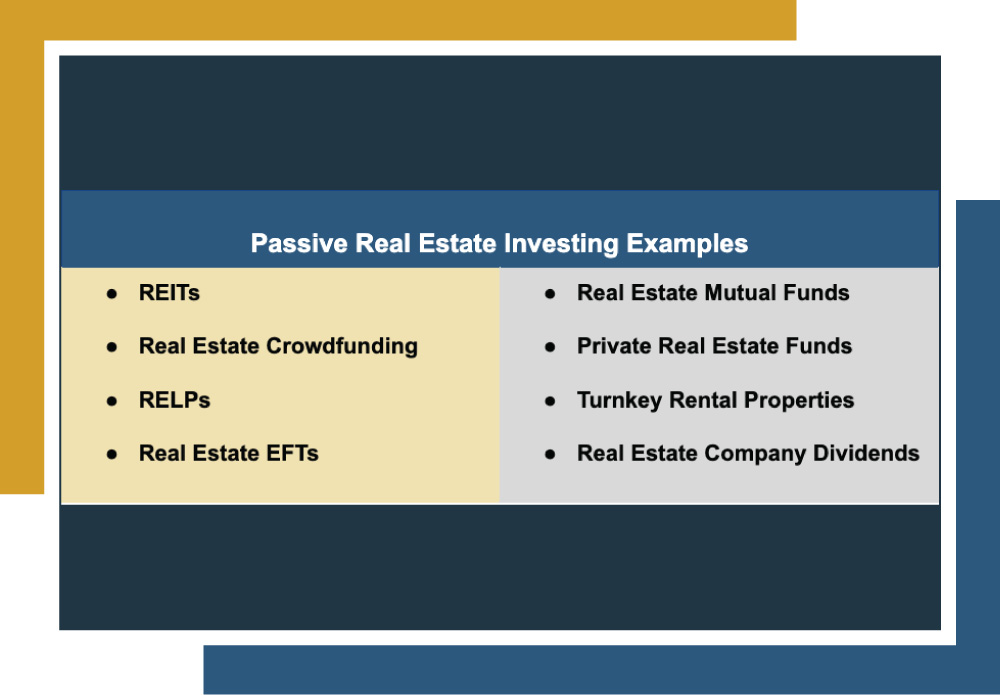

For others, there are more passive approaches to real estate investing. These approaches typically involve investing in other entities that manage most of the investing decisions and don’t require as much active participation by investors. Even when filtering out the more active real estate investment options, there are a plethora of passive ones. Below are some passive real estate investing examples.

- Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-generating real estate across sectors like residential, commercial, and industrial properties. They enable investors to participate in real estate without owning physical properties and must distribute at least 90% of taxable income as dividends to shareholders.

- Real Estate Crowdfunding: Real estate crowdfunding pools small investments from numerous investors, often online, to fund real estate projects. Investors participate in specific ventures and earn a portion of profits or rental income based on their investments.

- Real Estate Limited Partnerships (RELPs): RELPs involve passive investors contributing capital to a real estate project managed by a general partner who handles operations and decisions. Limited partners provide funding with limited liability.

- Real Estate Exchange-Traded Funds (EFTs): Real Estate ETFs are exchange-traded funds that mimic real estate index or asset performance, offering a diversified real estate securities investment akin to stocks.

- Real Estate Mutual Funds: Real estate mutual funds are professionally managed funds investing in diversified real estate-related assets like REITs, real estate stocks, and securities. Investors purchase shares, and a fund manager handles investment decisions on their behalf.

- Private Real Estate Funds: Private real estate funds are managed investment vehicles that target private real estate opportunities, like property ownership, development projects, or related assets. They’re often available to accredited investors and institutions with longer investment horizons.

- Turnkey Rental Properties: Turnkey rental properties are fully renovated and pre-tenanted properties sold to investors by property management firms or real estate providers. They’re designed for hassle-free rental income generation with minimal investor involvement.

- Real Estate Company Dividends: Real estate company dividends are dividends paid by publicly traded real estate firms, like REITs or real estate developers, to their shareholders. They usually represent a portion of the company’s profits and are regularly distributed to shareholders holding company shares.

How do Passive Real Estate Investing Options Stack Up?

Passive Real Estate Investing Options Compared | |||

Investment Type | Level of Involvement | Liquidity | Risk Level |

REITs | Low | High | Moderate |

Real Estate Crowd Funding | Low to Moderate | Low to Moderate | Moderate |

RELPs | Low | Low to Moderate | High |

EFTs | Low | High | Moderate |

Real Estate Mutual Funds | Low | Moderate | Moderate |

Private Real Estate Funds | Low | Low to Moderate | High |

Turnkey Rental Properties | Low | Low to Moderate | Moderate |

Real Estate Company Dividends | Low | High | Moderate |

It’s crucial to understand that while these options are comparatively more passive and may be less volatile than other real estate investment options, they all carry a level of risk, like all investments. Any real estate investment can be subject to a “total loss.” Always consult with your financial advisor before making any investment decisions.

Benefits of Passive Real Estate Investing Examples

There are many reasons why an investor would want to take one of these more passive approaches to real estate investing. For one, they require significantly less knowledge of real estate as you won’t really be in control of the investments. You’ll only need a basic understanding of real estate and investing.

Furthermore, it can require less upfront capital investment as investors won’t need to purchase, renovate, or manage entire properties on their own. Also, because of this factor, you can typically put your money to work immediately because many of these options involve existing real estate.

Finally, when taking many of these approaches, you may be able to invest in things you otherwise wouldn’t be able to. For example, many investors may lack the million dollars necessary for a high-rise condominium building or a large apartment complex. However, with some of these options, such as REITs, crowdfunding, and company dividends, investors can invest in asset classes that would have otherwise been inaccessible.

Canyon View Capital Offers Truly Passive Real Estate Investment Products

Many investors may be aware of the benefits of investing in real estate but may find themselves deterred by the responsibility required, even in some of the more passive real estate investing examples.

At CVC, we’re passionate about real estate and manage a multifamily portfolio valued at over $1 billion1. Backed by our “buy-and-hold” strategy that targets stable returns, we use our experience to offer investors passive real estate investing options that also offer tax advantages via passive losses.

Still need more information on 1031 exchanges vs Opportunity Zone Funds?

For over 40 years, CVC has managed, owned, and operated real estate valued at over $1B2. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns. To learn more about passive real estate investing examples, call CVC today! Get Started

12$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.