Imagine you’ve been overseeing an investment property for a specific duration. Perhaps the property has experienced appreciation, prompting you to consider selling for a profit. Or maybe you’re contemplating a shift to a different investment opportunity for many reasons.

Either way, when you sell an investment property, you will typically expect to owe capital gains taxes once the sale has been completed. However, savvy real estate investors have been using 1031 exchanges to potentially defer their capital gains tax burden indefinitely.

However, 1031 exchanges are complex, and one nuance to be aware of is what is known as the cost basis. In this article, I’ll explain how to calculate cost basis after a 1031 exchange.

| Discussion Topics |

How to Calculate Cost Basis After a 1031 Exchange

Engaging in a 1031 exchange, where you sell and purchase property to benefit from tax deferral, involves a spectrum of anticipated and unforeseen expenses. Whether it’s the purchase price, capital improvements, selling costs, or other financial aspects, being well-informed about the various numerical components is crucial when utilizing this potent tax deferral tool.

It’s essential to understand the intricacies of these transactions to make informed decisions and maximize the advantages of a 1031 exchange. Knowing how to calculate cost basis after a 1031 exchange is crucial for future tax implications.

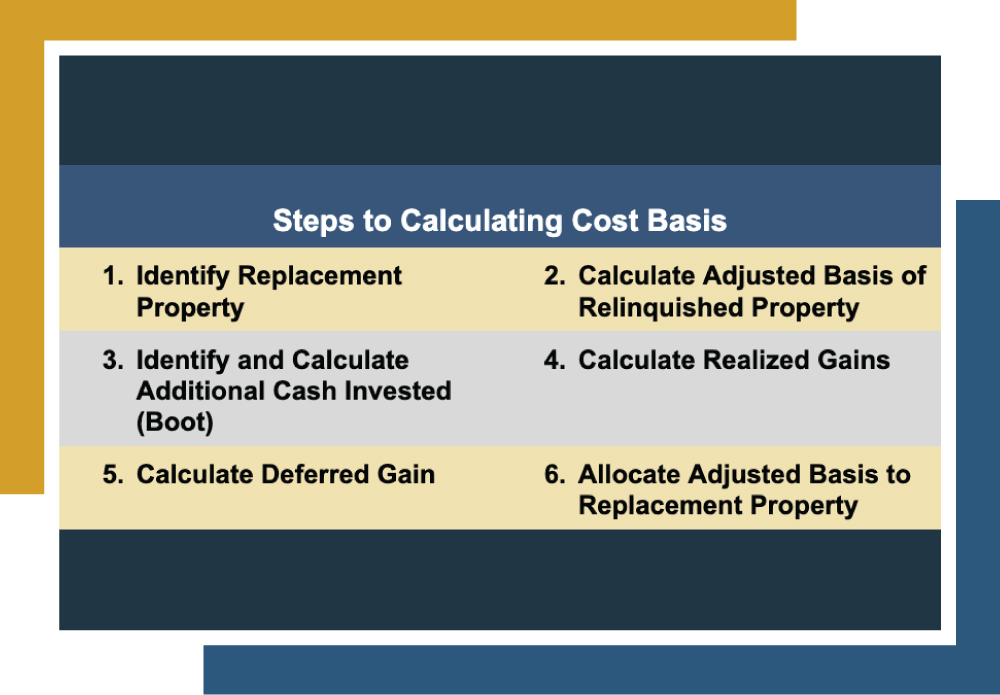

The cost basis of a 1031 exchange can be calculated in a few steps.

Calculating Cost Basis on a 1031 Exchange | ||

| Identify the property you intend to acquire as the replacement property in the 1031 exchange. | |

| Determine the adjusted basis of the property you’re selling, which includes the original price, capital improvements, and adjustments for depreciation. | |

| Recognize any cash or non-like-kind property received. Calculate the boot amount. | |

| Determine recognized gains by multiplying the total realized gain by the ratio of boot received to total consideration. | |

| Calculate the deferred gain, which is the postponed gain (total realized minus recognized gain). | |

| Allocate the adjusted basis of the relinquished property to the replacement based on its fair market value at the exchange time. | |

| Finally, calculate the new cost basis of the replacement property by subtracting any boot from the allocated adjusted basis and adding any additional cash or property invested. | |

Calculating Cost Basis on a 1031 Exchange

In the following example, Property A will be the relinquished (or original property), and Property B will be the newly acquired property.

