Whether you’re a seasoned investor or a newcomer testing the waters, you’re probably already aware of some of the benefits the real estate market can offer. It’s not uncommon for real estate investors to start with single-family properties. But what about another option?

Multifamily real estate offers an exciting opportunity for investors of all backgrounds to diversify their investment portfolios. Moreover, factors such as population growth1, rents rising once again2,3and the Federal Reserve ending its 18-month rate hiking spree make multifamily investing an ideal option for many investors looking to stay ahead of some trends for 2024 and beyond.

In this article, I’ll briefly overview multifamily investing in 2024, detailing key factors and potential challenges shaping investor strategies in this sector.

| Discussion Topics |

What Is Multifamily Investing?

Imagine owning a property that houses multiple rental units that all work together as a part of a cohesive whole to generate stable rental income streams. This is what we call multifamily investing, and it stands in stark contrast to single-family investing, which involves properties that house a single unit’s tenant worth.

Essentially, multifamily investing is a strategy that involves acquiring properties made up of two or more residential units, including apartment buildings, duplexes, condominiums, and 2-4 unit properties, as opposed to Single Family Rentals (SFR). Instead of relying on a single occupant to generate rental income, investors can have multiple income streams from units housed within a single location.

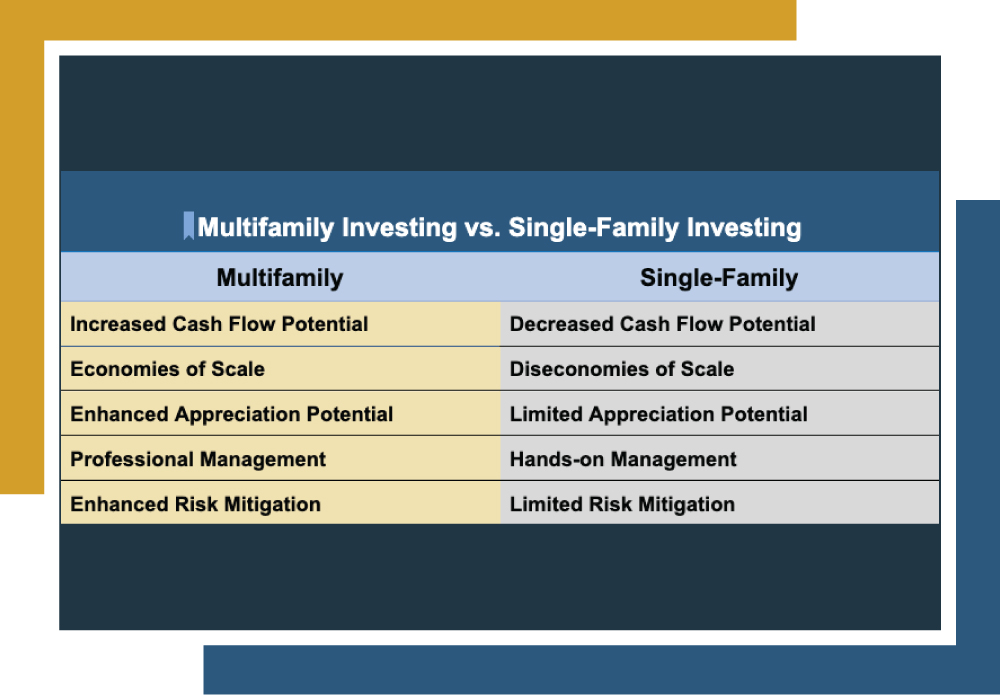

When compared to single-family investing, multifamily investing comes with a slew of potential benefits, including:

Multifamily Investing vs. Single-Family Investing | |

Multifamily | Single-Family |

Increased Cash Flow Potential. | Decreased Cash Flow Potential. |

Economies of Scale. | Diseconomies of Scale. |

Enhanced Appreciation Potential. High potential due to factors like desirable locations, growing demand, and economies of scale contributing to potentially accelerated property appreciation | Limited Appreciation Potential. Potentially slower appreciation rates are due to factors such as market conditions, neighborhood growth, and reliance on comparable homes in the neighborhood. |

Professional Management. | Hands-on Management. |

Enhanced Risk Mitigation. | Limited Risk Mitigation. |

Perhaps one of the best features of multifamily investing is the potential for added diversification to your real estate portfolio. Even if you’re managing single-family properties, you can add multifamily investing to your investment strategy to hedge against the potential pitfalls of single-family rentals—while simultaneously enjoying both advantages. These benefits should analyzed on a case-by-case basis and should always be discussed with your investment advisor before committing funds.

