1031 exchanges offer real estate investors a valuable opportunity to defer capital gains taxes when selling and replacing properties. By retaining the full proceeds from property sales, investors can maintain their portfolio and net worth intact. This helps sustain a robust real estate market by keeping funds within the industry rather than surrendering them to the IRS.

1031 exchanges present challenges and strict timelines for investors.

Among these, the 45-day window demands prompt identification of replacement properties. In this article, I’ll guide you through the process of identifying replacement properties for a 1031 exchange, aiding your journey toward success.

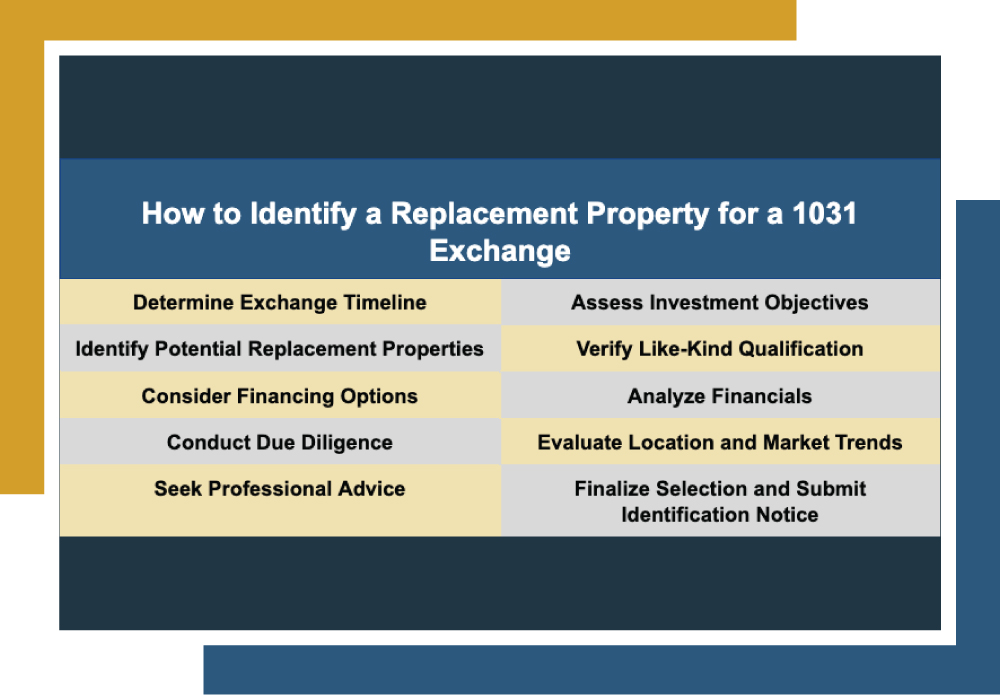

How to Identify a Replacement Property for a 1031 Exchange

1031 exchanges require investors to identify the property that they intend to replace their relinquished property within 45 days of selling the relinquished property. If this sounds like a small window in which to find suitable replacement properties, that’s because it is.

However, if you understand the basics of how to identify a replacement property for a 1031 exchange, this process can be a little more manageable.

Steps to Identifying a Replacement Property | |

| Understand the 45-day identification period and the 180-day exchange period. |

| Define your investment goals, such as cash flow, appreciation, or tax benefits. |

| Research and compile a list of properties that align with your investment objectives. |

| Ensure that the potential replacement properties qualify as like-kind to the relinquished property. |

| Evaluate financing options, including cash, loans, or seller financing, for acquiring the replacement property. |

| Review the financial aspects of each potential replacement property, including cash flow projections, expenses, and potential returns. |

| Perform thorough due diligence on the properties, including inspections, title searches, and zoning regulations. |

| Assess the location and market trends of each replacement property to gauge its potential for growth and stability. |

| Consult with tax advisors, real estate agents, and legal professionals to ensure compliance and make informed decisions. |

| Refine your list of potential replacements through research, due diligence, and professional guidance. Submit the chosen property to the QI within the 45-day identification window. |

Why It’s Crucial to Identify Replacement Properties Promptly

When commencing 1031 exchanges, the identification window is one of the first and largest hurdles. This is because identifying a replacement property in such a small window is difficult.

However, it’s crucial to ensure that this step is completed promptly for several reasons, such as:

- IRS Requirements: Investors have a mere 45 days to identify a replacement property. Failing to meet this deadline can disqualify the entire 1031 exchange and result in immediate capital gains tax liabilities.

- Limited Options: Real estate investment opportunities are often competitive, and suitable replacement options may not always be readily available. Identifying potential replacement options as early as possible can help investors thoroughly evaluate their options and make informed decisions. Waiting until the last minute can limit choices and lead to rushed decisions, potentially resulting in selecting properties that may not align with the investor’s goals.

- Negotiation and Closing Processes: Identifying a replacement property early allows investors more time to negotiate favorable terms, secure financing, and navigate closing procedures. This proactive approach helps avoid delays that could jeopardize the exchange.

- Contingency Plans: Unforeseen circumstances can arise during 1031 exchanges, such as potential replacement properties falling through. Identifying backup properties early in the process provides investors with contingency options, ensuring that they have alternatives if their primary options become unfavorable or unattainable.

If you’re an investor looking for options that can streamline your identification process, Canyon View Capital may be able to help.

Canyon View Capital Can Streamline the Identification Process

Now that you better understand how to identify a replacement property for a 1031 exchange, you may be wondering how to make the best proactive choice for your replacement property. If you’re concerned with the timing of the identification window or simply no longer wish to manage properties yourself, CVC has options for you.

We have a large portfolio of multifamily properties located in the Midsouth and Midwest. This allows us to invite investors like you to exchange into one or more of our properties as Tenants in Common, offering a timely replacement option. Moreover, you won’t have to worry about managing property as we handle the heavy lifting for you while you enjoy passive real estate income and potential tax benefits.

Ready to upgrade your portfolio with diversified, stable investments?

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.