Calculating Cost Basis on a 1031 Exchange | ||

Property A | Property B | |

Purchase Price | $500,000 | $1,250,000 |

Accumulated Depreciation | -$50,000 | |

Adjusted Basis of Property A | $450,000 | |

Selling Price | $750,000 | |

Selling Expenses | -$20,000 | |

Net Sales Proceeds from Property A | $730,000 | |

Purchase Price of Property B | $1,250,000 | |

Additional Cash Invested (Boot) | $50,000 | |

Total Cost of Property B | $1,250,000 | |

Deferred Gain | -$520,000 | |

Adjusted Basis of Property B | $730,000 | |

Realized Taxable Gain of Property A | $280,000 | |

In this example, an additional $50,000 in cash (boot) is employed during the 1031 exchange. The deferred gain is calculated based on the variance between the net sales proceeds from Property A and the total cost of Property B. Following this, the adjusted basis of Property B subtracts the deferred gain from the adjusted basis of Property A.

Note that this is a hypothetical example, and the values provided are for illustrative purposes and may not accurately reflect the current market conditions or adhere to the latest tax regulations. 1031 exchanges involve many intricate tax considerations. So, make sure you speak with your tax professional or financial advisor for the most up-to-date information.

Understanding Cost Basis

The cost basis of a property is the foundation for calculating capital gains taxes. When it comes to 1031 exchanges, it involves evaluating the adjusted basis of the relinquished property and incorporating any additional factors associated with the exchange, such as:

- Accumulated Depreciation: Subtract accumulated depreciation from the original purchase price.

- Improvements or Capital Expenditures: Include any improvements or capital expenditures that may impact the adjusted basis.

- Deferred Gain: Calculate the deferred gain, which is the difference between the selling price and the adjusted basis of the relinquished property.

- Additional Cash (Boot): Consider any additional cash involved in the exchange, known as “boot.”

- Mortgage Differential: If applicable, consider differences in mortgage amounts between the relinquished and replacement properties.

Understanding cost basis and how to calculate cost basis after a 1031 exchange is vital for several reasons, such as deferred gain recognition, accurate tax reporting, compliance with tax laws, and optimizing tax benefits.

If this sounds like a lot, well, it is. They say the best things in life usually come with some trade-offs. Unfortunately, 1031 exchanges can be as complicated as they are beneficial. However, don’t let that deter you from unlocking the potential of 1031 exchanges, especially now that you know how to calculate cost basis after a 1031 exchange.

Canyon View Capital may be able to help.

Canyon View Capital Offers a Potentially Easier Path to 1031 Exchanges

Now that you know how to calculate cost basis after a 1031 exchange, it’s time to consider your next moves. At Canyon View Capital, we offer investors like you the opportunity to exchange into one or more of our multifamily properties as Tenants in Common, meaning that you’ll benefit from passive real estate income without worrying about individual property management.

This option can be a great fit for investors looking to maintain the presence of real estate in their portfolio but no longer want to shoulder the burden that comes with it. It can also make the 1031 exchange process more accessible by simplifying the identification of replacement properties.

With a portfolio of properties throughout America’s Heartland, we utilize a conservative “buy-and-hold” strategy that targets stable and consistent returns and passive losses to reduce your tax burdens.

Ready to upgrade your portfolio with diversified, stable investments?

For over 40 years, Canyon View Capital has managed, owned, and operated real estate, now valued at over $1B1. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

Still wondering how to calculate cost basis after a 1031 exchange? Reach out today!

1$1B figure is based on aggregate values of all CVC-managed real estate investments as of March 31, 2023.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.