Investment Approach

Real Estate Income Fund

Looking for a way to get more out of your retirement account? Learn how a real estate income fund could be the perfect solution.

When it comes to investing, you can bet that just about everyone is looking for an edge. This is even more true in today’s world of economic uncertainties.

Investors have increasingly turned to real estate. It’s easy to see why, as it offers many benefits such as increased diversity, appreciation, leveraging using debt, a hedge against inflation, passive income potential, stability, and potential growth, making real estate investment a savvy choice in today’s financial landscape.

If your funds are locked in a 401(k) or IRA, you may be wondering about the possibility of investing in real estate, primarily since these accounts are generally restricted to investing in traditional investment options like stocks and bonds.

The good news is you can! However, it requires the account to be self-directed.

There is a wide range of real estate investment opportunities available these days, including real estate income funds, which enable investors to leverage the potential benefits of real estate through their self-directed 401(k)s and self-directed IRAs while still benefiting from the tax-deferred nature of those accounts.

Discussion Topics

Are my Retirement Accounts Good Enough?

Historically, traditional retirement savings accounts like 401(k)s and IRAs have been integral to Americans’ financial plans. It’s not hard to see the appeal; these accounts offer a user-friendly approach to effortlessly earmark funds, embodying a “set it and forget it” mentality.

In addition, they may include perks such as employer contribution matches, boosting savings, and are tax-deferred. Generally, traditional retirement savings accounts provide the following benefits:

| Tax Advantages | 401(k) contributions are made pre-tax, reducing your taxable income in the contribution year. Similarly, IRA contributions are often tax-deductible and provide immediate tax benefits. |

| Tax-Deferred or Tax-Free Growth | The funds in both accounts grow tax-deferred (or tax-free if it’s a Roth account) until you begin making withdrawals in retirement. |

| Employer Matches | Many employers will match your contributions, substantially boosting your retirement savings. |

| Automatic Payroll Reductions | 401(k) contributions are deducted directly from your paychecks. |

| Portability | Both of these accounts are portable, which allows you to roll them over to your next employer or consolidate multiple accounts into one. |

| Retirement Income | When you retire, you can withdraw funds from your accounts to supplement your income and enjoy greater financial stability. |

| Estate Planning | Both of these accounts offer options for beneficiaries and allow the transfer of assets to heirs. |

However, due to market instability, 401(k)s and IRAs have seen significant turbulence in recent years. This is because these accounts typically only have their funds invested in traditional assets such as stocks and bonds, which are at the whim of the stock market.

In 2022, retirement account balances fell drastically, and while they bounced back in 2023, there are still concerns over their stability1. Keep in mind that their supposed stability is one of their factors.

It’s understandable to find this concerning and to consider seeking alternative investment options. Luckily, if you have a self-directed 401(k) or IRA, you can enjoy some of the main benefits of 401(k)s and IRAs while using the funds in your account to invest in real estate.

What is a Real Estate Income Fund?

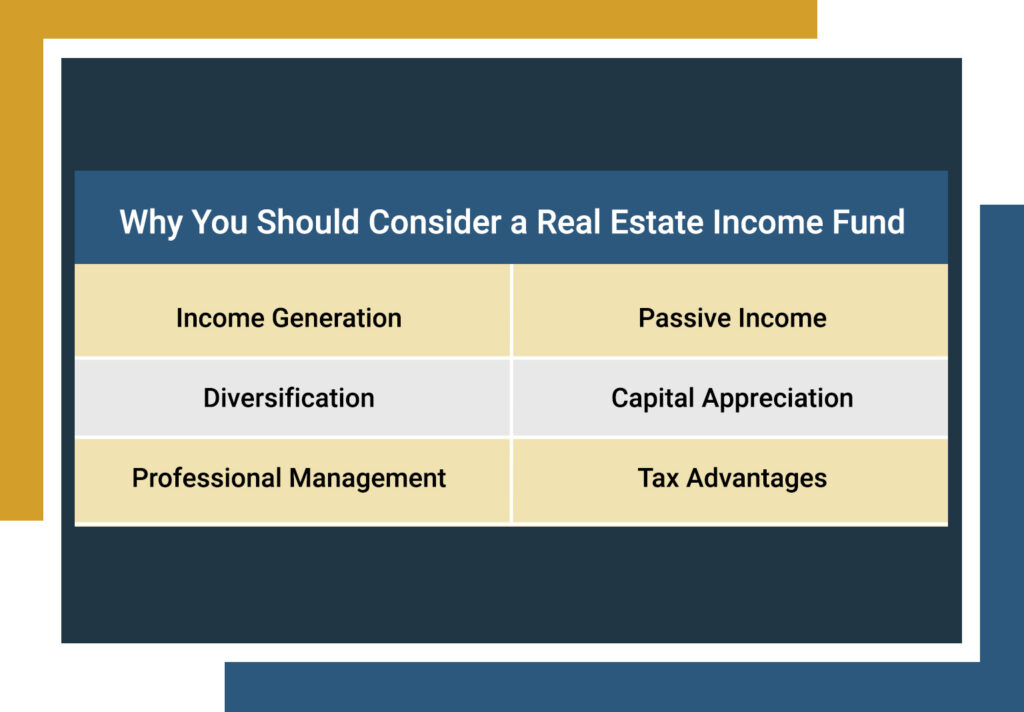

| Income Generation | Real estate income funds are designed to provide regular income streams for investors funneled back into their retirement savings accounts. |

| Diversification | Real estate income funds can invest in various real estate assets such as multifamily, commercial, and single-family properties. This can help spread risk across different property types and geographic locations. |

| Professional Management | Real estate income funds are usually managed by seasoned investment professionals who are well-versed in real estate. These fund managers make informed, strategic decisions on asset allocation, property selection, and timing of investments to maximize income potential and minimize risk. |

| Liquidity | Real estate income funds provide investors with greater levels of liquidity versus direct ownership of real estate. Investors can buy and sell shares of the fund, offering increased flexibility. |

| Passive Income | Real estate income funds offer a passive investment option for those seeking regular income. This helps maintain the relative ease of use of 401(k)s and IRAs, as investors aren’t responsible for managing properties. |

| Potential for Capital Appreciation | Real estate income funds don’t just generate income; they may also experience capital appreciation over time as changes in property values or improvements occur. |

| Tax Advantages | Investing retirement savings in real estate income funds maintains traditional tax benefits and offers additional advantages like deductions on real estate expenses and favorable dividend income treatment. |

It’s important to note that no benefits of any investment vehicle are guaranteed, and all investment vehicles carry some risk. Always consult your financial advisor or a tax professional before investing in new investment options to ensure that they align with your risk tolerance and investment objectives.