As the demand for housing continues to rise, multifamily investing can help boost rental income and appreciation, offering investors a double win.

Multifamily Investing 2024: What You Need to Know

Now that you have a solid understanding of multifamily investing, you’ll need to be aware of some of the current trends for multifamily investing and some that may pose a challenge for those looking to get into multifamily investing in 2024.

- Soft Landing. A “soft landing” in the real estate market refers to gradually easing economic conditions without a sharp overturn. Multifamily real estate is expected to see a smooth transition from a period of rapid growth to a sustainable level of activity. Stable property values and increased transaction volumes reinforce this soft landing.

- Trend Towards Market Normalization. Following a volatile period during and after the pandemic, recent data indicates that the multifamily market is stabilizing. Rent growth peaked in early 2022 and has slowed to under 2% nationally, while vacancy rates have stabilized around 6%. Despite this not sounding entirely positive, it means investors can now make more informed decisions with reduced market volatility.

- Interest Rates Are No Longer Rising and Expected to See Cuts. While some experts expected interest rates to decrease through 2023, the US economy had other plans. However, the Federal Reserve finally began capping interest rates, and many experts expect it to make cuts in 2024. For multifamily investors, borrowing will be cheaper and could increase demand for multifamily units, driving up property values and rental incomes.

- Shortage of Single-Family Properties. The housing shortage continues in 2024 with a lack of inventory, high prices, and increasing mortgage rates, making it difficult for many Americans to afford single-family properties. This shortage continues to contribute to increased demand for multifamily units and should drive this year’s increase in rental prices.

- Oversupply of Multifamily Properties. Developers are addressing the shortage of single-family homes by expanding the supply of multifamily housing, with the national pipeline adding over 1 million rental units. While this has led to a higher vacancy rate, it ensures a sufficient supply of multifamily properties, averting a shortage similar to what’s seen in the single-family sector.

However, an oversupply can potentially contribute to lower cap rates and decreased profits. Thankfully, while a historic surge of completion in multifamily units will occur in 2024, a downturn in new construction is anticipated.

- More Long-Term Rentals. As home ownership continues to remain out of reach for many Americans due to mortgage rates and other factors, long-term rentals are expected to become more common. This increased demand could potentially decrease vacancy rates and increase rental incomes.

- The Influence of Remote and Hybrid Work. As remote and hybrid work become more commonplace in post-pandemic society, multifamily units featuring home office spaces are experiencing increased demand. Investors can capitalize on this trend by enhancing the value of their properties through the incorporation or retrofitting of existing spaces to cater to the needs of remote and hybrid workers, potentially leading to higher rental income.

Despite economic challenges such as slowed growth, growing vacancy rates, and oversupply, investors can navigate these hurdles and leverage certain economic aspects to their advantage in 2024.

One strategy is for multifamily investors to focus on improving or renovating existing properties rather than purchasing new ones, which can increase cash flow without incurring high debt costs.

Additionally, investors can opt for passive investment through real estate investment firms like Canyon View Capital, which offers properties in stable markets acquired before interest rates surged. This approach provides the potential for rising rents and reduced debt costs without the hassle of property management, enabling investors to earn passive returns.

Canyon View Capital Makes Multifamily Investing Easy

When making an investment decision, it’s essential to consider all your options before committing to one. Even with some of the hurdles we’ve seen over the past year and potential challenges ahead, multifamily investing in 2024 is still an excellent option for many investors looking to diversify their investment portfolios.

With over 40 years of experience, CVC’s professionals excel in managing multifamily properties. Our deep understanding of rental market dynamics allows us to provide investors with lucrative opportunities. Partnering with us offers a path to the same passive returns they can expect from managing rental properties in stable markets without worrying about the time, resources, and energy required to keep them running.

Still need more information on the best 1031 exchange investments?

1U.S. Urban Population 1960-2024. Macrotrends. Accessed April 1, 2024..

2JP Morgan/Chase. ”2024 apartment market update for multifamily investors.” for JP Morgan/Chase. jpmorgan.com Feb. 28, 2024. Accessed April 1, 2024.

3U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: Rent of Primary Residence in U.S. City Average [CUUR0000SEHA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CUUR0000SEHA, Feb. 21, 2024. Accessed April 1, 2024.

4Pino, Ivana and Paul, Trina. ”The Fed left rates unchanged but plans to cut them later this year. Here’s what it means for your money.” for Fortune. fortune.com. Feb. March 21, 2024. Accessed April 1, 2024.

5$1B figure based on the aggregate value of all CVC-managed real estate investments as valued on March 31, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.