In the realm of investing, individuals constantly seek methods to enhance their portfolios and safeguard their capital. However, a common obstacle to this goal comes in the form of taxes, as the IRS typically claims a portion of all transactions. Real estate is no different.

However, savvy investors know how to utilize various methods that allow them to defer their taxes and keep a bigger share of their profits. If you don’t consider yourself among them, fear not! In this article, I’ll break down six powerfulreal estate tax deferral strategies to help you understand some of your options.

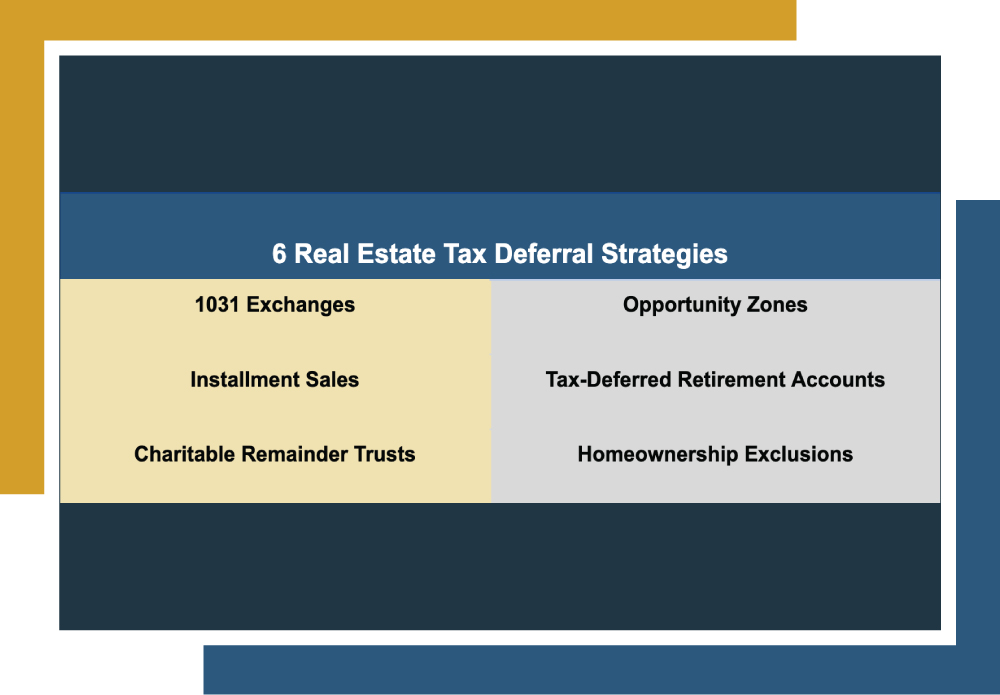

6 Real Estate Tax Deferral Strategies

Many are at your disposal if you’re looking for real estate tax deferral strategies. I will highlight a handful of common strategies generally seen as potential fits for various real estate investors.

- 1031 Exchanges: 1031 exchanges involve selling the original property and using the proceeds to buy a replacement property within a specific timeframe. They defer capital gains taxes until the replacement property is sold outside of the exchange, enabling investors to retain all profits from the original sale within their investment portfolio.

- Opportunity Zones: Opportunity zones entail investing in designated economically distressed areas, deferring capital gains taxes until 2026 or the investment is sold.

- Installment Sales: Installment sales involve receiving proceeds from a property sale in installments and deferring capital gains taxes until payments are received.

- Tax-Deferred Retirement Accounts: Tax-deferred retirement accounts, like self-directed 401(k)s and self-directed IRAs, allow real estate investments with pre-tax funds, postponing taxes until distributions are made

- Charitable Remainder Trusts: Charitable remainder trusts involve transferring real estate into a trust, receiving income for a set time, and deferring taxes until trust income is received.

- Homeownership Exclusions: Homeownership exclusions allow the exclusion of capital gains tax upon the sale of a primary residence within certain limits.

Tenants in Common vs. Other Ownership Types | ||||

Strengths | Weaknesses | Timing of Deferral | Investment Requirements | |

1031 Exchanges | Defers capital gains tax and facilitates portfolio growth. | Limited replacement property options and stringent timeline requirements. | Taxes on capital gains are deferred until the replacement real estate is sold outside of a 1031 Exchange. | Replacement property must be of “like-kind,” and exchange must be completed within a tight window. |

Opportunity Zones | Tax incentives for investing in economically distressed areas, potential for long-term appreciation. | Limited to specific geographic areas, uncertainty about future tax benefits. | Capital gains tax is deferred until 2026 or the sale of the investment. | Investment in qualified real estate in Opportunity Zones. |

Installment Sales | Flexibility in receiving sale proceeds and potential tax deferral benefits. | Risk of default by the buyer may prolong tax liability. | Capital gains tax is deferred until installments are received. | Buyer and seller agree to installment sale terms. |

Tax-Deferred Retirement Accounts | Pre-tax contributions, tax-deferred growth potential. | Early withdrawal penalties and required distributions. | Taxes are deferred until retirement account distributions are made. | Subject to retirement account rules and regulations. |

Charitable Remainder Trusts | Tax benefits from charitable contributions, the potential for income stream. | Irrevocable transfer of assets, complex legal and administrative requirements. | Taxes are deferred until the donor receives real estate trust income. | Transfer of real estate assets with adherence to trust terms. |

Homeownership Exclusions | Exclusion of capital gains tax on primary residence sale. | Limited to primary residence, exclusion limits may not cover substantial gains. | Taxes are excluded if the gain falls within exclusion limits upon the sale of a primary residence. | Must meet ownership and use requirements. |

It’s worth noting that all investments, including real estate, carry some level of risk. Regardless of the potential benefits, you should consult your financial advisor or tax professional to ensure that any new real estate tax deferral strategies align with your financial goals and risk tolerance.

Canyon View Capital’s Investment Options

If 1031 exchanges or tax-deferred retirement accounts fall within your realm of interest, Canyon View Capital may be able to help.

- How Does CVC Help With 1031 Exchanges? CVC holds an extensive multifamily real estate portfolio throughout the Midsouth and Midwest. One hurdle with 1031 exchanges is the limited time to find new properties. We offer a solution: investors can swap into one or more of our properties as Tenants in Common. This process makes it easier to find suitable replacement properties since our options are readily available.

- How Does CVC Help With Tax-Deferred Retirement Accounts? CVC provides two investment options that enable investors to utilize funds from their self-directed 401(k)s or self-directed IRAs for real estate investments. These options are intended to pass on some of the numerous tax benefits associated with real estate investing.

Both options offer investors the opportunity to earn truly passive real estate income without the need to manage the property themselves. Our investment vehicles are ideal for accredited investors seeking an investment approach that tries to reduce the need for hands-on involvement.

Let Canyon View Capital Be Your Guide

Now that you know more about some popular real estate tax deferral strategies, it’s time to consider your next move. At CVC, we’re passionate about real estate investing. It’s what our team members have been eating, sleeping, and breathing for decades.

We aim to help investors like you enjoy the benefits of real estate investing while we shoulder most of the burden of managing properties. By focusing on a conservative strategy and investing in stable areas, we aim to provide you with a seamless journey toward your financial goals in real estate.

Ready to upgrade your portfolio with diversified, stable investments?

For over 40 years, the principals at Canyon View Capital have worked in real estate, with a portfolio currently valued at over $1B1. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

For more information on real estate tax deferral strategies, reach out today!

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.