Individual retirement accounts (IRAs) have long been popular among investors seeking a straightforward approach to saving for retirement or investing in conventional assets like stocks and bonds. Yet, traditional IRAs have restrictions that can limit your investment options and narrow your financial ambitions.

But there’s also a particular type of IRA that gives investors even more freedom regarding where they invest their money. I’m referring to self-directed IRAs, which allow investors to own alternative assets such as real estate. This option is popular for investors due to its variety of potential benefits compared to other investment options.

In this article, I will explore self-directed IRAs and break down the self-directed IRA real estate investing pros and cons to help you understand if using a self-directed IRA for real estate investing is a move that you should consider.

| Discussion Topics |

Understanding Self-Directed IRAs

Traditional IRAs are a type of retirement savings account that offer individuals tax advantages, such as tax-deferred contributions and tax-deferred growth, that lower a person’s overall tax liability and allow the funds to grow tax-deferred while in the account.

Usually, IRAs, such as traditional IRAs, are managed by a brokerage or a bank, giving them a level of simplicity versus other investment options or savings accounts. The money sits in the account and is invested in what the brokerage or other party feels would be worthwhile, such as specific stocks or bonds. They can be an excellent option for people who want to maintain a hands-off approach to investing and saving.

However, because they are so streamlined, investors can be extremely limited in where they can invest money from the IRA. Conversely, self-directed IRAs allow investors to invest their IRA funds into a swath of other ventures on top of the options offered by traditional IRAs.

While self-directed IRAs are independent of brokerages or banks that make your investment decisions for you, they do have to go through a custodian. This entity will handle transactions and financial reporting and ensure that investments do not violate rules.

Broadly, self-directed IRAs offer the following over traditional IRAs:

- More investment options: Self-directed IRAs allow investors to put their money in a wider array of options than traditional IRAs. With self-directed IRAs, you can invest in real estate, private equity, cryptocurrency, and more, allowing you more options to try and diversify your portfolio better.

- Greater control and flexibility: With a self-directed IRA, investors have more agency over managing their funds according to their knowledge, expertise, and strategy.

- Potential for higher returns: By investing in alternative assets or taking advantage of niche or emerging investment opportunities, self-directed IRAs offer higher returns because of the broader selection of investment options. However, a higher potential for returns comes with a higher potential for risk.

- More responsibility and greater complexity: Because investors have more control over self-directed IRAs, they must follow more rules and guidelines. The IRS has many guidelines and restrictions on prohibited transactions to ensure the use of IRA funds for retirement.

It’s crucial to thoroughly understand your investment goals, risk tolerance, and level of involvement when picking between a traditional IRA and a self-directed IRA. If alternative investment opportunities sound enticing to you, consult a financial advisor to help determine if self-directed IRAs align with your retirement strategy.

Pros and Cons of Self-Directed IRA Real Estate

Now that you understand self-directed IRAs, let’s look at one of the alternative investment options available to those with self-directed IRAs—real estate. Unlike traditional IRAs, self-directed IRAs allow you to invest private funds into and hold real estate such as single-family homes, raw land, commercial properties, and multifamily properties like apartment buildings, condominiums, and duplexes.

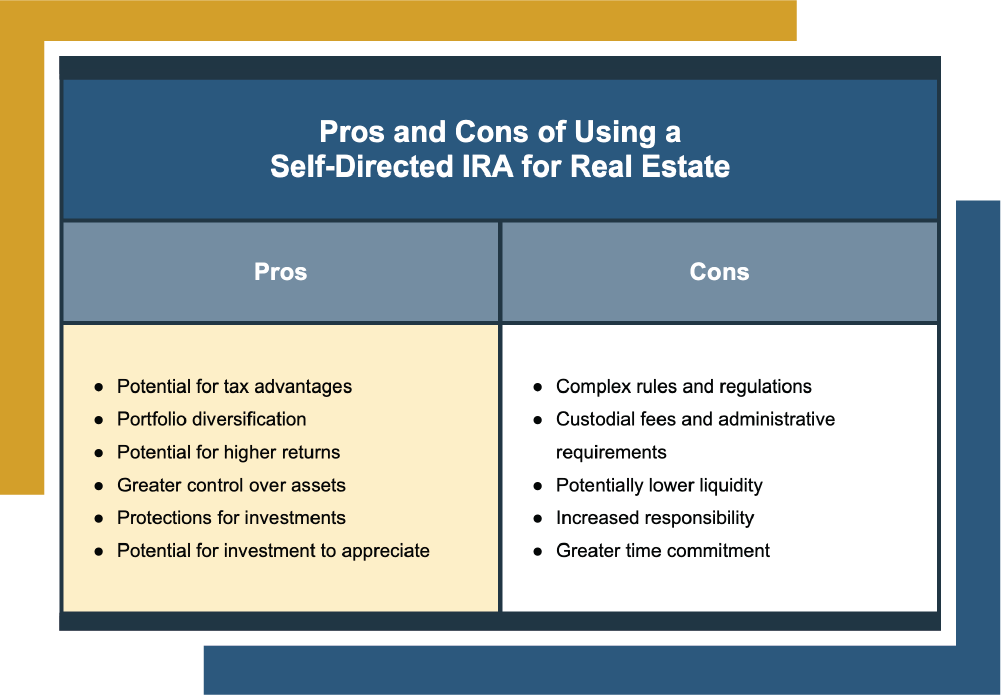

Doing so allows you to take money from a retirement account and augment it with an asset that generates income through monthly rent payments. There are many benefits to using your self-directed IRA to invest in real estate, but as with any investment vehicle, there are also some potential drawbacks.

Below, I provide an overview of self-directed IRA real estate pros and cons.

Pros and Cons of Using a Self-Directed IRA for Real Estate | |

Pros | Cons |

|

|

As you can see from these self-directed IRA real estate investment pros and cons, there are many potential benefits and a few caveats to using a self-directed IRA for real estate. While some of these caveats may sound like deal breakers, especially ones that result from the increased time commitment and greater levels of responsibility, there are ways to try and reduce them.

You could invest in real estate using your self-directed IRA and hire a property manager, for example, or you could invest in a fund that brings you the potential benefits of real estate investing with your self-directed IRA without worrying about the hassle of managing your investment property. That’s where Canyon View Capital comes in.

Use Your Self-Directed IRA for Real Estate Investing with the Help of Canyon View Capital

The professionals at Canyon View Capital know how demanding real estate investing can be. For over 40 years, our principals have managed a portfolio of real estate aggregated at over $1 billion2. That’s why we’ve developed investment vehicles for investors like you who want to enjoy the fruits of real estate investing without worrying about managing properties or keeping up with guidelines and regulations.

At CVC, we’re passionate about multifamily real estate, and we want to work with you to help you enjoy genuinely passive real estate income from your self-directed IRA. That way, you can spend less time worrying about your money and more time enjoying your money.

Still wondering about self directed IRA Real Estate?

At Canyon View Capital , we’re passionate about multifamily real estate, and we want to help you enjoy genuinely passive real estate income from your self-directed IRA. To Learn More About Self-Directed IRA Real Estate Pros and Cons, call CVC today!

Verified accreditation status required.

1Kagan, Julia, “What Is the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA)?”, for Investopedia. April 26, 2023. Investopedia.com. Accessed July 12, 2023.

2$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.