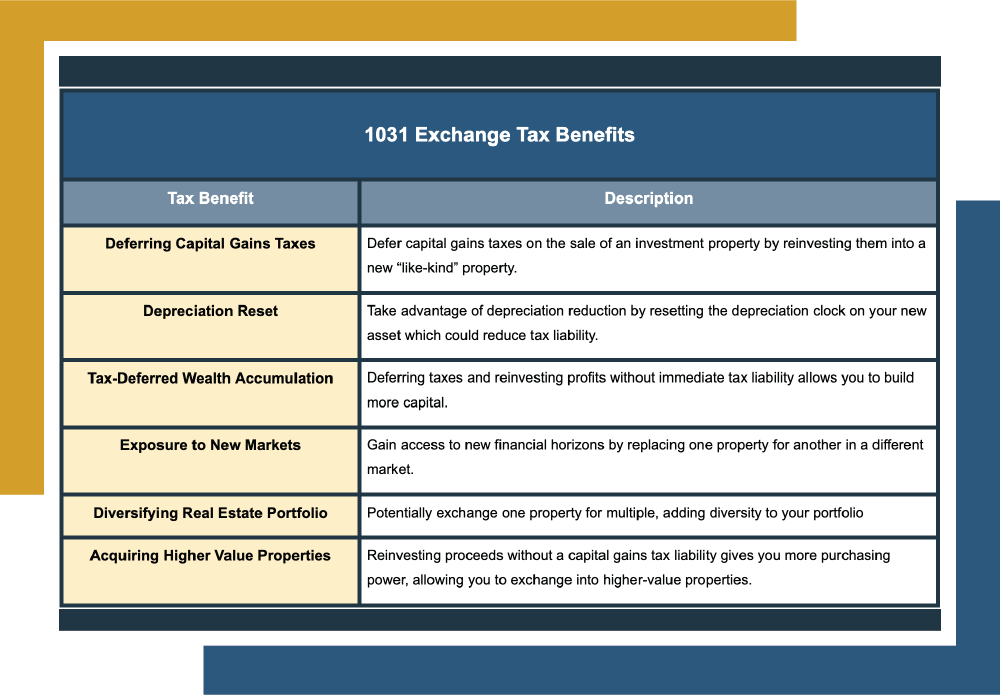

1031 Exchange Tax Benefits Investors Should Know

Real estate investors and property managers understand the appeal of passive income and the possibility of long-term wealth accumulation that can come with real estate investments. However, when it’s time to sell an investment property, the burden of capital gains taxes can put a damper on your finances, potentially depriving you of as much as […]

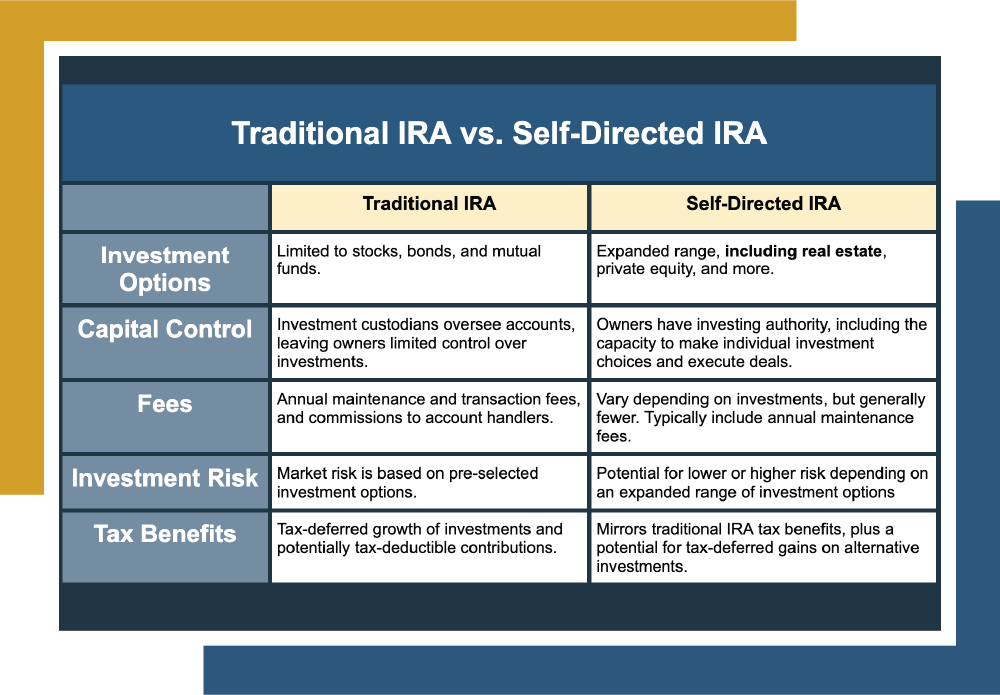

Self-Directed IRAs for Real Estate Investing: Get a Head Start on Stable Gains

As an investor, it’s natural to worry about what might happen to your assets over time. While familiar options, like stocks, bonds, and 401(k)s are popular choices for investing in the future, many people ignore the potential of real estate investments because they assume they don’t have the available funds to get started. If this […]

