Investors seeking more agency over where their money is invested often turn to self-directed IRAs. These IRAs offer significantly more investment control and diverse investment vehicles than other IRA types, benefiting individuals who want a more comprehensive array of investment options.

Broadly speaking, self-directed IRAs have many factors that set them apart from other IRA types, including:

- Broader scope of investment options

- Greater control and decision-making capabilities over investments by the investor

- More investor responsibility

- Potential for increased portfolio diversification

- The usage of a custodian or trustee for specific asset types

- Greater complexity and higher potential risks

In this article, we will explore some of the best self-directed IRA alternative investments to help you better grasp the options at your disposal and determine which may align best with your investment goals.

| Discussion Topics |

Self-Directed IRA Alternative Investments Investors Should Know

While IRAs allow investors to save money for retirement on tax-advantaged bases, the distinguishing characteristic of self-directed IRAs is that they allow investors to hold many asset types.

Some IRAs may only allow investors to invest their money in mutual funds, stocks, bonds, and other traditional investment options. Self-directed IRAs allow investors to remove the reins and gain more control over how their money is invested.

Instead of brokerage firms or banks controlling where money is invested, self-directed IRAs put investors in the driver’s seat of their own investment strategy, providing the opportunity for self-directed IRA alternative investments such as:

- Real Estate: The purchase of physical properties, such as residential and commercial properties, that are rented out to tenants for rental income

- Private Placements: Direct investing in private companies or not publicly traded ventures; examples include startups, venture capital, or private equity opportunities

- Precious Metals: The purchase of tangible, valuable metals such as gold, silver, and platinum

- Promissory Notes: The lending of money to another party that agrees to repay the loan over time with interest

- Stocks and Bonds: Stocks are shares of ownership in a company that can benefit from capital appreciation. Bonds on the other hand are sort of like IOUs from government entities or corporations used to raise funds. While stocks and bonds are more traditional investment options, with self-directed IRAs, investors have more control over which stocks and bonds they choose to invest in, which could include bonds issued by private entities.

- Cryptocurrency: The purchase of block-chain-backed assets such as Bitcoin, Ethereum, Doge, and other digital currencies that operate independently of traditional financial institutions

Self-directed IRAs offer investors a multitude of additional investment options while also enhancing the level of control they have over investment options that they would have with a non-self-directed IRA, such as stocks and bonds.

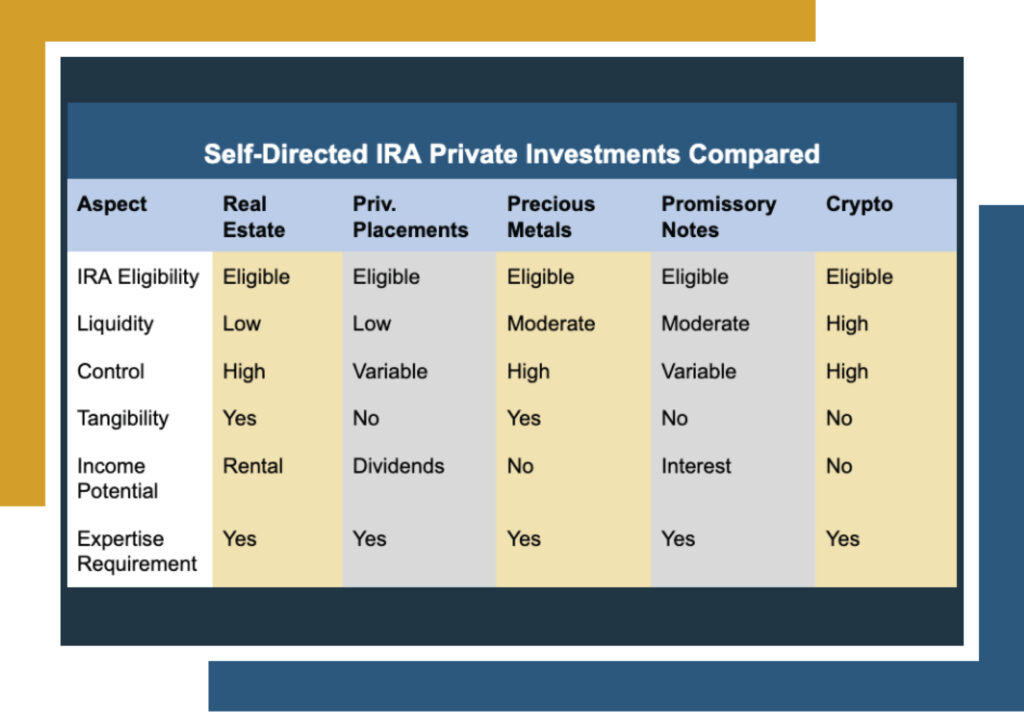

As with any investment option, these alternatives are characterized by their unique advantages and disadvantages, and no asset is perfect.

