Investors who manage investment real estate know just how much of a nuisance capital gains taxes can be. Should you part ways with an investment property and proceed with its sale, be prepared to owe the IRS a substantial portion, often upwards of 28% of the sale profits—an exorbitant figure by any measure.

While you can expect to be on the hook for capital gains taxes under most circumstances, savvy investors use tools like 1031 exchanges to defer those taxes and channel the sale proceeds into acquiring a new property.

In this article, we’ll explain how capital gains on a 1031 exchange work and how you can be next in line to use this potent strategy to increase your purchasing power.

| Discussion Topics |

Capital Gains on a 1031 Exchange: How Do They Work?

When you sell an investment property, you will unfortunately owe capital gains taxes that will often severely undercut your profits. This can be even more problematic when you are trying to acquire new property with the proceeds from the sale.

The good news is that 1031 exchanges offer a way to reduce and perhaps eliminate your tax liability. But how do capital gains work on a 1031 exchange?

Simply put, a 1031 exchange postpones the capital gains taxes you would owe upon the sale of an investment property by reinvesting the entire sale proceeds into purchasing a new investment property—significantly increasing your purchasing power. It’s like finding a hidden path that allows you to bypass toll booths and preserve more of your hard-earned funds.

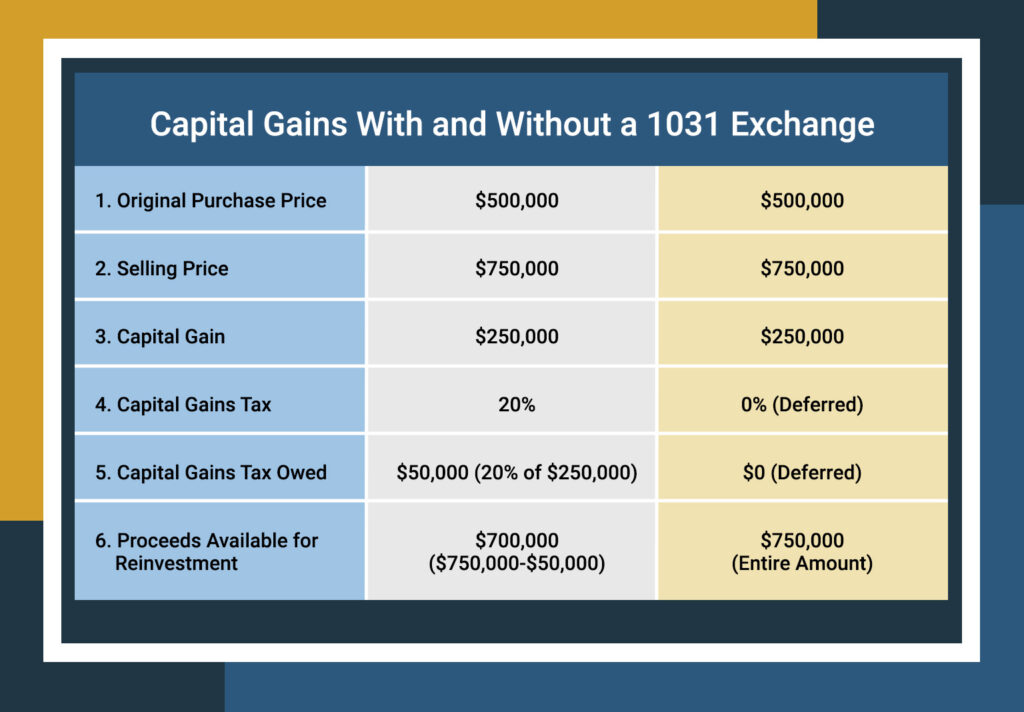

Here’s an example of a 1031 exchange in action.

Capital Gains With and Without a 1031 Exchange | ||

| $500,000 | $500,000 |

| $750,000 | $750,000 |

| $250,000 | $250,000 |

| 20% | 0% (Deferred) |

| $50,000 (20% of $250,000) | $0 (Deferred) |

| $700,000 ($750,000-$50,000) | $750,000 (Entire Amount) |

One of the best parts of 1031 exchanges is that they can theoretically be done indefinitely. Every time you decide to move on from a property that you used a 1031 exchange to purchase, you can do it again.

Here’s a breakdown of how it works.

