A 1031 Exchange, as outlined by the IRS, is a unique tool that savvy investors can use to retain the full proceeds from selling an investment property within their portfolio. This is achieved by deferring their capital gains tax burden and exchanging into a replacement property.

However, 1031 exchanges have strict rules and guidelines that must be followed meticulously, making them somewhat complex. One such requirement is the involvement of a 1031 exchange qualified intermediary for the exchange to proceed smoothly.

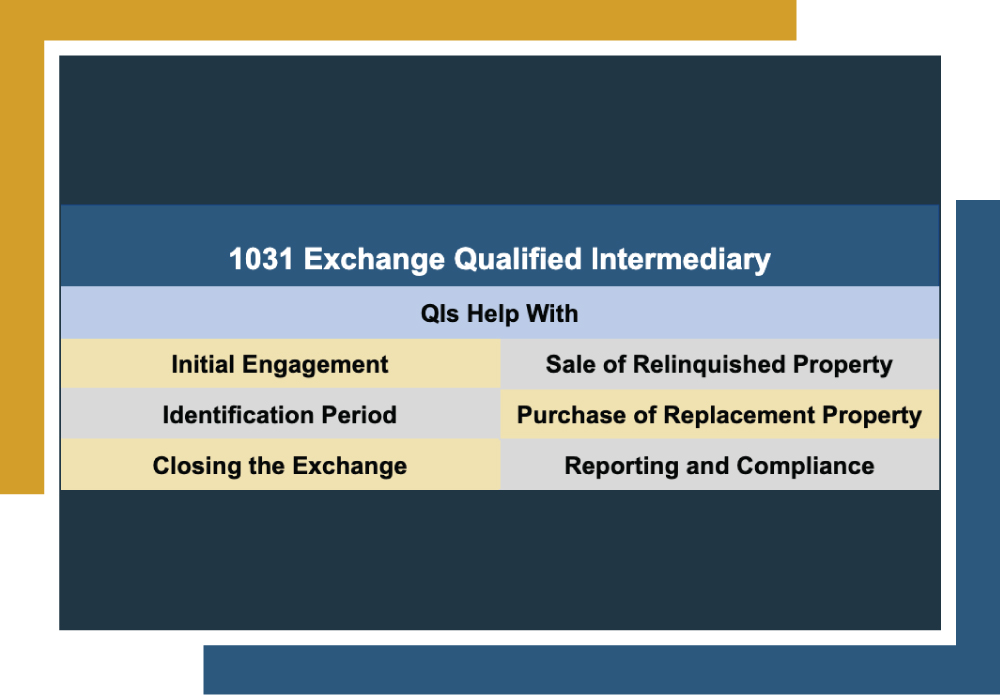

1031 Exchange Qualified Intermediary

A 1031 exchange qualified intermediary is a neutral third party enlisted to aid in the 1031 exchange process. 1031 exchange guidelines require investors to entrust proceeds from the sale of the relinquished property to a QI, who then uses them to acquire the replacement property, ensuring compliance with IRS regulations.

QIs are an IRS requirement and valuable due to their expertise in completing 1031 exchanges. They are enlisted at the beginning of the exchange process, typically before the sale of the relinquished property, and play a crucial role throughout.

The Role of a 1031 Exchange Qualified Intermediary | |

| QIs help the investor understand the exchange process and requirements and help them prepare. |

| QIs will hold the proceeds from the sale of the relinquished property in a segregated escrow account. They will also prepare necessary exchange documentation. |

| QIs will sometimes assist the investor in identifying potential replacement properties. Additionally, they will use the proceeds from the sale of the relinquished property to acquire the replacement property. |

| QIs help facilitate the purchase of the newly identified replacement property. They will use the proceeds from the sale of the relinquished property to complete the purchase. |

| QIs will ensure that all documentation is properly executed and will coordinate the transfer of funds and titles between parties. |

| QIs continue to provide necessary documentation for tax reporting purposes and ensure compliance with IRS regulations. |

It’s crucial to understand that qualified intermediaries are a requirement to commence and complete a 1031 exchange. They are extremely useful in ensuring compliance with IRS regulations and maintaining organization throughout the complex 1031 exchange process.

Who Can Act as a QI?

Many entities can act as 1031 exchange qualified intermediaries, including:

- Specialized Companies: Companies dedicated specifically to providing QI services often have extensive experience and expertise in facilitating exchange and ensuring IRS compliance.

- Real Estate Attorneys: Many real estate attorneys also act as QIs and can provide legal guidance and ensure IRS compliance.

- Banks and Trust Companies: Some banks and trust companies also offer QI services, leveraging their experience with handling financial transactions and escrow accounts.

- Title Companies: Some title companies will offer QI services as a part of their suite.

- Qualified Individuals: In some cases, individuals may act as a QI if they meet specific criteria set by the IRS. However, this option is less common as it usually requires specific expertise and adherence to strict guidelines.

What Questions Should I Ask a QI?

Questions to Ask a QI | |

What is their level of experience? |

|

What is their QI fee? |

|

How accessible are they? |

|

What safeguards do they have in place to protect funds? |

|

Can they assist with identifying replacement properties? |

|

Canyon View Capital Offers Unique 1031 Exchange Opportunities

Now that you better understand the role of a 1031 exchange qualified intermediary, it’s time to think about your next steps. While we are not QIs, at Canyon View Capital, we recognize the complexities and challenges associated with 1031 exchanges and the potential benefits they offer investors.

That’s why we provide tailored 1031 exchange options, including the opportunity to exchange into one or more of our multifamily properties as Tenants in Common. This approach allows investors to enjoy the benefits of passive real estate income without property management responsibilities.

Ready to upgrade your portfolio with diversified, stable investments?

For over 40 years, the principals at Canyon View Capital have worked in real estate, with a portfolio currently valued at over $1B1. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

For more information on what a 1031 exchange qualified intermediary is, reach out today!

1$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.