Self-Directed IRA Alternative Investments Compared | ||

Investment Option | Advantages | Disadvantages |

Real Estate |

|

|

Private Placements |

|

|

Precious Metals |

|

|

Promissory Notes |

|

|

Stocks and Bonds |

|

|

Cryptocurrency |

|

|

Note that this comparison serves to provide a broad summary of the advantages and disadvantages of some of the most popular self-directed IRA alternative investments. All investments carry risk and investors should thoroughly research and assess each option, and consult with their financial advisor before making any adjustments to their investment strategy.

Self-directed IRAs offer investors the ability to have greater control over their investments, but they also demand greater diligence and responsibility from investors.

Understanding Self-Directed IRAs

IRAs are popular retirement accounts that can provide investors with advantages over other options like 401(k)s. There are different types of IRAs available. Non-self-directed IRAs can be rigid, investing in stocks and bonds. In contrast, self-directed IRAs offer more freedom of options. Investors control investments, accessing diverse assets and alternatives for better risk management and diversification.

However, self-directed IRAs need a specialized custodian to ensure IRS compliance. Custodians handle assets and transactions but lack investment authority. Self-directed IRAs follow contribution limits, distribution rules, and eligibility criteria like other IRAs.

While self-directed IRAs provide more options and flexibility, they require more investor involvement. It’s important you consult with a financial advisor before using a self-directed IRA.

Canyon View Capital Helps Investors Enjoy Passive Real Estate Returns

Here at Canyon View Capital, we know just how demanding investing can be. We take our cumulative decades of experience in real estate investing to help investors like you try and achieve the benefits of self-directed IRA alternative investments without having to shoulder as much of the burden.

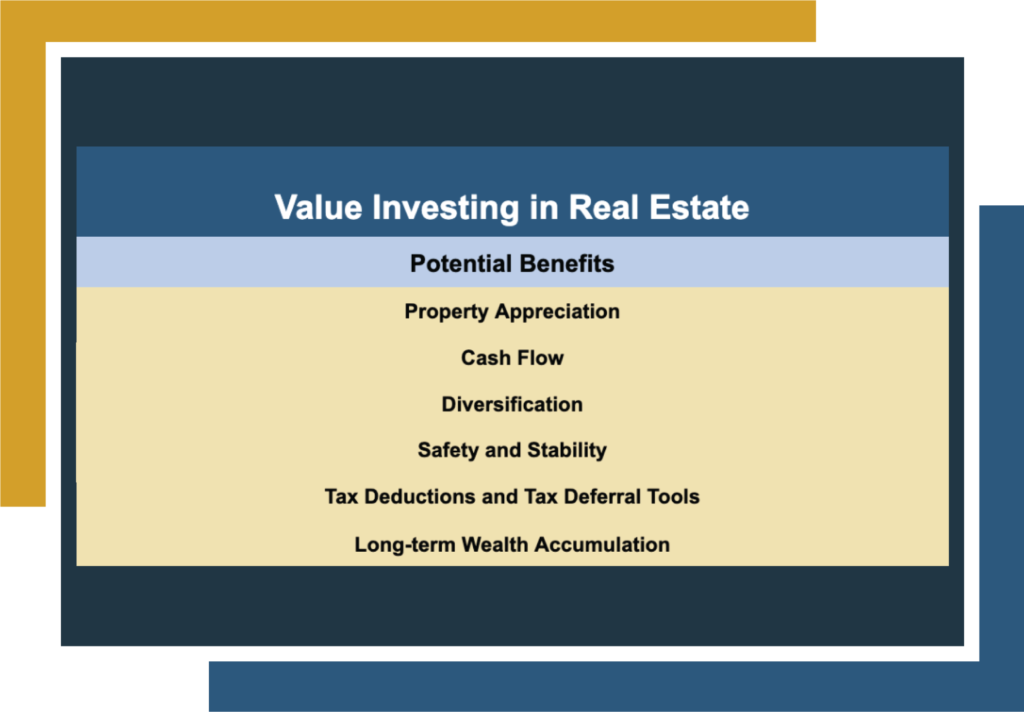

Real estate is an alluring option for many investors, especially within the multifamily realm. However, many investors may be deterred by time commitments and the increased responsibilities of property management. For those investors, we offer investment products that allow them to receive passive income backed by our multifamily properties located throughout the Midsouth and Midwest—they have the potential to earn passive income without needing significant hands-on time.

Still need more information on the IRA Alternative Investments?

1Patrick Grimes, “Why Income-Generating Real Estate Is The Best Hedge Against Inflation,” for Forbes, April 14, 2022, Forbes.com. Accessed Aug. 2, 2023.

2Nicole Lapin, “Explaining Crypto’s Volatility,” for Forbes, Dec. 23 2021. Forbes.com. Accessed Aug. 3, 2023.

3$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.