1031 exchanges are powerful tax deferral tools that allow investors to negate their capital gains tax liability, letting them keep all the proceeds from the sale of an investment property in their investment portfolio.

The rigidity and strict timelines of traditional 1031 exchanges to ensure their validity can pose challenges. However, the reverse 1031 exchange provides investors with flexibility in initiating their exchanges. This article will explore the reverse 1031 exchange timeline to help you decide if it’s the best path forward for you.

| Discussion Topics |

Reverse 1031 Timeline

In a traditional 1031 exchange, the process starts when the investor’s original (or relinquished) property is sold, triggering a tight window for completion. Finding suitable replacement properties within this tight window as ideal properties may not be readily available.

However, an alternative path to a 1031 exchange exists, offering relief from some of the individual stressors of the traditional process, such as property identification.

In contrast, the reverse 1031 exchange timeline begins with identifying the replacement property, which may make the timeliness of completion much more manageable. This added flexibility might empower investors to make more deliberate and strategic decisions when navigating the exchange process.

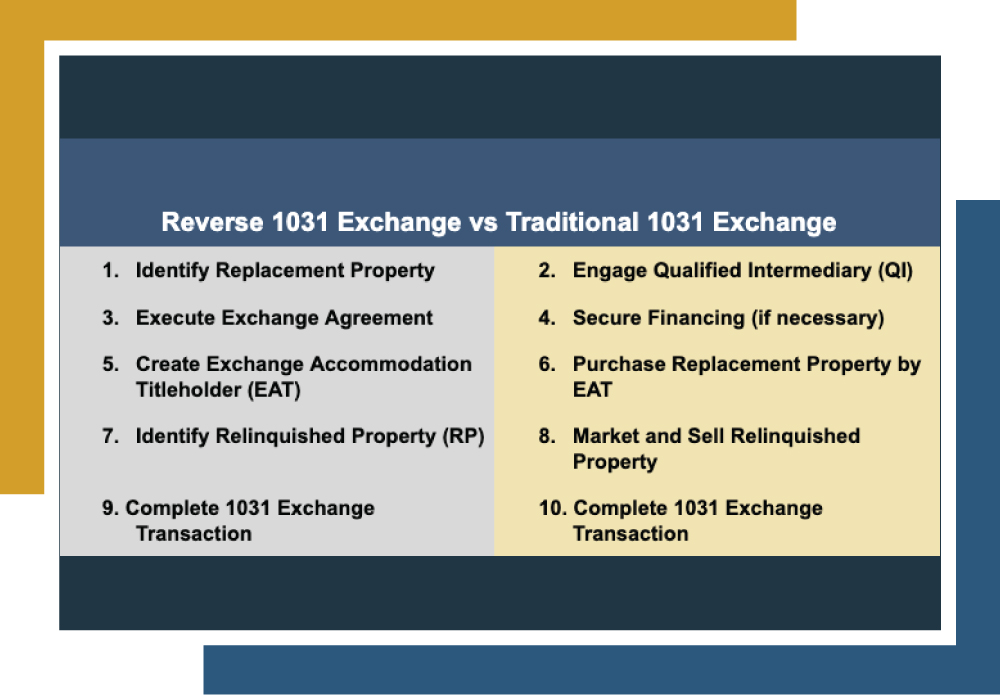

Reverse 1031 Exchange Timeline | |

| Determine the property you want to acquire as the replacement property in the exchange. |

| Hire a QI to facilitate the exchange. QI holds the proceeds from selling your relinquished property and helps structure the exchange to comply with 1031 regulations. |

| Enter into an exchange agreement with the QI outlining the terms and conditions of the reverse exchange. |

| If you need financing to acquire the replacement property, secure it before proceeding with the exchange. |

| QI or a related entity establishes an EAT to hold title to the replacement property during the exchange period. |

| EAT acquires the replacement property using funds provided by the QI. |

| After acquiring the replacement property, identify the property you intend to sell (the relinquished property) within the IRS’s identification deadlines. |

| List and sell the relinquished property. The QI holds the proceeds from the sale. |

| Once the relinquished property is sold, use the proceeds the QI holds to purchase the replacement property from the EAT. |

| Transfer the replacement property from the EAT to your ownership. The reverse exchange is complete. |

| Comply with IRS regulations for timelines, identification, and exchange periods. Maintain comprehensive documentation and seek advice from tax professionals for compliance and maximizing tax benefits. Report the exchange on your tax return using IRS Form 8824, Like-Kind Exchanges. |

Reverse 1031 Exchange Timeline vs Traditional 1031 Exchange

Reverse 1031 Exchange vs Traditional 1031 Exchange | ||

Reverse 1031 Exchange | Traditional 1031 Exchange | |

Timing | The investor acquires replacement property before selling the relinquished property. | The investor acquires the replacement property after the relinquished property is sold. |

Identification Period | Begins after acquiring replacement property; the investor has 45 days to identify the relinquished property. | The investor has 45 days from the sale of the relinquished property to identify replacement property. |

Exchange Period | Begins after acquiring replacement property; the investor has 180 days to complete the exchange. | Begins after the sale of the relinquished property; the investor has 180 days to complete the exchange. |

Relinquished Property Sale | Occurs after acquiring replacement property within the exchange period. | Initiates the exchange process; must be completed within the exchange period. |

Although reverse 1031 exchanges provide increased flexibility and empower investors to make well-informed decisions, they still demand thorough due diligence and a comprehensive understanding of rules and regulations, akin to any investment strategy.

Always seek guidance from a tax professional or financial advisor before using a new investment strategy to ensure informed decision-making and regulation compliance.

Canyon View Capital Offers 1031 Exchange Investment Options for Investors

After gaining a comprehensive understanding of the reverse 1031 exchange timeline, you’re likely contemplating your next steps. Whether you’re considering a traditional or reverse 1031 exchange, Canyon View Capital is here to make the process more manageable for you.

We specialize in simplifying 1031 exchanges, including reverse exchanges, for investors. Investing in one or more of our multifamily properties as Tenants in Common allows you to reap the benefits of real estate investing, enjoying genuinely passive income without the hassles of property management. Our diverse replacement property options streamline 1031 exchanges, making identification requirements more straightforward for you.

Ready to upgrade your portfolio with diversified, stable investments?

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.