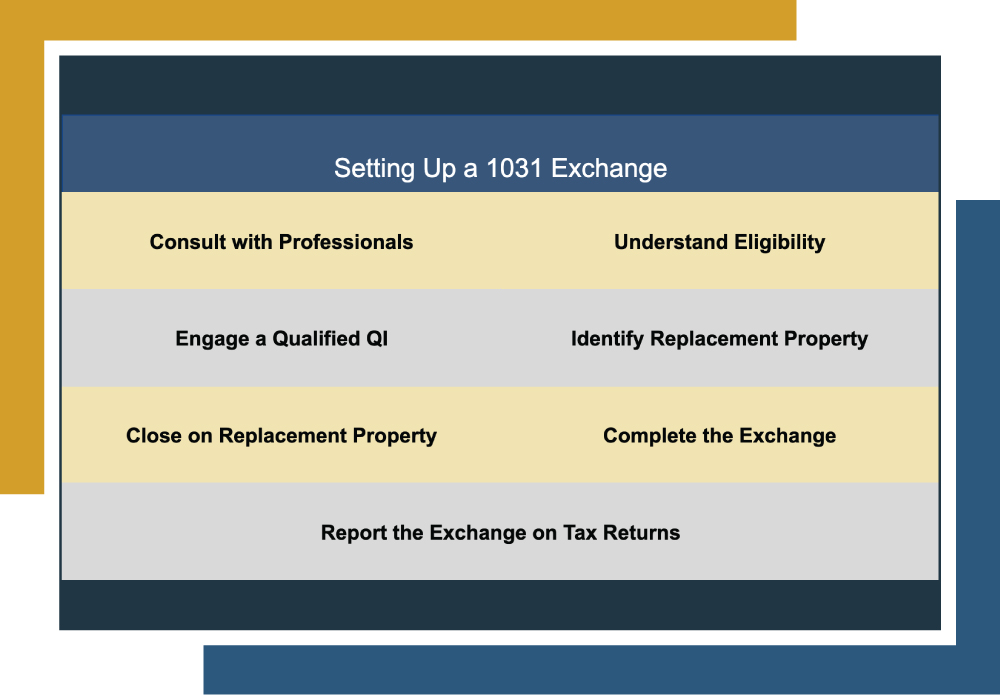

- Identify a Qualified Intermediary (QI): The IRS does not allow investors to hold the proceeds from a sale that is being used for a 1031 exchange. Instead, you must partner with a QI to hold the proceeds and ensure the exchange adheres to IRS guidelines.

- Initiate a 1031 Exchange: When you sell your original property, you can begin the 1031 exchange process by identifying a like-kind replacement property within 45 days of the sale.

- Timeline for Completion: The entire 1031 exchange process must be completed within a tight 180-day window.

- Deferred Capital Gains: By following the rules of a 1031 exchange, you will defer the capital gains taxes that would have otherwise been due to the IRS at the time of sale. Essentially, the deferred gain is rolled into the new property.

- Adjust Basis in the New Property: The new property’s basis is adjusted to account for the deferred gain from the old property. This means that when you eventually sell the property, the deferred gain becomes taxable unless you decide to use another 1031 exchange.

While capital gains taxes will often chip away at the profits you have earned, 1031 exchanges offer a strategic route to reduce your taxable liability significantly. Nevertheless, investors must recognize that 1031 exchanges are intricate processes governed by stringent guidelines and tight timelines. Adherence to these rules is crucial to ensure compliance and the validity of the exchange. Also, like any tax strategy, there are advantages and concerns to consider.

Understanding Capital Gains

Before knowing how a 1031 exchange works, you must understand capital gains in general.

Capital gains are the profits realized from selling a capital asset, such as real estate. When you sell an investment property, these capital gains are subject to taxation. Capital gains are calculated by subtracting the asset’s purchase price—sometimes called the cost basis—from the selling price. When the result is a positive number, it is a capital gain. If it is negative, it is a loss.

Essentially, Capital Gain = Selling Price – Purchase Price

Here’s an example:

You purchased a property for $500,000 and later decided to sell it for $750,000. When you subtract the purchase price ($500,000) from the selling price ($750,000), you are left with $250,000 in profit, which means you have a capital gain of $250,000.

Capital Gain = $750,000 – $500,000

Capital Gain = $250,000

You would then be liable for a capital gains tax on your $250,000 profit.

Moreover, capital gains are typically classified into two types based on how long the asset is held. This is referred to as the holding period. The applied tax rate directly correlates with the type of capital gain.

- Short-Term Capital Gains: Holding an asset for a year or less is considered a short-term capital gain. This type of capital gain is typically taxed at your ordinary income tax rates.

- Long-Term Capital Gains: Holding an asset for a year or more is considered a long-term capital gain. Long-term capital gains often qualify for lower tax rates than short-term capital gains.

Additionally, there are various key elements to consider when discussing capital gains taxes and their effects on your investment strategy, as they may affect the rate at which your capital gains are taxed.

Factors That Influence Capital Gains Tax Rate | |

| Your individual or joint filing status and your taxable income will affect the rate at which your capital gains are taxed. Higher-income individuals may be subject to generally higher capital gains tax rates because of their tax bracket. |

| The length of time you hold a property will affect the tax rate. For example, if you owned a property for more than a year, it’s considered a long-term capital gain, and if you help it for one year or less, it is a short-term gain. |

| Individuals with higher income levels may face an extra 3.8% NIIT tax. This applies to the lower of their net investment income or the amount exceeding specified thresholds in their modified adjusted gross income. |

| If the investment property was your primary residence for two of the past five years, you may qualify for the home sale exclusion. This allows you to exclude up to $250,000 (or $500,000 for joint filers) of capital gains from the sale of your primary residence. |

| If you claimed depreciation on the property during ownership, a portico of your gain may be subject to depreciation recapture and taxed at a different rate. |

| Some states impose their own additional capital gains taxes. These rates and rules vary. |

Keep in mind that tax laws can change, and they frequently do. New regulations can influence your total tax responsibility. You should regularly seek advice from a financial advisor or tax professional to stay informed about the latest updates in capital gains tax laws and regulations.

Use Your 1031 Exchange With Canyon View Capital

Understanding how capital gains on a 1031 exchange work is a crucial piece of information for anyone investing in real estate.

However, investors often decide to part ways with their investment properties for various reasons—whether it’s a desire to explore new opportunities, let go of a problematic asset, or simply lighten the load of property management responsibilities.

At Canyon View Capital, we present investors with a straightforward solution for their 1031 exchange through our easy exchange option. You can efficiently identify replacement properties by selling your property and seamlessly transitioning into one of our diverse multifamily properties as Tenants in Common. What’s more, you get to reap the rewards of multifamily investing without the hassle of managing the property.

Not only do you preserve many of the advantageous tax benefits, such as passive losses, associated with real estate investing, but we also handle the heavy lifting. We manage a portfolio of multifamily properties valued at over $1 billion1, and we want to help investors like you enjoy the benefits of multifamily investing.

Still need more information on IRA Alternative Investments?

12$1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.