Much like other investment avenues, real estate investing offers diverse opportunities for investors seeking financial freedom. While many opt for the traditional approach of rental properties, it’s essential to be aware of alternative options, such as Real Estate Investment Trusts (REITs), which have gained popularity.

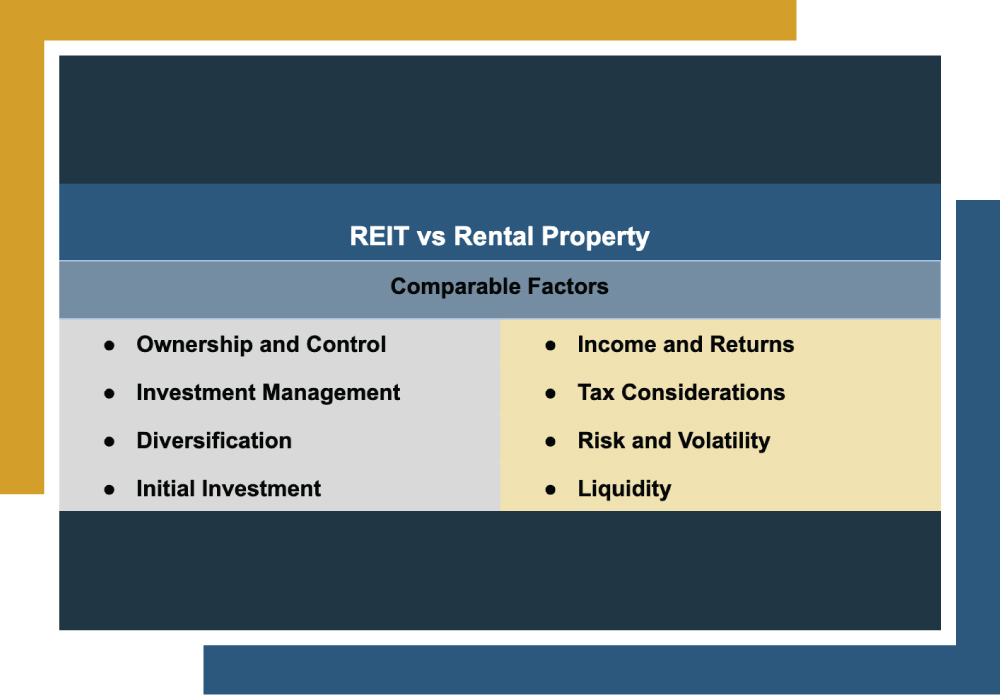

This analysis will delve into the distinctions and commonalities between REITs and rental properties. By comparing the benefits and challenges of REITs vs. rental properties, we aim to provide you with a comprehensive understanding to help you determine which aligns best with your financial strategy.

| Discussion Topics |

REIT vs. Rental Property

While REITs and traditional rental properties both serve as effective platforms for real estate investment, they operate in distinctly different ways.

Investing in REITs is akin to owning shares in an extensive, professionally managed real estate portfolio. Investors benefit from the expertise of professional managers and enjoy the liquidity of publicly traded shares. On the other hand, owning rental properties is like running a small business. Investors have direct control over the property and its management but must also handle the day-to-day operations and challenges.

Understanding REITs

Although they involve investing in real estate, REITs work differently than investing directly in rental properties. With a REIT, you aren’t purchasing real estate directly. Instead, you purchase shares of a trust that owns and operates the real property. The REIT is the actual owner.

As an investor, you have little input on the property held by the REIT. Instead, your investment in the REIT is an asset much in the way that an investment in a company’s stock works, with you receiving dividends when the REIT’s property(s) appreciate and turn a profit.

Understanding Rental Properties

Rental properties are what we typically envision when thinking about traditional real estate investments. When you invest in rental properties, you take on full responsibility for ownership, including maintenance, tenant management, and rent collection.

This type of investment generates income through rental payments and potential property appreciation, offering direct returns based on how well you manage and maintain the property.

When comparing REIT vs rental property, it’s clear that each offers unique advantages and requires different levels of involvement. Understanding these differences can help investors decide which path aligns better with their financial goals and lifestyle.

REIT vs Rental Property | ||

REITs | Rental Properties | |

| Indirect ownership through shares, no direct control over properties. | Direct ownership, full control over property management. |

| Professionally managed, passive investment. | Actively managed; requires hands-on involvement or hiring a property manager. |

| Built-in diversification across various properties and locations. | Limited unless owning multiple properties in different areas. |

| Lower initial investment, shares can be bought at low prices. | Higher initial capital is required for down payments, closing costs, and potential renovations. |

| Regular dividend income, the potential for share price appreciation. | Rental income can fluctuate, and property value appreciation contributes to returns. |

| Dividends are taxed as ordinary income; some may qualify for deductions. | Deductions can offset rental income, and capital gains taxes apply upon sale. |

| Subject to both real estate market and stock market volatility as well as interest rate fluctuations. | Market fluctuations impact property values; rental income can provide stable cash flow. |

| Highly liquid, shares can often be easily traded on stock exchanges. | Low liquidity, selling a property can take time and incur significant costs. |

Exploring Other Options

Neither REITs nor direct rental property ownership is a perfect match for some investors. While REITs offer a hands-off investment option, they have some unique disadvantages due to their shared real estate and stock ownership traits.

Canyon View Capital offers an innovative approach to real estate investment that sidesteps the downsides of both REITs and traditional rental properties. Specializing in multifamily real estate, we provide access to professionally managed real estate investment funds designed to deliver stable, passive rental income with potential tax advantages.

Key Benefits of investing with CVC:

- Passive Income: CVC’s investment funds allow investors to enjoy passive rental income from our multifamily properties.

- No Landlord Responsibilities: Enjoy the benefits of real estate investing without the hassle of property management.

- Tax Advantages: Our funds are structured to maximize tax efficiency, allowing investors to potentially benefit from passive losses and utilize tax deferral strategies such as 1031 exchanges.

Collaborating with CVC Could Be a Great Fit for You

Now that we’ve explored the differences between REITs and rental properties, you’re probably thinking about your next move.

At CVC, we specialize in multifamily real estate investing. With decades of experience, our principals have developed a portfolio worth over $1 billion1.

We’re eager to share our expertise with accredited investors like you, helping you enter the multifamily real estate market and reap its rewards without the usual stresses. We handle property management across the Midsouth and Midwest, ensuring you enjoy hassle-free, passive rental income.

Need more information on a REIT vs rental property?

We’re happy to help! Call CVC today to learn more. Get Started

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.