1031 Exchange Holding Period Explained for Investors

So — you’ve decided to seize the opportunity and enjoy the benefits of a 1031 exchange! Or maybe you’re still gathering information before making that leap. After all, why wouldn’t you take advantage of a tax break that lets you defer capital gains taxes, potentially into perpetuity? While 1031 exchanges are a great way to […]

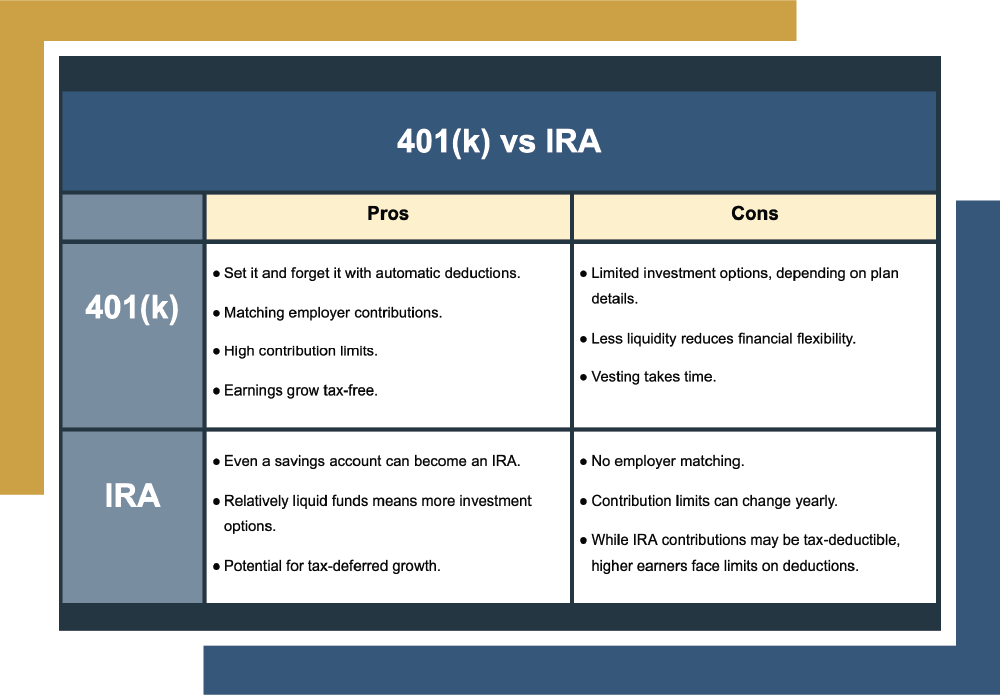

401K Real Estate Investment Rules

A common concern for many Americans progressing through their careers is how to prepare for the transition from actively working to “retired” — emotionally and financially. If you’re one of the millions of people with an employer-sponsored retirement plan, you’re probably wondering if you’ve saved enough — and may be curious about the returns you’re […]

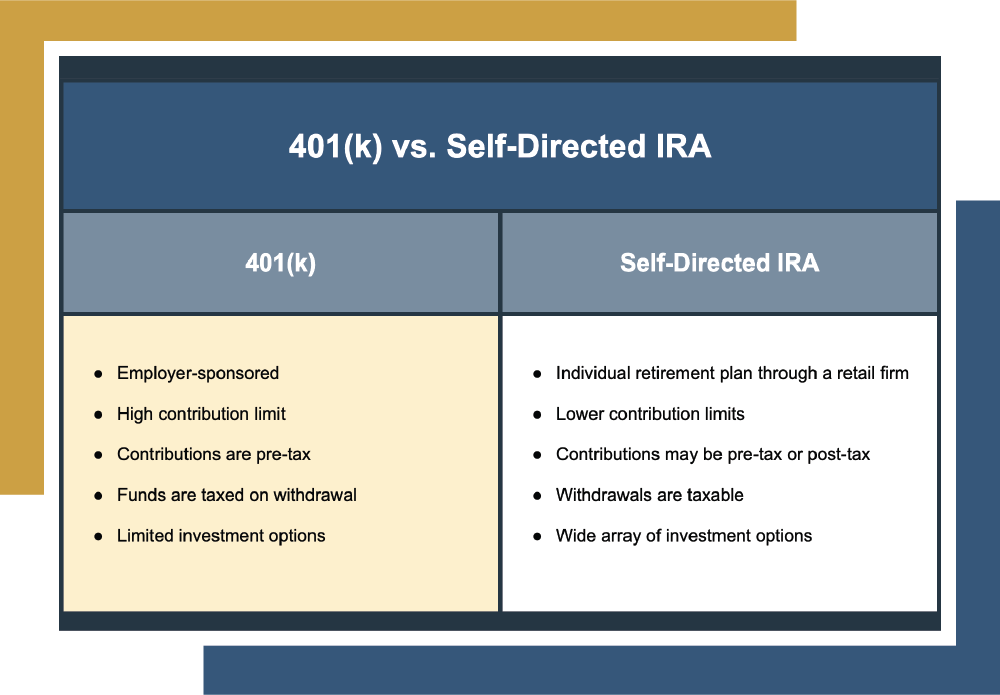

Using a 401K for Investment Property: A How-To

Most Americans state that building wealth for the future is a major career goal. This ethos of “working to live” instead of “living to work” prompts many folks to start setting capital aside for a comfortable retirement. While not many want to work forever, most people do look forward to living well, especially in their […]